Two Defense ETFs That Are Flying Under The Radar

Post on: 16 Март, 2015 No Comment

Stay Connected

In the spirit of Veterans Day, I have chosen to profile defense-related ETFs that have contributed to the armed forces and security of our nation. The companies that make up the defense industry represent hundreds of billions of dollars in annual GDP and continue to be on the leading edge of technological innovation. The dollars spent in research and development lead to new breakthroughs in aerospace, nautical, and land-based equipment that give our country an advantage in military operations.

As an investor, you are able to capitalize on the strength of these companies and their earnings to propel your portfolio to new heights.

The two largest ETFs in this segment are the iShares US Aerospace & Defense ETF (NYSEARCA:ITA ) and the PowerShares Aerospace & Defense Portfolio (NYSEARCA:PPA ). Both of these ETFs represent a handful of stocks that are devoted to the development, manufacturing, and support of national defense. ITA currently has over $250 million in assets spread among 39 companies whose top holdings include Boeing (NYSE:BA ), United Technologies (NYSE:UTX ), and Lockheed Martin (NYSE:LMT ).

On the other hand, PPA as a slightly more diversified base of 51 underlying stocks and $81 million in total ETF assets. Both funds are market cap-weighted to give the largest allocation to the biggest stocks and currently charge an expense ratio of 0.45% and 0.66% respectively.

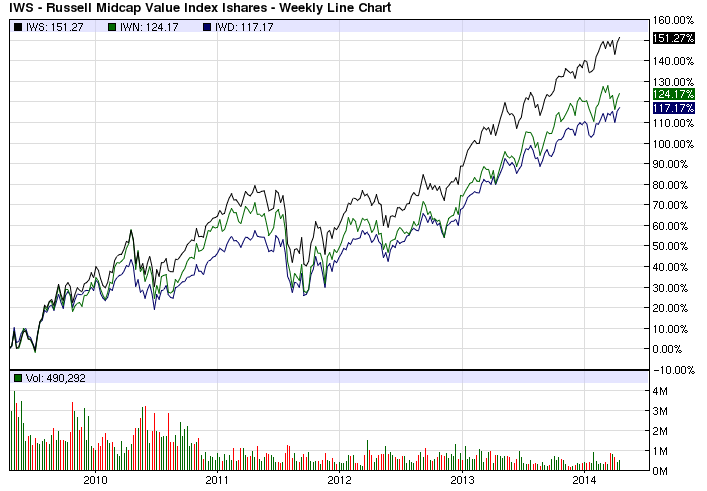

These ETFs have had equally fantastic returns in 2013, with ITA gaining over 46% and PPA notching a 40% move higher. That handily beats the 26% unrealized return of the SPDR S&P 500 ETF (NYSEARCA:SPY ).

Considering the breadth of outperformance, it is surprising to me that these ETFs have not garnered more assets and attention this year. Clearly they are flying under the radar (pun intended) for the majority of ETF investors who have been lured to more exciting areas of the market, such as solar and biotechnology stocks. In fact, many investors may be hesitant to pour money into defense companies that are forecasted to lose government funding in the near future.

The impact of the 2013 government sequestration and budget cuts are projected to reduce defense funding by nearly $1 trillion over the next decade. Even the recently christened next generation aircraft carrier, the USS Gerald R. Ford, has fallen behind schedule due to budget constraints. Its final completion is now projected to run beyond 2016 amid cost overruns. These examples of defense spending are getting more and more scrutiny in an era of budget austerity.

As long as the economy stays on track, many larger companies such as Boeing will be able to help offset a decrease in government spending with other lines of business such as commercial aircraft. Other smaller companies that are more focused on specific government-only defense products will likely feel more of a pinch as we slow down purchases of weapons, vehicles, and other military equipment. The benefit of investing in an ETF instead of individual stocks is that you get diversification amongst a wide array of companies with different products and services to mitigate business risk.

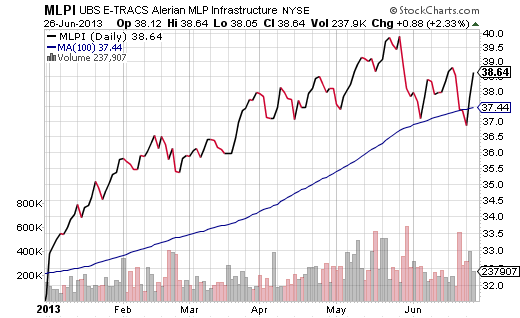

Ultimately I believe that these stocks will continue to outperform the broader market if the economy can continue its ascent. Given that both of these funds are sitting near their 2013 highs, I am hesitant to give an unqualified buy recommendation at these levels. I would prefer to wait for a pullback to initiate any new positions in these holdings. That should also be paired with a stop loss or sell discipline to mitigate the risk of a deeper correction.

Read more from David Fabian, Managing Partner at FMD Capital Management: