Trust Deeds v

Post on: 19 Июнь, 2015 No Comment

Trust Deeds vs. REITs

When considering the possibility of investing in a trust deed many investors turn instead to the trust deed’s third cousin twice-removed, Real Estate Investment Trusts (REITs). Unfortunately many of these investors don’t fully understand the difference between trust deeds and REITs and don’t know that, by running to the more often discussed investment, they are losing out on many of the advantages trust deeds offer that REITs simply can’t match.

REIT Overviews

A REIT (Real Estate Investment Trust) is a real estate company that manages a pool of properties and sells stock in the pool. Those who buy the stock own a small interest in the basket of properties the real estate company owns and share in its profits. In fact, at least 90% of a REIT’s taxable profits must be paid out to shareholders in the form of dividends. A small number of all the REITs that exist are called Mortgage REITs. Mortgage REITs are different from Equity REITs because they make a profit by lending to property buyers. The vast majority of REITs are Equity REITs and they make money by renting and managing properties.

REITs are publicly traded and their values do fluctuate. In addition to receiving dividends, investors can capitalize on any gains the position has in the market by selling them. Of course, this means the investor can also lose money since they may sell their position for less than they purchased it for.

Differences between REITs and Trust Deeds

If you really want a pure real estate investment, REITs will be like unfiltered water to your delicate investor’s palate. REITs can have as much as 25% of their assets invested outside of real estate. In addition, REITs must have at least 100 investors invested in the trust and, in most cases, have far more than that minimal number. With so many investors each individual investor has a very small interest in the overall investment.

Because REITs are sold as stocks, they are not a fixed income position and they offer no repayment of principal at maturity since there is no maturity. Investors can profit with REITs if they gain value in the market while they own them and by taking a share of the profits paid out as dividends, but investors who buy shares of a REIT are left very exposed to potential losses with unlimited downside potential. Lastly, the purchase and sale of a REIT triggers a commission payable to the broker.

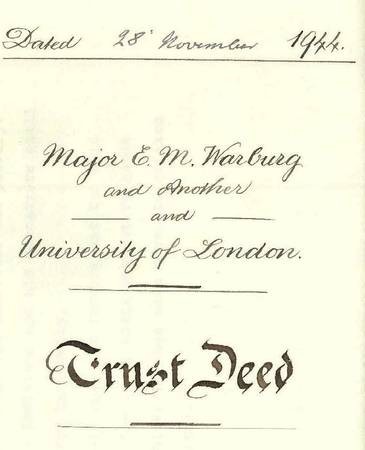

Trust deeds could not be more different than REITs. A trust deed is an agreement between one investor and one borrower. Some trust deeds, also referred to as fractionalized investments. can have more than one investor but the number is usually very small. California, for instance, allows a maximum of only 10 such investors for every fractionalized investment. Trust deeds have no other assets watering down the real estate portion of the investment since it is entirely made up of a secured lien on the property that provides collateral for the lender or lenders.

Trust deeds also offer a fixed investment with an interest rate determined at the outset of the relationship. The loan to value ratio is not generally more than 60% so trust deed investors also enjoy an equity cushion of 40% or more. When the property buyer pays off the loan through sale of the property, refinance or other means, the investor receives his or her entire principal back. If the borrower should default, the investor can recapture his or her principal at the sale of the property after the non-judicial foreclosure procedure. Trust deeds also have no fees, commissions or loads associated with them.

As any seasoned investor knows, there is no simple answer to investing success. One of the most important tenets of investing smart is to thoroughly explore all of the options in front of you, not just those favored by one individual broker. Once you research them, you will find that trust deeds are the perfect investment vehicle to balance out your portfolio and offer you a safe solution to creating investment income.