Tweedy Browne On Macro Uncertainty Growth Investing and some tips to budding analyst

Post on: 17 Июнь, 2015 No Comment

Tweedy & Browne: On Macro Uncertainty, Growth Investing, and some tips to budding analyst

When I started my investment journey two years back, I was much more attracted to the investment philosophy of partners of Tweedy & Browne compared to Warren Buffet. I found Tweedy & Browne emphasis on buying numerous group of bargain securities easier compared to buying selected few companies with strong moat at fair prices as emphasized by Warren Buffet [But gradually over last few months I am moving towards concentrated portfolio with a mix of both quality companies & special situations]. I fully agree with what Prof Sanjay Bakshi said in his recent interview here

My view is that investors, when they start out, should practice wide diversification and move towards concentrated positions only after about a decade of experience and as they move towards concentrated positions, their propensity to take business risk and management risk will go down but their ability to acquire deep knowledge about a handful of businesses with value creating potential will go up

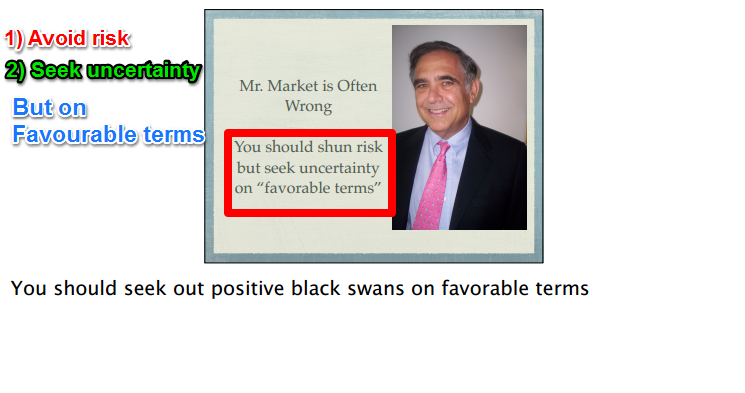

Investment philosophy of partners of Tweedy & Browne is best explained in the two below slides.

I have prepared a brief note extracting some of their interesting thoughts on value investing from their past letters to shareholders. You can download the note from here. Christopher H Browne, one of the partners of Tweedy & Browne, has written a fantastic and simple to follow book Little Book of value Investing . I have tried to pick up 20 most important points from this book. You can download that from here. Let me explain what happens when you ignore advice of these legendary investors. One of their advice in the books is

If a company is facing strong competition from a more efficient competitor with lower costs, it is perhaps best to utter those comforting words no, thank you and move on to the next candidate.

Even after reading their book, I chose to ignore their advice and invested in Philips Carbon Black [PCB]. PCB was facing severe competition from cheap Chinese imports. My entire bet was on imposition of safeguard duty on Chinese imports by Government of India. But even after a year of imposition of duty, there was no material reduction in imports. You can read the detailed discussion of this stock here [Observe my overconfidence is linear relationship between cause and effect in the PCB thread] Fortunately, I followed Tweedy & Browne advice of wide diversification and as a result overall impact on portfolio was less.

Below are some of the most important ideas which I found applicable to any value investor whether he is following deep value style or moat investing. [Extract from Tweedy & Browne shareholder letter are given in italics .Emphasis in bold is mine ]

What to do under current macro uncertainty

Current environment requires investment in stable and large business:

In the current uncertain environment (2011) it is necessary to have portfolios that are designed to weather virtually any kind of turbulence that may come our way. and that is precisely what we have tried to do. Our Fund holdings today continue to be comprised in large part of larger, less cyclical, steadier companies with more sustainable demand characteristics that are globally diversified, have solid balance sheets, sell products to an aspiring and growing middle class. and pay an attractive dividend yield while we wait for value recognition.

In March 2013 letter……………

So the question is, what are we to make of all this [macro concerns] and how do we translate it into coherent investment decisions? We certainly are not about to pick sides in the debate. A compelling case can be made either way, and much depends on how finite your time horizon is. The first and simplest conclusion is that macro forecasting is at best difficult if not impossible to get right on a sustained basis. Forecasting how the multitude of economic cross currents and behavioural factors driving buy and sell decisions will be translated into stock prices at any given point in time is beyond our skill set. That said, we accept that macroeconomic circumstances are going to have an impact to a greater or lesser extent on every business and every individual.

We own a business and businesses have a value independent of stock prices. Determining that value, we believe, is a more objective, knowable process than forecasting markets. We continually ask ourselves, what are the competitive advantages or weaknesses of a business? Does it have the financial flexibility and strength to withstand a difficult economic environment? Do its products have sustainable demand prospects? Can the business adapt to changing circumstances? In this process, we are attracted to companies that compete around the world. because in effect, we think that they are reducing the risk presented by any one market while at the same time positioning themselves to take advantage of more promising opportunities. Once we are comfortable with the business, and the value that would accrue to us as shareholders in an arm’s length sale of the business, we then look to buy shares, if they are available in the public market at a discount from our estimate of value. If not, we wait.

Problem of investing in growth companies

While we are not opposed to owning growth stocks, we see several pitfalls. More often than not, the higher growth rate is already reflected in the stock price ; i.e. the stock market has already discounted the future growth in earnings thereby increasing investor risk if the company is unable to achieve the investment communitys expectations. This has happened on numerous occasions in the past. Few, if any, businesses grow forever. By this we mean companies that can sustain high growth rates over long periods of time. While certain businesses can grow rapidly in their early stages, the task of compounding an ever larger sales and earnings base eventually leads to a slower growth rate.

