Two questions every investor should ask

Post on: 19 Май, 2015 No Comment

George’s Latest Posts

Stephane Bidouze/Shutterstock

“Says who?”

During my formative years on Long Island, whenever one of my friends made an impressive boast, I’d respond — Says who? After getting the answer I’d ask — What do they know?

These questions should be every investor’s first line of defense when hearing an economic prediction or receiving an investment recommendation.

The answer to Says who? will deflate most predictions and recommendations. Too often, financial advice is just a personal opinion or speculation, frequently accompanied by charts, graphs, a compelling narrative and dubious back-testing.

If the answer to Says who? is the financial media, there is little assurance that the author or speaker is qualified to give investment advice. This is where the question, What do they know? proves its value.

The first decade of the 21st century has been called the lost decade for investors. The Standard & Poor’s 500 Index SPX, +1.26% yielded an average annualized loss of 0.9% from January, 2000 through December, 2009. But is a decade of negative stock returns an unprecedented occurrence? From 1926 through 2012, there have been 78 rolling 10-year periods (1926-1935, 1927-1936 etc.) and the S&P 500 Index delivered positive returns in 74 of them. Ten-year dry spells are uncommon but a lost decade isn’t something new under the sun.

No sensible investor owns a portfolio consisting only of an S&P 500 index fund. A simple, more prudent allocation would be what I call the Lazy Golfer Portfolio. It contains five Vanguard index funds — allocated 40% to the Total Stock Market Index Fund VTSMX, +1.30% 20% to the Total International Stock Index Fund VGTSX, +1.14% 20% to the Inflation Protected Securities Fund VIPSX, -0.23% 10% to the Total Bond Market Index Fund VBMFX, +0.00% and 10% to the REIT Index Fund VGSIX, +1.78% In the lost decade the Lazy Golfer Portfolio, annually rebalanced, yielded an average annualized return of 3.6% — disappointing but nothing to cry about.

Lost Decaders don’t mention that if we looked back 15 years from December, 2009, instead of 10 years; the S&P 500 Index yielded an average annualized return of 8%. An example of the adage that figures don’t lie but liars figure .

For most investors, the lost decade provided many great buying opportunities. By ignoring the headlines, staying disciplined and continuing to fund their retirement accounts, they often bought stocks at deeply discounted prices. The lost decade? Says who? What do they know?

In recent years, many commentators have been promoting the idea that the financial crisis has ushered in a “new normal.” For the next decade, its proponents argue, the slow economic recovery will lead to lower corporate profits and disappointing stock returns. The new normal will require new investment strategies — which they will happily provide. But let’s be realistic, no one can predict what’s going to happen next Tuesday, much less what will happen over the next 10 years. Any sportscaster who confidently predicts the next 10 Super Bowl champions on national TV would be laughed off the stage. Perhaps investors need to start laughing when anyone has the chutzpah to predict what the next decade has in store for the global economy. A new normal? Says who? What do they know?

Late in 2010, I attended a luncheon meeting of my local chapter of the Financial Planning Association. Lunch was provided by the sponsor, the American Funds. A fund representative gave his company’s market outlook for 2011. He forecast that it would be a good year for stock investors but only those who owned the right stocks. He assured us that 2011 would bring a stock picker’s market.” Following a bored yawn, I silently thanked American Funds’ investors for buying my lunch. Most pay an annual fee of 0.24%, called a 12b-1 fee, to pay the fund group’s marketing expenses. One man’s ceiling is another man’s floor. Thanks for lunch!

Is your favorite mutual fund group picking your pocket with 12b-1 fees? You can check your funds’ fees and expenses at your favorite financial website. If your portfolio consists of broker sold funds, be prepared for an unpleasant surprise.

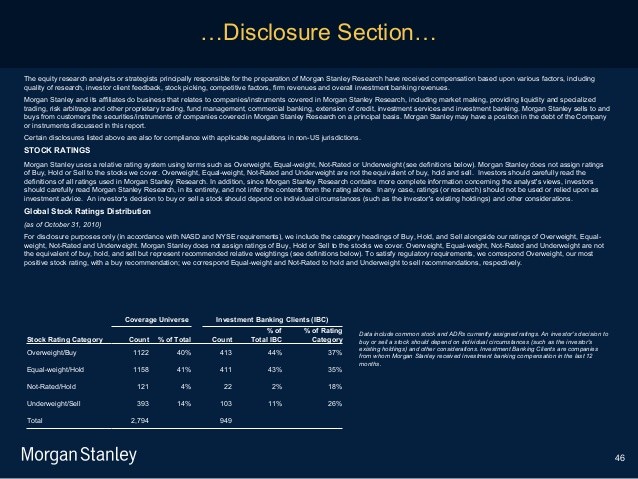

According to the Year-End 2011 Standard & Poor’s Indices Versus Active Fund Scorecard (SPIVA), 84% of all actively managed U.S. domestic stock mutual funds underperformed the S&P 1500 total stock market index in 2011. A stock picker’s market? Says who? What do they know?

For the past few weeks, the financial media has been bombarding us with predictions that the Federal Reserve would start cutting back on its bond purchases. The only question was by how much. Apparently, no one told Ben Bernanke. Fed tapering? Says who? What do they know?

Most people offering investment advice speak in conclusions. You need the details behind their recommendations. Do yourself a favor. Before making an important financial decision, get the answers to, Says who? and What do they know?