Types Of Option Orders by

Post on: 29 Июнь, 2015 No Comment

Types Of Option Orders — Introduction

Nothing has confused more option trading beginners than the different type of orders available for each stock options trade and the myriad of order parameters available. Stock trades only has 2 kinds of trades. to buy or to sell, but in option trading, there are 4 different kinds of orders available for each trade. Buy To Open, Buy To Close, Sell To Open and Sell To Close.

Here’s a decision flow for every option trade:

Types Of Option Orders — Buy To Open

Types Of Option Orders — Sell To Close

Types Of Option Orders — Sell To Open

Types Of Option Orders — Buy To Close

Example. John wants to close the short Jan40Call position now. He will Buy To Close the Jan40Calls.

Go To The Buy To Close Tutorial.

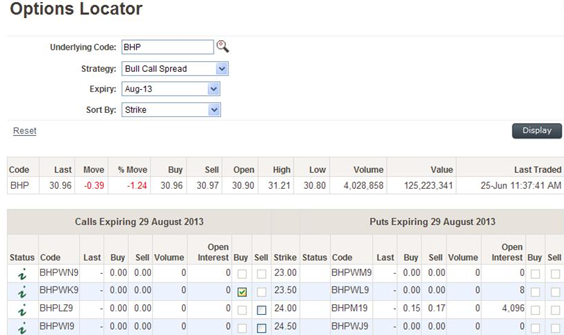

Types Of Option Orders — Combination Orders

Many option strategies requires a combination of different option contracts, placed using a combination of the above orders. For example, a Bull Call Spread making up of a Long At The Money Call Option and a short Out Of The Money Call Option. To open this Bull Call Spread Position, one would have to Buy To Open the at the money call options and then Sell To Open the out of the money call options. Conversely, to close this position, one would have to Sell To Close the at the money call options and Buy To Close the out of the money call options.

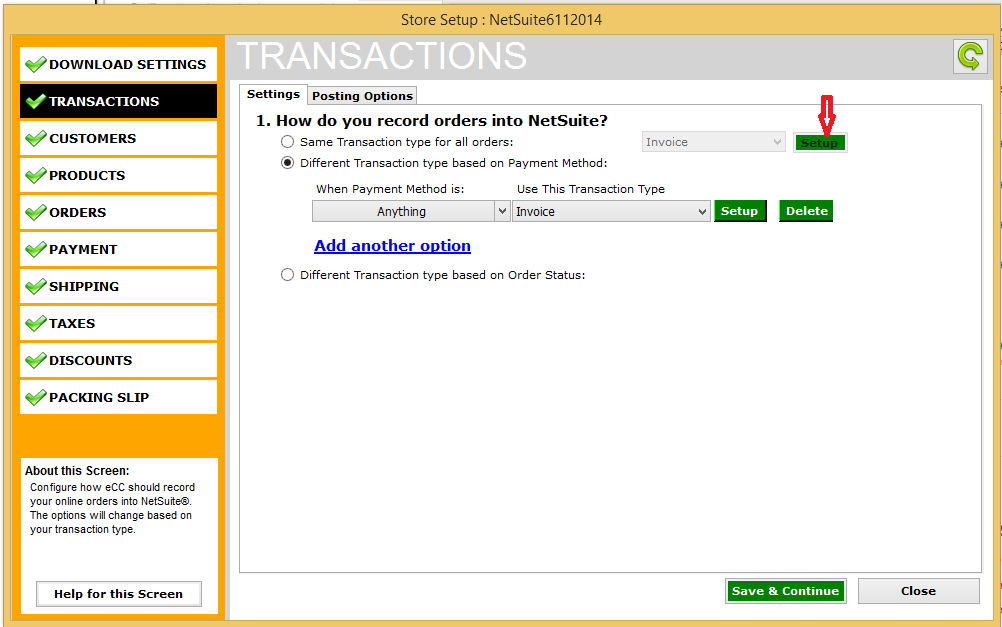

There are 2 types of combination orders that helps make the job of coordinating the entry or cancellation of multiple option positions easy. They are: One-Trigger-Other (OTO) and One-Cancel-Other (OCO) orders.

One-Trigger-Other (OTO)

Activating a secondary options order when the primary options order fills. This is especially useful for legging into positions such as a Covered Call where you want to sell the call options right after the stocks get filled.

One-Cancel-Other (OCO)

This is a less popular options order which 2 trades are executed at the same time and the filling of one trade cancels the other trade.

Beginner option traders who are performing only simple long option strategies, buying call and put options, need only use the Buy To Open and Sell To Close orders.

Types Of Option Orders — Filling Orders

Apart from the different option orders, option trading beginners must also take note of the 2 kinds of filling orders available. They are. 1. Market Order and 2. Limit Order. This is not perculiar to option trading but is something that confused as many option trading beginners.

