Trend trading of penny stocks

Post on: 10 Август, 2015 No Comment

By Zen Trade on 2011-07-21

Penny stocks differ from real stocks in that they have a more variable price behavior. Generally penny stocks can show all chart patterns larger stocks will also produce, but there are patterns that are typical for and found only in the penny stock market.

Of course what is meant here are price explosions and implosions. While a price collapse can also happen with large stocks, albeit more seldom, the opposite, a price expansion overnight of, say, five hundred percent, is only possible with penny stocks.

Some people like to go for the implosions and short penny stocks, especially those that they think of being inflated by pump and dump schemes. This may be a valid strategy for the penny stock market. But is it sound?

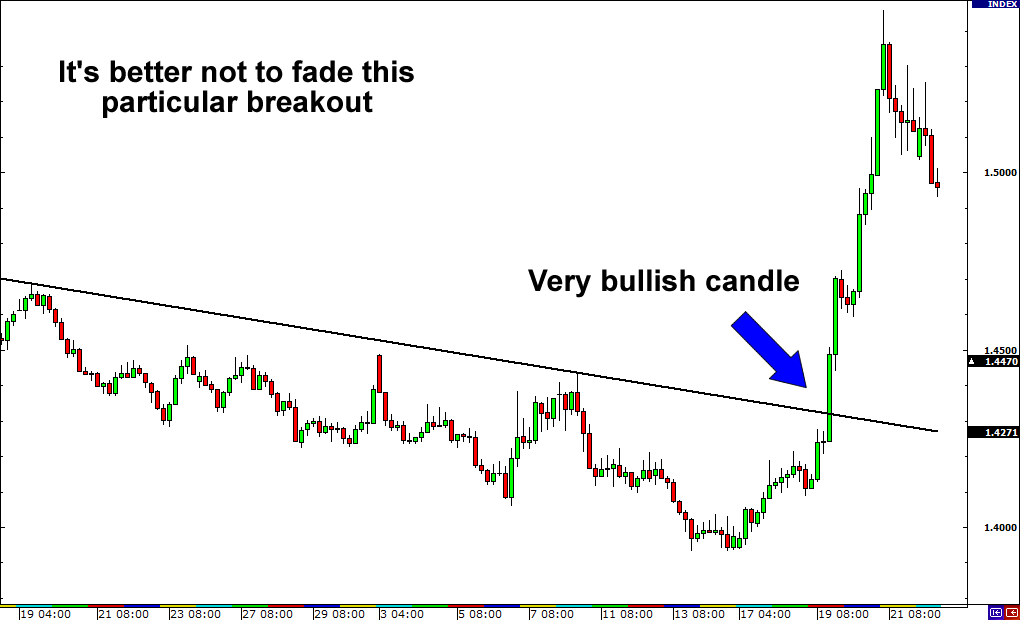

Shorting stocks is not sound! It may work at times, but holding them long for larger gains than a doubling your investment, is much more clever. Even more so for penny stocks. Shorting a stock that is artificially inflated may lead to severe losses. It gets possibly even more inflated after you entered the shorting bandwagon.

Why not go with the flow and bet on a resumption of the trend? At least people should understand that the beauty of penny stocks is the asymmetry of the maximal gains and losses. Therefore one penny stock system is to buy them cheap when the stock has already shown in the past that it can attract the interest of traders, resulting in much higher prices.

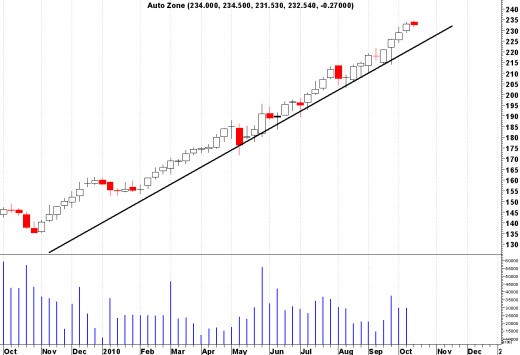

But the universal trading system is trend following. This is no different for stocks and so it should be also true for penny stocks. There are of course many stocks in the small cap arena that deliver trends, that may become real growth stocks or that are just small companies doing their business well and getting discovered by the market. The problem is mostly not to mix up these longer running trends with short lived price jumps.

The solution is quite simple. Watch out for enduring trends and then investigate the companies product situation. This is what small cap diggers do who search for diamonds in the rough. Helpful would be professional help, especially for the product side. Someone who is trading his own penny stock picks knowing that writing a penny stock letter will make him additional money.

Publishing a diamonds in the rough newsletter requires constant research. It will improve discipline! Selling this research may be a valid approach to improve the own trading results. So, dont be afraid and ask the old question, if someone is so good at trading, why doesnt he trade instead of writing about it? The answer to this question is in this case, and likely in many others, the writer trades and does a better job with his own trading, because of his writing.