Try Dollar Cost Averaging These 3 Stocks

Post on: 5 Май, 2015 No Comment

Want to nibble at these prices?

Try Dollar Cost Averaging These 3 Stocks

I am a bottom feeder when it comes to stocks. I enjoy taking advantage of fear in the market and buying at low prices. It is so remarkably simple, but buy low and sell high works.

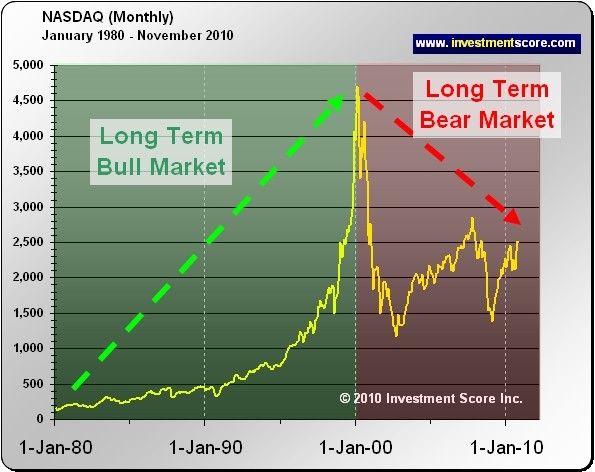

After a brief respite, stocks recovered thanks to a late-day rally Tuesday. The gains masked what was a very volatile day. Stocks are gyrating like the out-of-control Apollo 13 after explosions rocked that spacecraft from its scheduled mission to the moon.

If anyone thinks they can time the exact bottom of this mess, think again. I’ve heard from many investors that believed last Thursday was the peak of selling and started buying shares. They were greatly disappointed Monday when stocks fell hard again. These same investors used Monday’s selling to do more buying.

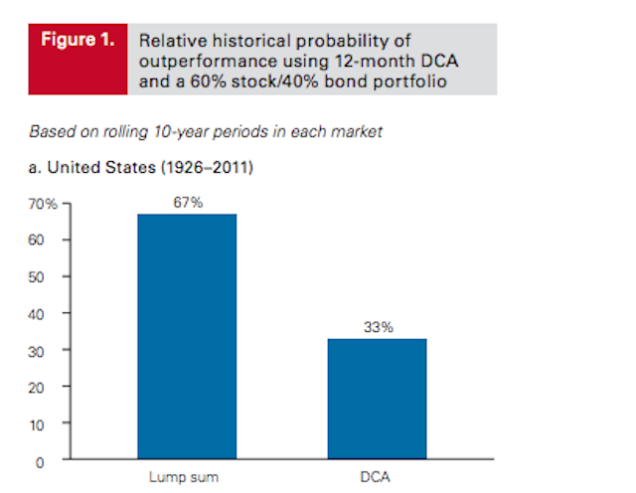

The pattern should serve as a reminder of a tried-and-true approach to buying stocks: dollar cost averaging. If you are one of the fortunate investors with cash available to buy stocks, it would be silly to put all your money to work at one single moment in time. Instead, take a little bit of cash and start buying stocks over time.

There is no doubt stocks are oversold given what we know to be true about the economy and corporate profits. While there is a possibility of a recession, such an outcome is not guaranteed. Stocks are telling us a recession is already here. As such, it very well might be a good time to deploy cash.

Here are three stocks to start nibbling on:

Zipcar

I heard an interesting interview on the radio with respect to the impact of economic uncertainty on individual consumers. This particular gentleman told the story of having a job, but now biking to work, forgoing the convenience of owning a car because he was making less money. I was struck by the peace of mind this person had in adjusting to his new reality.

Zipcar (NASDAQ:ZIP ) is a recent initial public offering stock with a business model that caters to regular folks that are downsizing or choosing to go green by forsaking car ownership, but that from time to time still need a car for longer-distance trips. Interestingly, while many recent IPOs like LinkedIn (NYSE:LNKD ) have been pummeled in the recent sell-off, Zipcar is holding up relatively well.

Its shares are down less than 10% since its July 21 close of $22.23. Amazingly, most of that loss was taking place Wednesday as the stock finally succumbed to selling pressure, dropping more than 8%. That is not just good outperformance it is remarkable.

A strong earnings report whereby Zipcar reported a smaller loss than expected is helping to support the stock. If you are a long-term investor, this is one stock you can start nibbling on. Remember: The time to buy interesting and aggressive growth stories is when things appear to be at their worst. We are at one such moment today.