Types of Mutual Funds

Post on: 29 Май, 2015 No Comment

According to the Investment Company Institute, there were 7581 open-end mutual funds with total assets of $11.6 trillion domiciled in the U.S. as of December 2011. This group includes types of mutual funds that cover the spectrums of asset classes, geography, level of economic development and investing styles. Among these, you will find high-performers in every category. With the appropriate knowledge and a little work, you can construct a portfolio on a par with that of institutional investors by selecting an efficient set of these funds.

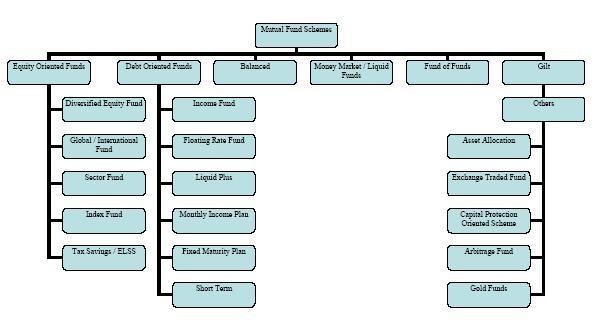

You will find a list of the various types of mutual funds below with links to detailed descriptions at the bottom of this page. However, there are so many different types of mutual funds that can be described in so many different ways that there is practically no limit to the number of categories into which they can be organized. Therefore, anyone who attempts to break the funds down into some logical order has to make some decisions as to where to draw the line on the subdivision of fund categories.

You can use one of the many online screeners to find funds in any of the various categories and links to detailed information on specific funds that meet your screening criteria. You can find many fund screeners to pick from with a simple Web search.

The information in the following subsections will give you a better understanding of how mutual funds are classified, categorized and otherwise grouped.

Types of Mutual Funds

Please note the following:

- This is a general listing of the various types of mutual funds available to individual investors in the U.S.

- The stock mutual funds are managed by four different styles, which essentially quadruples the selection.

- The stock mutual funds can be subdivided by four market capitalization brackets, large, mid, small and micro, which expands the selection by another factor of four.

- The bond mutual funds can be broken down into short, intermediate and long duration, which triples the selection.

- There are index funds that replicate all the major stock, bond and commodity indexes, both domestic and international. And there are index funds that track certain sectors of the markets.

Stock

Domestic — 100% U.S.

Major Sectors:

- Corporate, Investment Grade

- Corporate, Speculative (a.k.a. high-yield or junk)

- Covertible

- U.S. Treasury, Including TIPS

- U.S. Agency

- Diversified, Corporate & Treasury

- Municipal, Nationwide

- Municipal, State-Specific

- Municipal, Speculative (a.k.a. high-yield or junk)

- Targeted Maturity (Any combination of the above.)

International — 0% U.S.

- International, Diversified Corporate & Government

- International, Regional Corporate & Government

Emerging Markets. Diversified Corporate & Government

World or Global — All countries, including U.S.

- World. Diversified Corporate & Government

Asset Allocation (Some combination of stocks and bonds.)

- Domestic

- World or Global

- Balanced

- Target Date