Two ways to play the retail rebound

Post on: 14 Сентябрь, 2015 No Comment

Two ways to play the retail rebound

By John Wasik

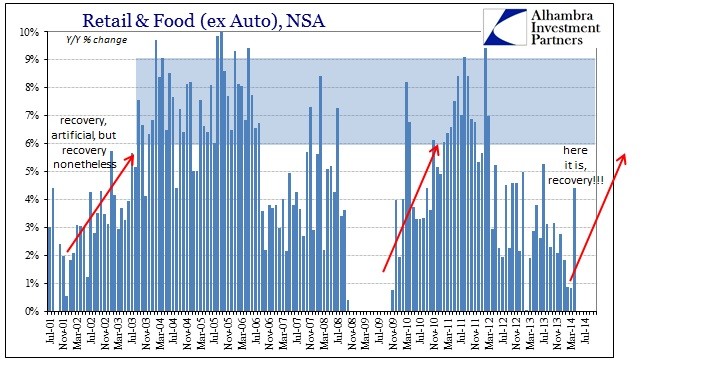

(Reuters) With consumer stocks blazing this year, it makes sense for investors to focus on retailers as the U.S. economy continues an inchworm-like recovery. But retail is a fickle business. And trying to guess which companies will survive over the long-term is a dangerous game.

Instead of buying individual stocks. youd be better off owning an exchange-traded fund of retailers benefiting from a revival of consumer spending, employment, home wealth and economic growth. Two of the top three sectors in the economy have been consumer discretionary products and staples. which include the stock of both manufacturers and retailers. The sectors have gained 14 percent and 17 percent year to date, respectively, through May 1, according to Standard & Poors. The other top sector was healthcare.

There are four exchange-traded funds that focus on the retail group. I like two of them, for different reasons.

One of the best-performing retail ETFs has been the SPDR S&P Retail ETF, which has consistently beaten the Standard and Poors 500-stock index and its benchmark index of consumer cyclical stocks over the past three years. The fund is up almost 20 percent for the three years through May 1 and is up 13 percent year-to-date, beating the consumer cyclical index by almost four percentage points.

As an index fund focusing on all the major retailers, the SPDR fund will capture the performance of major players like Wal-Mart Store Inc, Target Corp and Amazon.com Inc without being dominated by them. Its two largest holdings were drugstore chain Rite Aid Corp and wholesale distributorSuperValu Inc as of May 1.

No one stock accounted for more than 1.6 percent of the total portfolio. With 98 stocks in its portfolio, the SPDR fund is virtually equally weighted and not overexposed to big swings in troubled giants like Wal-Mart, JC Penney Company Inc and Sears Holdings Corp .

A worthy alternative is the relatively new Market Vectors Retail ETF, which holds big players like Wal-Mart, Home Depot Inc and Amazon as well as up-and-comers like TJX Companies Inc.

The fund was up almost 20 percent last year and 12 percent year-to-date. Its managers take a different approach from the SPDR fund: They focus on segment leaders like Home Depot and CVS Caremark Corp but deploy nearly half the funds assets in consumer defensive stocks that might hold up better during a slowdown.

LONG-TERM TRENDS

These funds appear to be well-positioned to respond to the long-term changes in the industry. Although companies like Amazon continue to dominate online sales, these fund managers wont count out brick-and-mortar stores, especially those offering bargains.

A growing shift favors smaller, more specialized stores such as Ross Stores Inc and T.J.Maxx, which provide deep discounts on name-brand items. Consumers who may have preferred shopping at aging retailers JC Penney and Sears/K-Mart are either trading up to stores like Macys or trading down to T.J.Maxx or Ross for brand names at significant discounts, says Jason Asaeda, a retail analyst at Standard and Poors. The funds Ive picked own stocks like TJX and Ross.

Retail innovators are paying attention to changing demographics and long-term changes in Americans purchasing habits. Successful chains will adapt, while losers like electronics retailer Circuit City, which went bust in 2009, will be liquidated.

Online retailers such as Amazon.com continue to poach sales from brick-and-mortar specialty stores such as Office Max Inc and Office Depot Inc, which have proposed a merger to compete with office giant Staples Inc. Consumers have increasingly gone to the physical stores to inspect merchandise and showroom prices, then shopped online to get better deals. Stores without a robust online presence and rapid retail mode of delivery wont survive.

Best Buy Co Inc, for example, hopes to regain market share by opening some 800 Mobile stores, which focus on portable electronics, while closing up to 200 existing locations. It remains to be seen whether Congress can level the playing field by allowing states to collect retail sales taxes from online retailers.

You need to be vigilant about retailers despite the healthy returns this year. These stocks are acutely sensitive to overall economic activity in the United States, given how closely linked they are to consumer confidence.

With doubts surfacing recently over the economys resilience retail sales dropped a seasonally adjusted 0.4 percent in March consumer spending, which accounts for 70 percent of the U.S. economy, could get wobbly fast. If a new slowdown were to come, it would rapidly blister most retailers.