Uncovering Hidden Commodities Exposure

Post on: 16 Март, 2015 No Comment

Market Wrap: Gold Hits 3-Month Low Amid Dollar Surge; Platinum At 5-Year Low; NatGas Outperforms

Written by Roger Nusbaum | February 25, 2008

Uncovering Hidden Commodities Exposure

Details

Do you have more commodities exposure in your portfolio than you thought?

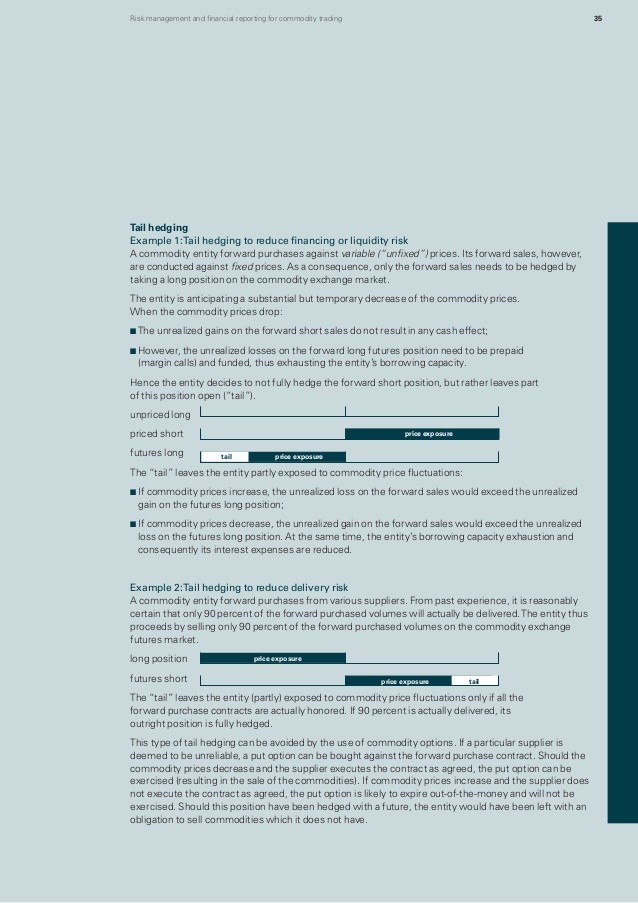

- Commodities + countries + alternative weighting = trouble

- The link between countries and commodities

- How much exposure do you need?

No doubt if you are reading this website you are interested in commodity exposure, one way or another, for you portfolio.

Commodity exposure can be added to every asset class, in a manner of speaking. Obviously any of the broad-based funds like DBC or DJP or any of the narrow funds like USO or SLV provide direct access. Certain stocks like oil companies or mining stocks allow entry with varying degrees of leverage to whatever commodity they deal in (these are not always the best proxy).

Additionally, there are countries like Brazil, Australia, Chile, Canada and Norway that are leveraged to various commodities that they produce, and so stock, bond and currency exposure to these countries can also be a commodity play. For example, a downward spiral in copper would impact Chile’s growth, trade surplus, currency, economic cycle and ultimately the stock market of Chile. This means that even a publicly traded bank or phone company from Chile would likely feel a big decline in the price of copper. This applies to other countries as well.

This creates a visibility of an unintended overweight exposure (as differentiated from an intended overweight by an investor who puts 30% into various commodity funds), creating more potential downside the next time commodities endure a correction of some sort.

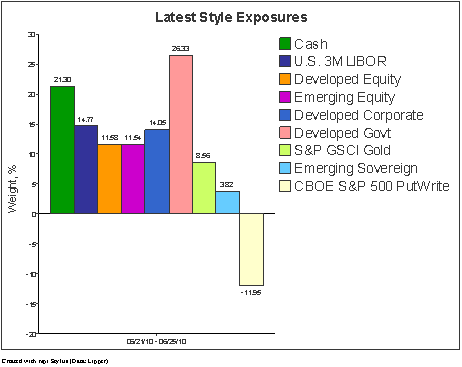

It is common for professional and do-it-yourself investors alike to end up with more exposure to certain segments than originally intended. Some of the broad-based ETFs have, for example, a heavier weighting to materials than the S&P 500 (the WisdomTree Earnings 100 ETF (EEZ) has a 10% weight to Materials, for example).

It might be reasonable for a portfolio to allocate 20% to a broad-based fund like EEZ for domestic equity exposure. Also reasonable might be for that same portfolio to put 5% into iShares MSCI Brazil (EWZ), which is 31% Materials. This same portfolio might also reasonably own 10% in Aberdeen Asia Pacific Income Fund (FAX) for foreign bonds, which is 52% in Australia. Maybe then, being well-read in various Materials themes, the same account has 5% in a uranium mining stock and 5% in streetTRACKS Gold Trust (GLD).

All of these holdings might seem to combine for a really diversified portfolio, but as Lee Corso might say, not so fast my friend. The S&P 500 has 3.55% in Materials. The components above only add up to 45% of a portfolio, yet the Materials exposure is already over 18% — if you accept that a big decline in commodity prices would be bad for all things Australia.

The point of this article is not how much to allocate to commodities, but to understand how easy it is to have more exposure than intended, and while it doesn’t really matter much now while the group is generally going up, if there ever is a serious correction, hopefully you don’t learn the hard way that you actually have twice the exposure that you thought you did.

Additionally, this same concept applies to other segments of the market as well. A peek under the hood of most of the WisdomTree dividend funds will reveal a very heavy weighting to the Financial sector. One or two of those funds plus a country fund (depending on the country), and it would be very easy to end up 30% in the Financial sector.

If you have ever read anything I’ve ever written about how much to allocate to commodities, you may recall that I think the right number is quite low, and while I concede that is subject to debate, I think everyone would agree that more exposure than originally intended could have dire consequences.

________________________________________________________________________________________

Roger Nusbaum is a Financial Advisor for Your Source Financial.