Market Orders

By selecting to fill an option order using Market Order, you are telling the option trading broker to fill at the first available price on the market, regardless of how much that price is. This kind of order is ok for very liquid option contracts with very tight bid-ask spreads where prices don’t change drastically. However, on less liquid option contracts, one could get filled at very high prices. The main disadvantage of a Market Order is that you will never know for sure what price your order will eventually get filled at, making trade management difficult. The actual filling price could be higher than what you first saw, thus requiring a margin of safety. That is why all option trading brokers requires you to have more money than necessary in your account in order to place a market order. Read more about Market Orders.

Limit Orders

By selecting to fill an option order using Limit Order, you are telling the options broker that you want to open the options position at no higher than a price that you determine. This kind of filling order eliminates the possibility of ever filling at any higher price than stated and therefore do not require a margin. The main disadvantage is that if the price has moved up while you are executing the order, the order may not be filled. In this case, if an order is not filled on limit order within a few seconds, you should check what the prevailing asking price of the option contract is and then modify the order accordingly. Read more about Limit Orders.

Types Of Option Orders — Order Timing

Besides ordering your options broker to buy or write options based on market or limit order, you need to tell your options broker the timing of that order. Typical timing orders are Good Till Cancelled (GTC), Day Order, Fill-Or-Kill (FOK), All-Or-None (AON) and Market-On-Close (MOC).

Good Till Cancelled (GTC)

A GTC order is an options order that remains valid until it is manually cancelled and does not expire automatically at the end of the day. Good Till Cancelled (GTC) orders are useful when establishing stop loss or profit taking orders that lasts for several days, weeks or even months. Most option brokers have their order screen default to GTC.

Day Order

A day order is an options order that expires when market closes if it is not filled during the day. This is useful for option traders who wish to enter at a certain fixed price for the day and if they don’t get it, they would rather not take the position.

Fill-Or-Kill (FOK)

A Fill-Or-Kill order is an options order that cancels if it is not filled entirely upon execution. This is useful for option traders who are following a strict trade and portfolio management strategy that requires a full investment of every position.

Immediate-Or-Cancel (IOC)

An Immediate-Or-Cancel order is similar to the Fill-Or-Kill order but allows for a position to be partially filled upon execution and then cancel the unfilled portion.

All-Or-None (AON)

An All-Or-None order is an order that executes only if it is filled entirely. The difference between the AON and the FOK or IOC orders is that the order does not get cancelled if the position is not filled immediately and can be used in addition to a Day Order or a Good Till Cancelled order.

Market-On-Close (MOC)

A Market-On-Close order is an options order that fills a position at or near market close. This is useful for option traders who wish to close their expiring option positions on the last minute of expiration day. Market-On-Close orders are particularly popular for options writers who wish to maximize profits by allowing the last cent of extrinsic value to decay away from the position before closing it.

Types Of Option Orders — Exit Orders

After you have established the option position, it is time to automate that exit through stop loss or profit taking points. Option traders can completely automate stop loss or profit taking points in order to remove the involvement of human emotions through Stop Orders, Contingent Orders and Trailing Stop orders.

Stop Orders

Stop orders are the traditional stop loss mechanism used back in the old stock trading days. It is basically a price triggered sell order that closes your positions when a predetermined price is hit. Today, with the advent of contingent orders for options trading and all its flexibility, stop orders are fast diminishing in importance. The main and most significant drawback of Stop Orders is that it is activated only when a specific price is hit. If the option should gap past that price, it could continue lower without triggering the stop order!

There are 2 types of stop orders: Limit Stop and Market Stop.

Limit Stop

Limit stops, also known as Stop Limit Order, activates a limit order to sell when the stop price is hit. Again, this makes it an extremely insecure stop loss method as not only is the order triggered only if a certain price is hit, it needs to be able to fill at the price specified in the limit order, otherwise the position is free to continue falling!

Market Stop

Market Stops, also known as Stop Market Order, activates a market order to sell when the stop price is hit. A Market Stop order ensures that a position is sold, at all cost, when the stop price is hit. The drawback is, the filling price may be a lot lower than the stop order price.

Contingent Orders

Contingent orders are certainly the most flexible way to automate stop loss and profit taking. Contingent orders execute an order only when specific parameters such as an absolute or percentage change in the stock price or option price is fulfilled. Read more about Contingent Orders.

Trailing Stop Order

Trailing stop orders are orders that executes on a certain absolute or percentage change from the most favorable option price. An example of a trailing stop order is one which sells the option position when the option price retreats 10% from its highest price. The broker automatically updates the order continuously to the highest price of the option. Read more about Trailing Stop Order.

Walk Limit Order

Walk limit orders are orders that automatically updates your limit order incrementally from somewhere between the bid and ask price all the way to the prevailing bid or ask price within seconds in order to try for a better fill than the prevailing bid or ask price. Read more about Walk Limit Order.

Roll

Most online options brokers have an option to roll your existing options contracts. This means closing off your existing options trading position and then opening a new position of the same size on the same underlying asset but with a further expiration month. This allows you to stay invested in the asset for a longer period of time. Read more about Roll Forward.