Traditional vs Roth IRA

Post on: 11 Май, 2016 No Comment

A comparison of Traditional vs. Roth IRAs and a guide to opening your IRA.

Start Investing for your Retirement

It’s never too early to start investing for retirement years. If you’re ready to get started, you should begin by familiarizing yourself with some of the basics of online investment trading and then consider opening an Individual Retirement Account (IRA). This page will acquaint you with Roth IRAs, one of the most common retirement account types, as well as some online investing basics that will help you plant the seeds now for a financially solid retirement to come. Since investing involves many personal decisions, you may want to have your tax professional or financial advisor brief you on the tax implications of trading activity.

What’s a Roth IRA?

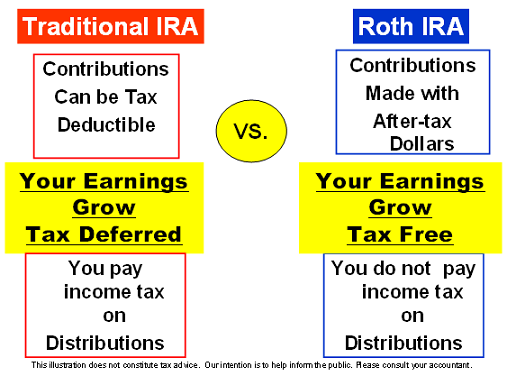

A Roth IRA is a type of account dedicated to saving funds for retirement. While similar to traditional IRAs, the biggest difference between Roth and traditional IRAs has to do with tax deductions. In a Roth IRA, contributions to the account are not tax deductible. However, qualified distributions are tax-free.

Opening a Roth IRA

Which type of IRA should you open? The two most popular account types are Traditional IRAs and Roth IRAs. Annual contributions to a Traditional IRA may be tax-deductible for that year — a nice advantage for those looking to lower their tax bill. However, there’s a trade-off: with a Traditional IRA you’ll be required to pay taxes on your withdrawals during your retirement years.

Investing in a Roth IRA works a bit differently. In a Roth IRA you invest post-tax dollars today — but then you’ll be able to withdraw funds tax-free during retirement. For investors who qualify, Roth IRAs enable your invested funds to grow tax-free, which can save you plenty in taxes in the long term.

TradeKing’s service representatives would be happy to familiarize you with these and other retirement accounts. TradeKing offers no-fee IRAs with a broad menu of personal finance investing choices, along with unbiased investing guidance to get you started right. We offer self-directed investing, so at the end of the day you’ll call the shots on your investment choices. That said, there’s no need to go it alone. We’re happy to introduce you to resources and investing news to help you find investments tailored to your needs.

What investments should I choose for my Roth IRA?

Excellent question. Today investors can choose from wide variety of investments vehicles. Maybe you’d like to learn how to invest in bonds or stocks. Diversified assets are also common choices for retirement assets.

Learning about your choices is the first step. After that you’ll need to think more about your specific investment approach. Perhaps you’re interested in investing in stocks based on investing articles and company fundamentals, or you may be drawn specifically to value investing or socially responsible investing choices. (Also known as ethical investing, green investing or environmentally responsible investing, this approach focuses on attractive investment vehicles in tune with your individual values.)

Whatever your inclination, TradeKing makes it simple to research online investing choices and get all your questions answered by a knowledgeable representative. Our investing tools help you filter your choices intelligently. After all, smart investing today helps you take that first step towards prosperity in your golden years.

Investing with kids

Investing with and for kids is a great way to teach them about personal finance and the broader market. Ask a TradeKing representative about account types that might work for you — and your family.

Changing jobs? Take your 401(k) with you

If you’re switching jobs, don’t leave your 401(k) behind. In fact, a job change can give qualified investors a great opportunity to move your 401(k) to an IRA There can be short-term tax consequences when doing so, but for qualified investors this move may save you considerably in tax bills over time. Call a TradeKing representative for more information on how this process works.

Open a TradeKing account

A nationally licensed stock and options brokerage, TradeKing helps self-directed investors like you become smarter and more empowered. At TradeKing we offer the same fair and simple price to all our clients — just $4.95 per trade, plus 65 cents per option contract. You’ll trade at that price, no matter how often you trade, or how big or small your account may be. We think that’s only fair and simple.

SmartMoney awarded TradeKing its full 5 stars for excellent customer service from 2008 to 2010. The SmartMoney online broker survey ranks brokerages on trading tools, banking amenities, research, investment products, customer service, commissions, interest rates, and mutual funds.