Types Of Trading

Post on: 16 Март, 2015 No Comment

Types of Traders

What are the different types of trading? I already covered the difference between day trading, swing trading and position trading, so on this page I’d like to give you a rough idea of what types of day traders are out there trading stock markets and other markets as well. For those of you new to trading, I’ll give you the basics behind what these traders are trying to accomplish and how they go about doing it.

I think the best way to go over the basic types of trading, is to first give you an idea as to why there are different types of traders to begin with. It all begins with the potential for profit. And, to make a profit in any market you of course need price change.

Well, there’s only two ways to do this in the stock market. You can buy a stock and sell higher or you can short some shares and buy them back at a lower price.

Take a look at the 30 minute chart of Home Depot (HD) below. You’ll see the same cycle occurring again and again. Trend — Lateral — Trend — Lateral, or in other words, higher volatilty — lower volatility — higher volatility, etc.

Some laterals turn price patterns into triangles and reduce price’s trading range and volatility even more, but the overall cycling of the market remains.

If it wasn’t for this cycling nature of all markets, there wouldn’t be much opportunity for traders to profit and markets wouldn’t exist.

Every type of trader sees price doing the same thing at the same time. The key difference though is they see different ways to profit and they go about it. for the most part, in only five different ways. That’s right, most retail trading (home based traders) are trading one of five general methods. Yes, there are many, many different trading strategies, but most of them fall into five basic types.

They are Range Trading, Mean Reversion Trading,Pullback Trading. Breakout Trading and Pair Trading. My intention here is not to state advantages and disadvantages of each type of trading, but merely to give a brief explanation.

Range Trading

During times of sideways, lateral type price movement some traders are most comfortable taking advantage of trading bounces between support and resistance lines. They’re called lines, but in reality they are more like areas.

Once a stock has established these areas. The trade is made in the direction of the opposite side or area.

Stops are generally placed with discretion outside or close to these S&R areas. Price Targets are the opposite side or somewhere in between.

Mean Reversion Trading

Mean Reversion traders use statistical tools such as standard deviation and mean averages to help them determine when price is ‘stretched’ too far from it’s average and likely to come back to it. Bollinger Bands is one such price indicator and tool.

These bands indicate (default setting) when price is two standard deviations from a 20 period simple moving average. As you can see, sometimes after price touches a band it makes it’s way back to the mean and sometimes it doesn’t.

Pullback Trading

Pullback traders use various indicators and methods to make trades, but they all basically go about it in similar ways. A price thrust gives a stock a new high or a higher high. Price pulls back or retraces a certain distance and the trader buys with the objective of selling after price moves a certain amount in the direction of the prevailing trend.

How do pullback traders determine how large of a retracement is sufficient? Some use moving averages, some use Fibonacci retracement techniques and others simply use price action trading methods.

Breakout Trading

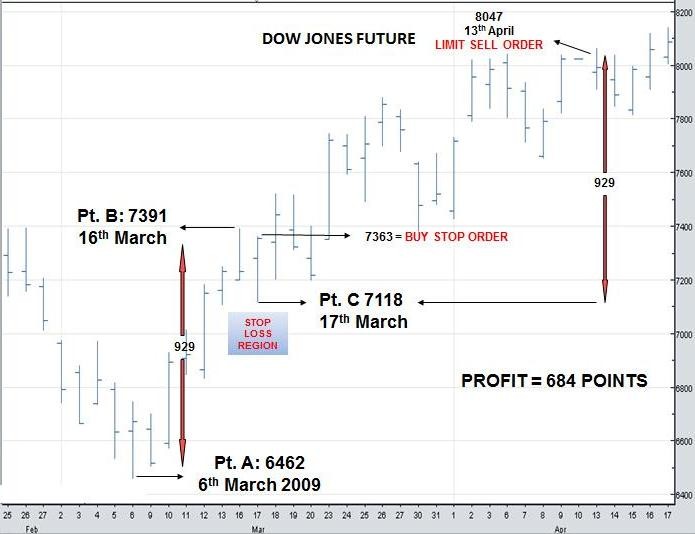

The goal of a breakout trader is to find trading opportunities in which he can exploit low risk trade entries for potentially high gains. Of all the types of trading methods, this is by far my favorite. I’ve always liked how this type of trading easily allows you to scout and scan for potential trades in advance and then be able to enter with buy or sell stop orders without having to keep a constant watch over each stock.

In the chart below Vulcan Materials (VMC) creates a lateral and then a triangle. A breakout trader would place a buy stop order above this pattern and would let it remain until either the pattern broke down or price broke out. Due to the predictable nature of volatility cycles, it’s just a matter of time before price breaks one way or the other.

VMC breaks above the pattern and well defined line of resistance and then proceeds upward the remainder of the session.

Pair Trading

Pair trading is a very different type of trading compared to the others above. The first four types are considered directional trading, because the trader is betting that the stock will go in one direction far enough for him to make a profit. With pair trading, a trader is betting on the relationship of two stocks or ETFs. That relationship is based on a pair’s price history together.

Pair Traders generally want their stock pair’s price history to be strongly correlated and/or co-integrated so that when there is a certain amount of deviation from each other they can make trades based on that deviation closing.

Once a deviation, which is often measured by the ratio of the stocks’ prices, has reached a specified amount, one stock will be bought and one will be shorted. Generally an equal amount of capital will be used for each stock. A profit is sometimes made when the pair has returned to the mean. Yes, this is a form of Mean Reversion Trading, but I think it’s different enough to put in separate category.

Of all the types of trading mentioned, this type requires the most trading capital, since there are two stocks entered on every trade.

Other Types of Trading

What about Trend Trading or Momentum Trading? You’ve probably heard of those too.

Trend Trading is really just a form of Breakout Trading, since trades are usually initiated by a breakout of the last N number of bars. The trade is usually exited in a similar manner, and often trend traders reverse as they exit a position.

Momentum Trading can be classified as either Pullback Trading or Breakout Trading, depending on how the momentum trader enters the stock. Momentum Trading relies on finding stocks that have exhibited some type of price inertia, and then entering on either a pullback or a breakout.