Types of Investment Funds OpenEnd ClosedEnd Funds and UITs

Post on: 26 Апрель, 2015 No Comment

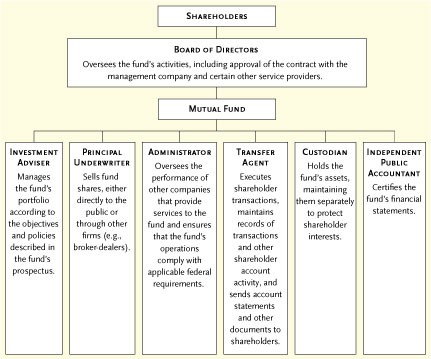

Investment companies were created to invest in a range of professionally managed securities or investments with the intent of accomplishing specific financial goals, such as capital growth or income. They have grown to become one of the main providers of asset management for millions of investors in the United States and around the world.

There are three main types of investment fund companies: open-end funds, closed-end funds, and unit investment trusts. But while they differ slightly in structure and characteristics, each provides investors with professional management and diversification, both inside and outside of IRAs and employer-sponsored retirement plans.

Open-End Funds

The open-end fund is by far the most common type of mutual fund available. Open-end funds are investment companies that are able to buy and sell an unlimited number of shares. Most of the household name mutual fund companies such as American Funds, American Century, Pioneer, Davis, TIAA-CREF, AIM, Putnam, Franklin, and Eaton Vance offer primarily open-end funds. There is no dollar or numerical limit to the number of shares that the fund company can issue to investors, and the company also buys back any and all shares outstanding.

Shares of open-end funds can only be bought and sold directly from the issuing fund company, and they cannot be traded in any type of secondary market. It is possible in some cases for an open-end fund to become closed to new investors if it grows to a size that prevents it from achieving its investment objective. For example, a fund that invests heavily in a rare type of security or investment may eventually take in more investor dollars than there are securities available for purchase by the fund, and may have to turn away new investors.

Sales Charges and Share Classes

Some open-end funds assess a sales charge, known as a load; the majority of this cost is paid to the broker who sells the fund, while the rest goes to the fund. For example, a fund that charges a 4.75% load will pay 4% to the broker and the remainder to itself. Investors can generally pay the sales charge in one of three ways:

- A Shares. The sales charge is paid in full at the time of purchase. An investor who buys $100,000 of a 4.75% load fund will have an initial investment of $95,250 after the sales charge has been deducted.

- B Shares. The sales charge is assessed when the shares are sold. Most B share funds have a declining sales charge schedule according to which the investor must pay a certain percent, such as 6% for all funds redeemed in the first year, and then 1% less the following year and so on until there is no charge for redemption in the seventh year. But while it is possible to escape paying the sales charge by leaving your money in, B share funds usually assess higher annual administrative expenses than their A share counterparts.

- C Shares. These are basically a combination of A and B shares. C shares assess a lower sales charge up front, such as 1% or 2%, and then also charge another fee upon redemption (usually similar to the up-front charge) if the funds are redeemed within a certain period of time, such as one or two years. C shares are usually the most expensive class of share to buy because they tend to charge higher annual administrative expenses than either of the other two share classes.

Cost

Open-end funds have two prices: their net asset value (NAV), which could be viewed as their bid price, as it does not include the cost of any sales charges, and the public offering price (POP), which is the price that new investors must pay to purchase the fund, and includes the cost of the sales charge. The NAV is always used when giving a quote of the fund price or calculating its historical performance. Open-end funds also use forward pricing, meaning that the price is updated at the close of trading each day.

Variable Annuity Subaccounts

The mutual fund subaccounts that are found inside variable annuity and variable universal life policies are open-end funds, which are essentially clones of those that are sold outside of the contracts and/or policies. Of course, this distinction effectively confuses many investors, who cant understand why their favorite funds from a given fund company are not offered inside a variable product when, in fact, they are. However, securities laws require that the clones be treated and classified as separate securities, so they are assigned separate names and CUSIP numbers (a tracking number that identifies the security with regulators).

For example, the Davis New York Venture Fund that is available directly from Davis Advisors is also offered inside the variable contracts created by Allianz Life company. It is labeled the Davis VA Value portfolio inside the contract, but it is managed by the same advisor and embraces an identical objective and philosophy as the original.

Closed-End Funds

Closed-end funds represent another major type of investment company. Unlike open-end funds, they only offer a limited number of shares. The fund company issues the shares in an IPO similar to stocks, and all the shares that are purchased then trade on an exchange like a stock.

Like open-end funds, closed-end funds are actively managed by portfolio managers and use forward pricing. They often tend to focus on a specific industry or sector, such as technology, healthcare, or energy, but there are also many with generalized growth or income objectives. Those that are income-oriented often use leverage in an effort to pay a higher yield, which also increases the risk.

The Closed-End Fund Association claims that the first fund of this type was issued in 1893, long before the first open-end funds were available. Closed-end funds are unique in that they are generally actively managed, which is not the case with open-end funds. Closed-end funds do not assess sales charges of any kind, but investors must pay a commission to buy or sell them, just like a stock or other security.

Exchange-Traded Funds (ETFs)

These funds are a type of closed-end fund that are not actively managed. ETFs trade intraday like stocks and closed-end funds, but they usually invest in a set portfolio of securities that does not change, such as an index or other benchmark.

One of the most common ETFs is the SPDR, known as the Standard & Poors American Depository Reciept, which invests in the S&P 500 Index Fund. ETFs also have a wide range of investment objectives. Because these funds do not require ongoing portfolio management, their fees are lower than those charged by actively managed funds.

Unit Investment Trusts (UITs)

UITs are essentially a hybrid of closed and open-end funds, with some characteristics of ETFs. They resemble open-end funds in that they can only be bought and sold directly from the issuer on an ongoing basis, although they can also be traded in the secondary market in some cases. They also usually charge a sales load of some type.

UITs are like closed-end funds in terms of issuance, because their offerings are not unlimited, and they resemble ETFs in that they always consist of a set portfolio of securities that were selected by a team of professional managers (or else mirror an index or other benchmark). But unlike any of its cousins, UITs are sold in units instead of shares (with each unit selling for $1,000), and are only held for a predetermined length of time as dictated by the trust that governs the portfolio.

When the portfolio matures, the trust is dissolved, the units are liquidated, and the proceeds are distributed to the investors, who will realize a taxable gain or loss from the sale of the units. Although UITs dont charge ongoing management fees in the manner of actively managed funds, they often have an initial sales charge that usually runs anywhere from 1% to 5%.

Final Word

The different types of investment companies have many of the same characteristics and offer similar services and benefits for investors. The right type of company for a given investor depends to some extent on the investors risk tolerance and time horizon.

Although ETFs and closed-end funds can meet the needs of a broad spectrum of investors, day traders and market timers will benefit from their liquidity and lower expense ratios, while open-end funds and actively managed offerings may be more appropriate for long-term investors. For more information on the various types of fund companies, consult your financial advisor .