Types of swaps

Post on: 25 Май, 2015 No Comment

Types of swaps

Tuesday, 15 June 2010 17:31

The five generic types of swaps, in order of their quantitative importance, are: interest rate swaps, currency swaps, credit swaps, commodity swaps and equity swaps. There are also many other types.

The most common type of swap is a “plain Vanilla” interest rate swap. It is the exchange of a fixed rate loan to a floating rate loan. The life of the swap can range from 2 years to over 15 years. The reason for this exchange is to take benefit from comparative advantage.

Some companies may have comparative advantage in fixed rate markets while other companies have a comparative advantage in floating rate markets. When companies want to borrow they look for cheap borrowing i.e. from the market where they have comparative advantage. However this may lead to a company borrowing fixed when it wants floating or borrowing floating when it wants fixed. This is where a swap comes in. A swap has the effect of transforming a fixed rate loan into a floating rate loan or vice versa.

A currency swap involves exchanging principal and fixed rate interest payments on a loan in one currency for principal and fixed rate interest payments on an equal loan in another currency. Just like interest rate swaps, the currency swaps also are motivated by comparative advantage.

A commodity swap is an agreement whereby a floating (or market or spot) price is exchanged for a fixed price over a specified period. The vast majority of commodity swaps involve crude oil.

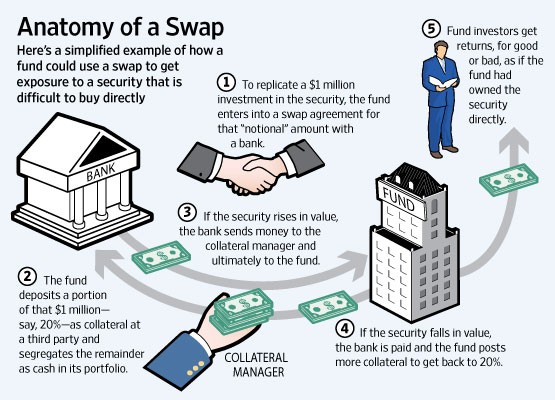

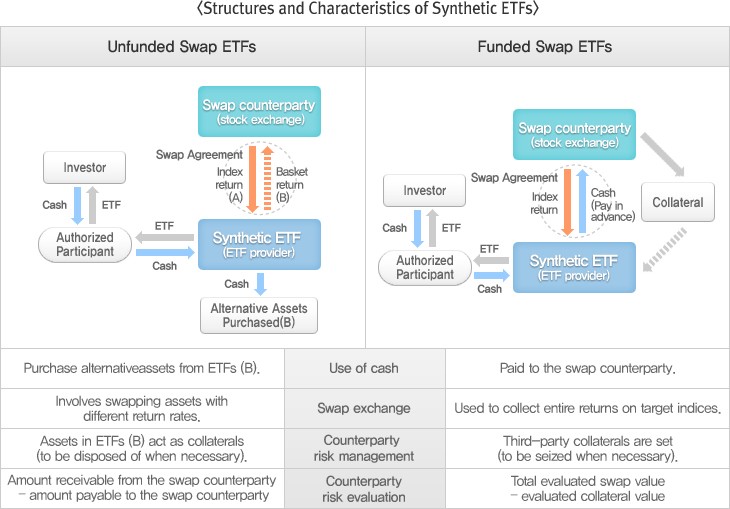

An equity swap is a special type of total return swap, where the underlying asset is a stock, a basket of stocks, or a stock index. Compared to actually owning the stock, in this case you do not have to pay anything up front, but you do not have any voting or other rights that stock holders do have.

Credit default swaps

A credit default swap (CDS) is a swap contract in which the buyer of the CDS makes a series of payments to the seller and, in exchange, receives a payoff if a credit instrument — typically a bond or loan — goes into default (fails to pay). Less commonly, the credit event that triggers the payoff can be a company undergoing restructuring, bankruptcy or even just having its credit rating downgraded. CDS contracts have been compared with insurance, because the buyer pays a premium and, in return, receives a sum of money if one of the events specified in the contract occur. Unlike an actual insurance contract the buyer is allowed to profit from the contract and may also cover an asset to which the buyer has no direct exposure.

Other variations

There are myriad different variations on the vanilla swap structure, which are limited only by the imagination of financial engineers and the desire of corporate treasurers and fund managers for exotic structures.

* A total return swap is a swap in which party A pays the total return of an asset, and party B makes periodic interest payments. The total return is the capital gain or loss, plus any interest or dividend payments. Note that if the total return is negative, then party A receives this amount from party B. The parties have exposure to the return of the underlying stock or index, without having to hold the underlying assets. The profit or loss of party B is the same for him as actually owning the underlying asset.

* An option on a swap is called a swaption. These provide one party with the right but not the obligation at a future time to enter into a swap.

* A variance swap is an over-the-counter instrument that allows one to speculate on or hedge risks associated with the magnitude of movement, a CMS, is a swap that allows the purchaser to fix the duration of received flows on a swap.

* An Amortising swap is usually an interest rate swap in which the notional principal for the interest payments declines during the life of the swap, perhaps at a rate tied to the prepayment of a mortgage or to an interest rate benchmark such as the LIBOR.