Types of Investment Taxes

Post on: 28 Май, 2015 No Comment

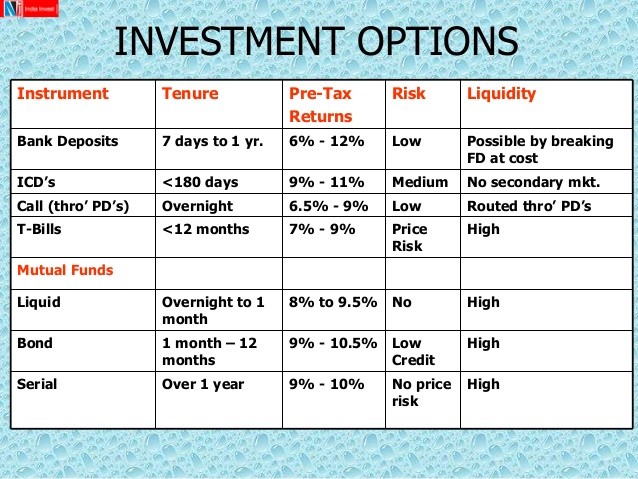

There are generally three ways in which investment income can be taxed: through dividends, capital gains, and investment interest. When a company profits, it distributes dividends to its shareholders. You can choose to receive the dividends as a check or have them invested directly in a dividend reinvestment plan, or DRIP. When you sell an investment security like bonds, stocks, or mutual funds at a profit, you generate a capital gain. When the opposite happens and you sell at a loss, it’s called a capital loss.

With a capital gain, the holding period for the investment security will determine the tax rate. For holding periods of longer than twelve months, rates are 15 percent for qualifying taxpayers in the 25 percent and higher tax brackets. For those in the 10 percent and 15 percent brackets, the long-term capital gains tax rate is zero that’s right, nothing (at least through 2010 under current law). If you hold a security for twelve months or fewer, any gains are taxed at the same rate as your ordinary income. Capital losses, whether long-term or short-term, can be deducted against any capital gains. Should your capital losses exceed your gains, up to $3,000 can be used to offset your other taxable income.

To keep your cash in your wallet, keep efficient tax records. These can equal big savings for you. For example, keep track of your tax credits and allowable deductions in order to use them, and you’ll find that more of your money stays yours.

Most interest earned from your investments, mostly fixed-income investments like bonds, are considered taxable at your marginal tax rate. Some interest-bearing investments offer you tax-free income at the federal or state level. For example, municipal bond interest is normally not taxed by the state or locality that pays the interest and is usually exempt from federal income taxes.

Then there’s the flip side: deductible investment interest. Even though many people believe that only mortgage interest is tax deductible, the current law lets investors deduct the interest they pay on loans (such as margin interest) they’ve used to make investments. Typically, you’re allowed to deduct that interest to the extent of your taxable investment earnings. When you’re figuring out your investment income for this purpose, you usually can’t include capital gains that are treated specially under the law or nontaxable interest or dividends. Your tax professional can help you figure out how much of your investment interest expense is deductible for tax purposes.