Trend Trading 101

Post on: 9 Октябрь, 2015 No Comment

Defining a Trend

Trends are typically thought of as a statistical regression that points in a particular direction. For example, stock prices may vary widely on a daily basis but a statistical regression of closing prices over a month might yield an upward sloping regression that would suggest a bullish long-term sentiment. These trends are useful because they help filter out the short-term noise in favor of more reliable long-term signals.

Figure 1 – Raff Regression Channel – Source: StockCharts.com

In the financial markets, technical analysts use a combination of tools to measure trends over time rather than relying strictly on statistical regressions. Trend lines are often drawn directly onto stock charts to show levels of potential support or resistance, technical indicators use mathematical principles to calculate things like trend strength, and a number of other indicators can be used to confirm trends.

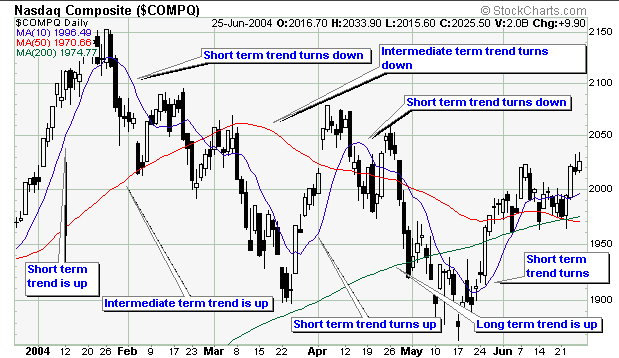

Most trend traders also use multiple time frame analysis to ensure they are trading with long-term and short-term trends. For example, looking at a 3-month chart might show a bullish picture, but the long-term 5-year chart could show a dramatic bearish picture. Trend traders should be mindful of both long-term and short-term trends in order to ensure they are on the correct side of the trade.

Identifying Trends

Technical analysts use a number of techniques to identify and validate both short-term and long-term trends, as well as predict potential reversals or changes in the trends. Trend traders usually try to latch on to existing trends, while contrarians try to identify near-term reversals to generate profits. Trend trading should also be familiar with reversal patterns in order to know when to sell their positions.

Moving Averages

Moving averages simply average past prices from a certain point in time and overlays that point on a chart. By removing day-to-day volatility, moving averages make it easier for traders to identify long-term trends. The actual price’s location relative to the moving average can also provide insight into whether an equity is currently above or below its recent averages.

A popular trend trading strategy known as moving average crossovers generates buy/sell signals based on one moving average crossing above or below another moving average, signaling a change in trend. For example, a short-term 20-day moving average crossing above a long-term 100-day moving average might be considered a signal to buy and vice versa for a sell signal.

Figure 2 – Moving Average Crossover Strategy – Source: StockCharts.com

Moving Average Convergence/Divergence

Moving average convergence/divergence (“MACD”) is a popular technical indicator that turns two moving averages into a momentum oscillator by subtracting the larger moving average from the smaller. By taking this approach, the technical indicator provides trend traders with insights into both trend direction and momentum, which is important for determining entry and exit points.

Trend traders often watch for crossovers and divergences for signals. When the shorter average diverges further from the longer average, momentum is considered to be increasing and vice versa for decreasing momentum. Trend traders also watch for divergences between MACD trends and price trends as a sign of a potential upcoming reversal and end of the current trend.

Figure 3 – MACD Trading Strategy – Source: StockCharts.com

Relative Strength Index

The relative strength index (“RSI”) is commonly used to measure the strength of a price trend by comparing days with a higher close with days with a lower close. By subtracting 100 from 100 divided by one plus the average number of up closes divided by the average number of down closes, the RSI generates a value that usually oscillates between 30 and 70 for the typical 14-day period.

In general, readings above 70 suggest that a stock is overbought, while a reading below 30 suggests that a stock is oversold. Trend traders may want to consider exiting long positions when the RSI rises above 70 for a prolonged period, while exiting short positions when the RSI falls below 30 for a prolonged period. However, RSI should always be considered in the context of other technical indicators.

Figure 4 – RSI Trend Indicators – Source: StockCharts.com

Benefits and Drawbacks

Trend trading may be the most common form of trading, but that doesn’t mean that there aren’t significant risks involved. Trend traders should be aware of all of the risks and rewards before implementing a strategy of their own. In addition, it’s also advisable to back-test a strategy on paper before implementing it with real money using any number of different tools available online.

Benefits of trend trading include:

- Statistical Support Trend traders are focused on making high-probability investments using statistical tools to confirm their trades.

- Long Holding Periods Many trend traders hold positions longer than other strategies, which reduces churn rates and commission costs.

- Money Management Money management strategies for trend trends are often relatively straightforward compared to other strategies.

Risks of trend trading include:

- Uncertainty Financial professionals always warn that past performance does not guarantee future price performance.

- Selectiveness Strong price trends are difficult to find and require screening hundreds or thousands of stocks to find the best opportunities.

- Sub-Optimal Price Trend trading often involves buying well above 52-week lows, unlike many contrarian strategies, which can be uncomfortable.

The Bottom Line

Trend trading is the most popular trading strategy used in the financial markets and it involves identifying long-term tendencies either higher or lower. Using tools like moving averages, MACD, and RSI, trend traders can identify trends, determine their strength, and identify potential areas of reversals. These strategies usually involve longer holding periods and more certainty, but at the end of the day, they aren’t a guarantee.