Types of Financial Market

Post on: 13 Май, 2015 No Comment

google+

Financial Market is the market where financial securities like stocks and bonds and commodities like valuable metals are exchanged at efficient market prices. Here, by efficient market prices we mean the unbiased price that reflects belief at collective speculation of all investors about the future prospect. The trading of stocks and bonds in the Financial Market can take place directly between buyers and sellers or by the medium of Stock Exchange. Financial Markets can be domestic or international.

Different Types of Financial Markets

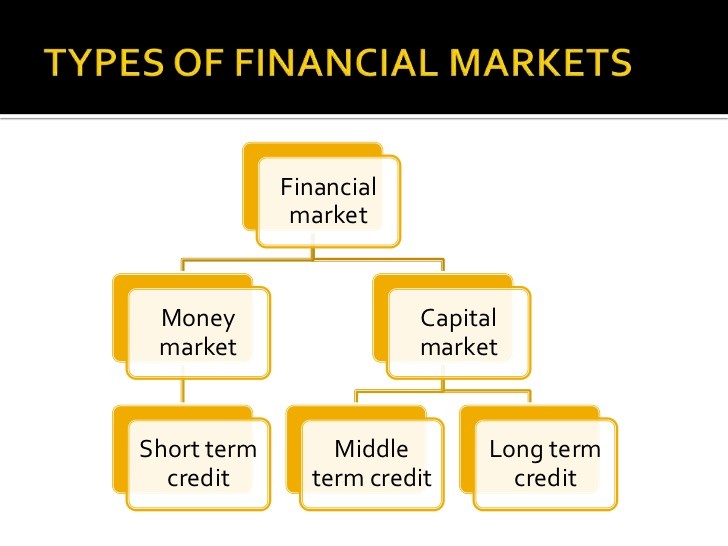

Capital Market

Capital Market consists of primary market and secondary market. In primary market newly issued bonds and stocks are exchanged and in secondary market buying and selling of already existing bonds and stocks take place. So, the Capital Market can be divided into Bond Market and Stock Market. Bond Market provides financing by bond issuance and bond trading. Stock Market provides financing by shares or stock issuance and by share trading. As a whole, Capital Market facilitates raising of capital.

Money Market

Money Market facilitates short term debt financing and capital.

Derivatives market

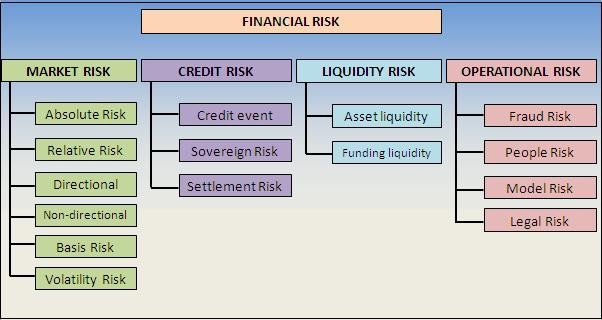

Derivatives Market provides instruments which help in controlling financial risk.

Foreign Exchange market

Foreign Exchange Market facilitates the foreign exchange trading.

Insurance Market

Insurance Market helps in relocation of various risks.

Commodity Market

Commodity Market organizes trading of commodities.

Contribution of Financial Markets

Financial Markets are essential for fund raising. Through Financial Market borrowers can find suitable lenders. Banks also help in the process of financing by working as intermediaries. They use the money, which is saved and deposited by a group of people; for giving loans to another group of people who need it. Generally, banks provide financing in the form of loans and mortgages. Except banks other intermediaries in the Financial Market can be Insurance Companies and Mutual Funds. But more complicated transactions of Financial Market take place in stock exchange. In stock exchange, a company can buy others’ company’s shares or can sell own shares to raise funds or they can buy their own shares existing in the market.

Basis of Financial Market

Basis of Financial Markets are the Borrowers and Lenders.

Borrowers of the Financial Market can be individual persons, private companies, public corporations, government and other local authorities like municipalities. Individual persons generally take short term or long term mortgage loans from banks to buy any property. Private Companies take short term or long term loans for expansion of business or for improvement of the business infrastructure. Public Corporations like railway companies and postal services also borrow from Financial Market to collect required money. Government also borrows from Financial Market to bridge the gap between govt. revenue and govt. spending. Local authorities like municipalities sometimes borrow in their own name and sometimes govt. borrows in behalf of them from the Financial Market.

Lenders in the Financial Market are actually the investors. Their invested money is used to finance the requirements of borrowers. So, there are various types of investments which generate lending activities. Some of these types of investments are depositing money in savings bank account, paying premiums to Insurance Companies, investing in shares of different companies, investing in govt. bonds and investing in pension funds and mutual funds.

Financial Market is nothing but a tool which is used to raise capital. Just like any other tool, it can be beneficial and can be harmful too. So, the ultimate outcome solely lies in the hands of the people who use it to serve their purpose.