Trailing Stop Orders

Post on: 29 Июнь, 2015 No Comment

An overview of advanced order types for option traders.

Most online brokers can do a fairly decent job of helping clients trade the most common investment vehicles, like stocks, bonds and mutual funds. But when it comes to advanced options trading. it takes a very special online broker to understand the needs of their clients.

One of the main focuses of the top online option trading firms is advanced order entry. Features like Contingent Orders, Trailing Stops, One Cancels Other and One Triggers Other are just a few must-haves for option traders. However, some online options brokers don’t provide or fully understand these features.

Now let’s take a closer look at what each type of advanced order entails.

Contingent Orders

Contingent orders allow option traders to enter a variety of option strategies that will be triggered only if the underlying security reaches a specified price. This enables you to implement technical analysis more freely into your option trading. For example, you could create a contingent order that will buy a bull call spread if the stock breaks through a key resistance point that the trader has predetermined.

Contingent orders can be used as a form of Stop Order. Here’s how that works. Stop orders are usually entered as a protective order in case the market starts going in the wrong direction. A stop order becomes an active market order to buy or sell a call or put option if and when a specified price (the stop price) is reached or passed. In other words, as soon as the stop price is reached, the order will be sent to the marketplace. Naturally, a sell stop price will be below the market, a buy stop price will be above the market.

A contingent order is similar: you set up a contingency—something that needs to happen to trigger your order to activate. Just like a stop order, that contingency can be that the option trades at or through a certain price you specify. The one nice thing about the contingency is that it can be done off of the price of an option or the price of the underlying equity. Also, contingent orders are offered on advanced option order entry, that is, for most online brokers that specialize in option trading. For example, if the stock hits your get out price, send an order to marketplace to close out your bear put spread.

Trailing Stop Orders

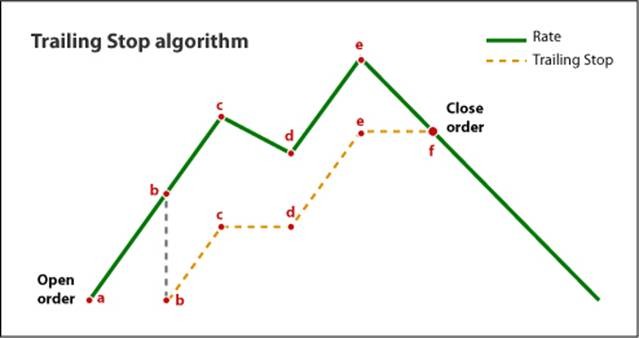

A trailing stop order is a close relative to the traditional stop order. As previously mentioned, stop Orders are usually entered as a protective order in case the market starts going in the wrong direction. Stop orders can perform a very important function. But many times, the security moves in a positive direction and the stop price quickly becomes obsolete because it is too far away from the new market price. So the existing order needs to be cancelled and replaced with a new more appropriate stop price to keep pace with the market.

Trailing stops do all of that work for you. The trigger price can be specified in terms of points or as a percentage above or below a security’s current market price. If the security’s price moves in a favorable direction after the order is placed, the stop order’s trigger price will be adjusted automatically.

That means you don’t have to keep canceling and replacing the order to keep pace with the market. The quote data is reviewed in thirty second cycles. If the security price moves toward the trigger price, then no adjustment is made. But if the security price moves away from the trigger price, a new stop price is set based on the terms set in the initial criteria.

One Cancels Other

A one cancels other (or OCO) order allows you to tie two orders together, so that if one order is executed the other order is cancelled. OCO orders are commonly used when there is an existing option position in your account. Most option traders have a plan for their existing put and call option positions. If they have a sufficient gain they want to close the position, and if the loss reaches a certain point they want to close the position. These two things can be accomplished with a combination of limit and stop orders.

A one cancels order allows you to enter a limit and stop order at the same time. Then, if the limited order is filled it will cancel the stop order, and vice versa. So you can easily mange the risks and rewards of your option positions with one simple order.

One Trigger Other

With a One Triggers Other order, you are placing two orders at once. The first order will be sent to the marketplace immediately, and the second is only sent if the first order is filled. The possibilities here are limitless. You can try to sell to close one option position at a limit price, and if that executes then buy to open a new option position. Or maybe try to buy a call with a specific strike price and if the fills then sell a call with a higher strike price and leg into your bull call spread.

Know the Risks and Rewards of Online trading

Whether you’re interested in stocks, bonds or options it is important to learn the benefits and drawbacks of trading online. If you are mainly an option trader, it’s particularly important to find an option broker that will cater to your specific needs and educate you along the way. TradeKing’s accessible team of knowledgeable brokers and our vast collection of online trading education resources can certainly help you in this regard.

Advanced orders are placed at TradeKing on a Not Held basis. When the conditions are met they are automatically released to the market as open orders. Certain advanced orders may not be eligible for execution when the condition is met (for example: you do not have enough buying power in your account). You solely are responsible for managing your orders to avoid errors, and the costs associated with the resolution. An advanced order can be held indefinitely until you decide to cancel it. Please note that advanced orders are particularly exposed to the risks derived from system malfunction and disruptions. Read a more descriptive disclosure about Advanced Orders

We also offer a powerful online platform from which individual traders and organizations can gain access to markets for stock and options trading, with low transaction costs. We make option trading simple, with advanced option order entry, comprehensive tools, charts and reporting for all account holders.

So if you’re an option trader or you’re thinking about becoming one, come give TradeKing a try. You’ll be glad you did.

We think once you discover all we have to offer, you’ll know we’re the right broker for you.