Understanding Active Share BPV Capital Management

Post on: 8 Апрель, 2015 No Comment

Active share is a fairly recent concept that provides a new measurement for the level of active management within a fund. However, its recency means the concept is often poorly understood, as evidenced by the number of questions we field on the topic.

In our multipart series on Understanding Active Share, we introduce the concept of active share, how it works, and how to measure it—starting with the basics.

Part One: The Basics of Active Share

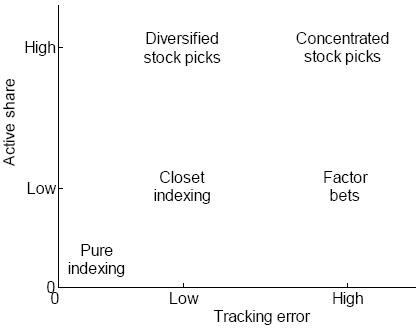

Gone are the days focusing solely on tracking error for weeding out the “closet indexers” of the world. Active share has been a hot topic in the past few years since being defined by Antti Petajisto and Martijn Cremers in their 2006 article, “How Active is Your Fund Manager? A New Measure That Predicts Performance.” The largest fund companies and consultancies now keep an eye on active share, and firms such as Lipper and Morningstar have added active share as a common metric. 1

So what is it?

Active share is the percentage of a fund’s portfolio that differs from its benchmark. Mathematically, this is calculated by comparing a security’s portfolio weight versus its benchmark weight. Do this for each security in the portfolio, take the absolute value of that difference, sum them, and divide by two. A portfolio with no holding in common with the benchmark would have 100% active share, while a portfolio that is identical to the benchmark would have 0% active share. 2

Active Share vs. Tracking Error

As mentioned above, active share is relatively new to the active management scene; rather, tracking error has historically been the investment industry’s favored metric. Tracking error is a measure of how closely a portfolio follows the index to which it is benchmarked. It’s measured by the standard deviation of the difference in the portfolio and the benchmark return over time. Lets assume you invest in the ABC mutual fund, which exists to replicate the Russell 2000 index. both in composition and in returns. If the ABC mutual fund returns 5.5% in a year but the Russell 2000 (the benchmark) returns 5.0%, then using the first formula above, we would say that the ABC mutual fund had a 0.5% tracking error. As time goes by, there will be more periods during which we can compare returns—more data points to put into the standard deviation formula. 4

Source: InvestingAnswers 5

Is Active Share the same for all funds?

In a Fidelity study on varying actively managed fund styles and sizes, they found that small-cap funds had a disproportionately high active share [in the 95-100% range], while large-cap funds showed a more normal distribution [with a median and mean both near 75%]. 6 This difference is due to both category and universe size. Large-cap fund managers have a smaller universe of stocks to choose from, which generally results in lower active share versus small-cap funds. Small-cap funds have a very large universe of stocks to analyze and filter into their portfolio of holdings, thus producing a higher active share.

Source: Fidelity 7

Conclusion

Next month, we will be taking a deeper dive into active share and tracking error, examining how they work together to provide a clearer picture of active management across different fund styles and sizes.

www.cfapubs.org/doi/pdf/10.2469/faj.v69.n4.7