In the April 2, 2001 issue of The Wall Street Journal, author Chris Zook, a partner at the consulting firm Bain & Company, wrote an article, Amazon’s Core Problem. In this article, Mr. Zook reports on a study his firm made of more than 2,000 companies worldwide “ in order to understand the odds and drivers of profitable growth.” He writes, “What we found was shocking. Only one in ten companies achieved true sustained, profitable growth—defined as 5.5% average annual revenue and income growth (adjusted for inflation) and earning the cost of capital—over the past 10 years.” Most Internet-related businesses would be eliminated from the “profitable grower” category because of the lack of profits. Mr. Zook goes on to define the three common pitfalls that companies encounter in the pursuit of growth and where Amazon.com has failed in this regard. The first is a failure to define the company’s true core business. Companies that define their core too broadly make misplaced investments “ that drain energy and weaken the core.”

Yes to growth investing but no to stocks with no history of growth

Growth in the eyes of value investors like us does not include new, cutting edge technology companies with little or no history of growth, and prospects based on unproven business models and projections.

No positive correlation between GDP & stock returns

In a recent article in The Wall Street Journal, Peter Tasker cited an academic study by Jay Ritter of the University of Florida that analyzed 100 years of data from 16 countries that showed that there was no positive correlation between GDP growth and stock market returns – if anything, the correlation was slightly negative. Again, we believe that faster growing countries simply do not offer attractive long-term investment opportunities unless valuations are compelling. Tasker goes on to explain that the companies that end up winning the struggle for survival in the emerging economies may not even exist yet, and cites the fact that there were over 100 different motorcycle companies during the Japanese miracle of the 1950s. “The market leader, Tohatsu, was driven out of business by the cut-throat pricing of a flaky upstart called Honda.”

My intention of highlighting pitfalls of growth investing according to partners of Tweedy & Browne does not mean I am against investing in high quality businesses at fair price as highlighted by Prof Sanjay Bakshi in his post on What happens when you buy dont buy quality. Infact, I have already began shifting my focus on high quality businesses. What I want to emphasize is one should not pay fair price for a commodity business disguised as high quality business. There are very few businesses which can grow at high rates for 10 years or more. So investor desirous of investing in high quality business at fair price should learn to say NO MORE OFTEN. Also go through this post by Vishal Khandelwal. where he tried to highlight some of the risks which are discussed earlier in this post.

Tips to budding analyst

The answer to this question could go on for pages. However, here is a sampling of some of the lessons we have learned over decades.

- Develop a handful of durable models for your business and life — constantly re-examine, tweak, and refine the models.

- Dissect behavioural biases and exploit them.

- Think of a company in the context of its competitors. not just as a stand-alone entity—look to the future as well as the current snapshot.

- Spend your time and analysis on higher-probability activities and continue to be humble about what is knowable and doable.

- Be intellectually honest—confront the challenges of your business head on—speak the simple truth and it will generally be well received.

- Equity returns occur often in concentrated bursts —you must be in to win—try to stay as fully invested as possible. [My observation: In some letters they did mention Seth Klarman principle that it’s better not to be fully invested in overvalued markets]

- Revel in the risk-reducing and return-enhancing advantages of diversification and the mathematics of skewness.

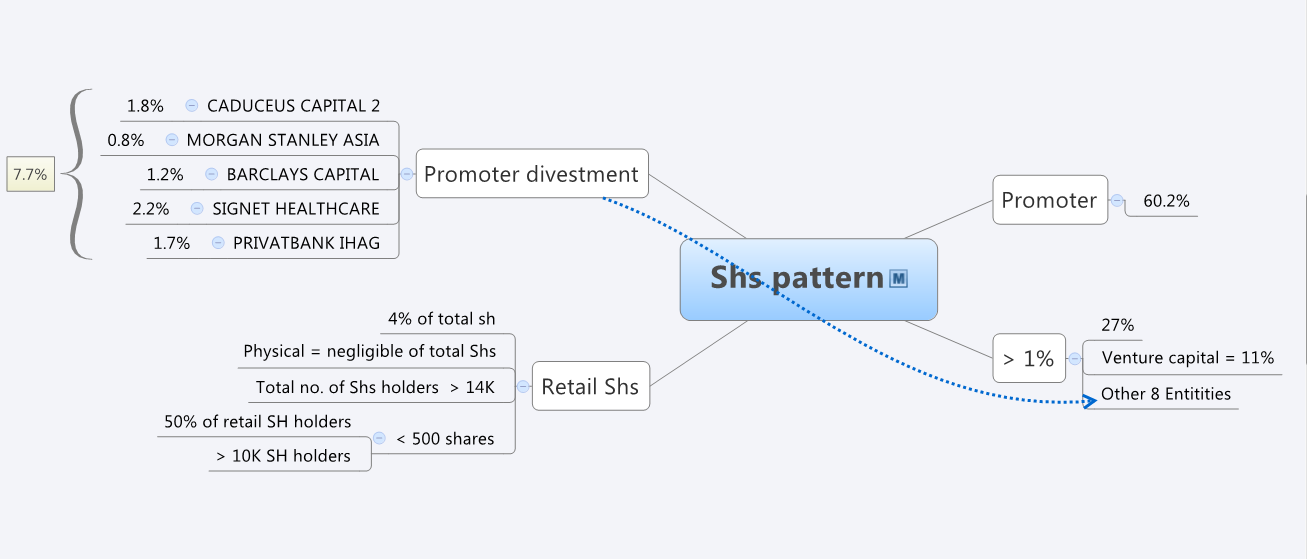

- Pay close attention to the behavior of knowledgeable company insiders.

- Make the government a very limited partner in your business.