Trapeze All Cap Model Trapeze Asset Management

Post on: 22 Июль, 2015 No Comment

Strategy Overview

The Trapeze All Cap Model is generally for clients whose principal objective is long-term capital appreciation.

The Trapeze All Cap Model combines our large cap strategy (i.e. Trapeze Global Insight) with our best North American small and medium cap ideas, often concentrated in individual positions and sectors. We employ a proprietary and systematic process to uncover large cap global equities which our analysis indicates are undervalued. The most undervalued securities in our global large cap universe 1 form the focus group for our analytical team to concentrate its research efforts for large cap investment targets. We seek out small and medium cap stock ideas using myriad sources, including filters and screens, outside research analysts, corporate regulatory filings, newspapers and periodicals, other like-minded investors and our diverse business contacts.

The All Cap Model has a notional guideline of a minimum weighting of approximately 60% or more in large cap stocks (allocation in actual client accounts depends on clients’ specific preferences and circumstances). The small/medium cap stocks typically have less liquidity and potentially higher volatility than large cap stocks. Investments will have a North American focus, however may include international securities depending on their relative attractiveness.

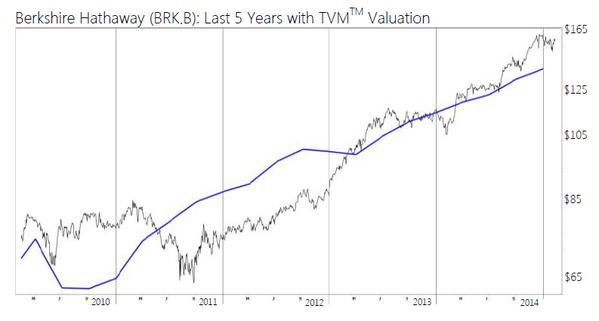

Our proprietary Trapeze Ratio of Adjusted Capital (TRAC™) system is used in an effort to optimize buy and sell decisions for targets and portfolio holdings. In addition to rigorous stock screening and research, we utilize a parallel process to monitor economic and market risk. The business cycles of all major economic regions are monitored via our Trapeze Economic Composite (TEC™) model. Market risk is monitored by our Trapeze Relative Indicator of Momentum (TRIM™). an algorithm that combines market momentum and volatility.

Although accounts will be invested primarily in equities, they may hold income securities when we believe the risk-return opportunity compares favourably to equities. Accounts will typically be fully invested, but may hold cash if our outlook dictates such allocation. Short-selling and option strategies may be implemented for clients who authorize them.

1 Our definition of large cap is based on trading volume (i.e. liquidity) rather than the more typical definition based on market capitalization and includes stocks with a minimum daily trading volume of approximately $20 million. We have compiled a global large cap stock univese comprised of approx. 1000 of the worlds largest companies that meet this liquidity threshold.