Trading the VIX

Post on: 14 Июнь, 2015 No Comment

The Best Protection Against a Falling Market?

Comments ( )

By Joseph Cafariello

Monday, July 15th, 2013

The Internet may have made stock trades easier to execute. But it has also made trade decisions much more difficult than they need to be. Trading need not be so complicated.

Take the VIX, for example. The Chicago Board Options Exchange Market Volatility Index (CBOE: VIX) is a complex formula that does one thing: measures the rate at which options on the S&P 500 index change in price.

Simply put, the VIX intends to measure the volatility of the S&P 500 index. The faster the S&P moves, the more its options prices will change, and in turn the more the VIX will change as well. Hence, its applicable name: The Volatility Index.

What is increasingly less applicable, however, is the way traders have become accustomed to trading it. The VIX is failing to give traders the protection they thought theyd get.

Not Always the Right Application

The most traditional use of the VIX is as a protection against a falling stock market. As stocks fall, they tend to fall quickly, causing option prices to change greatly, thereby sending the VIX sharply higher. A long position in the VIX would therefore capture the losses of your falling stocks.

But using the VIX in this way is not always sound, for the VIX is not an inverse index to the S&P 500. Rather, the VIX is a measure of S&P option volatility. And option volatility can occur whether stocks are moving up or down.

When stock markets fall, put options rise quickly in price, whereas when stock markets rise, call options rise quickly in price. Because the VIX does not differentiate between which options are moving, whether calls or puts it will spike upward when either set of options changes aggressively.

Thus, while the VIX does spike upward mostly in a falling market (since stocks fall faster than they climb), we must remember that the VIX can also spike up in a rising market if the S&P rises quickly.

In the graph below, the green circle shows the most common relationship, where the VIX (black line) moves opposite the S&P (beige line). Yet the red circle shows the odd times when both move together, in this case down. This latter case is especially odd because the S&P fell sharply, which should have caused the VIX to rise sharply. The VIX here failed to protect long stock positions (click to enlarge) .

The VIX is not always the best protector in a falling market. You would be better off with an inverse ETF that really does move opposite the index in almost perfect lock-step, say from 90-99% of the movement in most cases.

Increasingly Flawed

Yet another flaw in the VIX has arisen as of late in that it is changing at a greater rate than it once used to. This is due to new products such as ETFs that trade VIX options and futures in their portfolios, as well as some new products that trade S&P futures and options to replicate the VIX on their own.

As more and more traders buy and sell VIX-based and VIX-simulated ETFs, these funds will increased their buying and selling of VIX futures and options as well as S&P futures and options, increasing the volatility of the VIX and S&P themselves.

What we have, then, is a feedback loop, much like what you get when you hold a microphone directly at its own speaker, producing that ear-piercing screech as the sound amplifies itself.

A recent study of the VIX by Citigroup (NYSE: C) shows that these VIX-related contracts make up about 34 percent of overall volatility trading on the S&P 500, and as much as 44 percent of the short-term, 2-month volatility, Reuters reports .

Mike Pringle, global head of equity trading at Citigroup, informed Reuters :

The growth of structured products around VIX drove that move. In most cases, the VIX is sold to generate yield. But during some stress periods, the weakness in the spot level triggers significant computer-generated technical buying from these products.

It’s still relevant in extremes, Pringle concluded, but not in a normal functioning market.

Other Drawbacks

There are two other drawbacks to using the VIX as a hedge against a falling stock market. First, options on the VIX tend to be much more expensive than on other products, since the VIX can move in percentage terms much more violently than other indices. And if you hit a flat spot where the VIX stays horizontal for weeks, your options can erode to nothing very quickly.

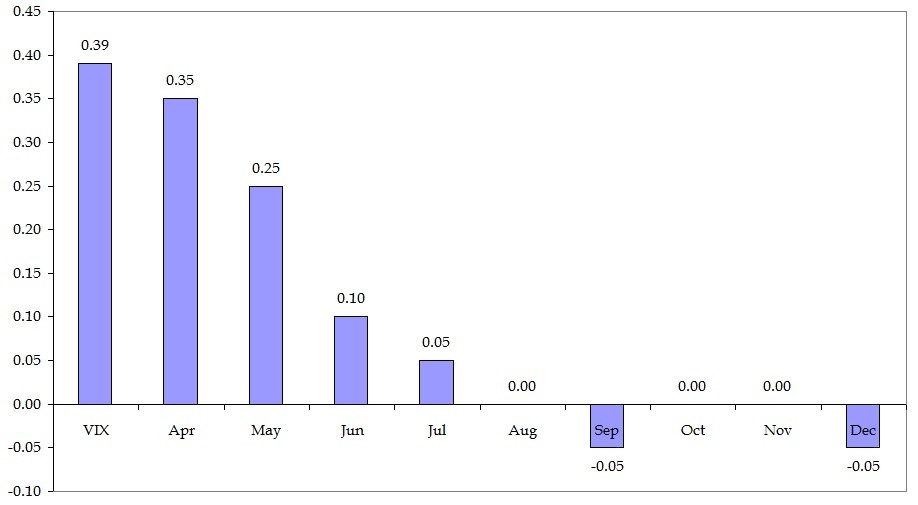

Second, VIX futures contracts which form the basis of VIX options and a majority of VIX ETFs can differ from near month to farther months quite significantly, much like short-term bonds can fluctuate differently from long-term bonds. The reason for this is that while an event can greatly move the near month VIX contracts, the events impact could be considered unimportant 3 or 4 months into the future and would thus have a negligible impact on VIX futures and options farther out.

So now its not just a matter of guessing the right direction of an event, but also guessing the right month when it will have the greatest impact.

2015: The Year of the Gold Bull Market

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: Gold Outlook for 2015

It contains full details on something incredibly important that’s unfolding and affecting how gold is classified as an investment..

Enter your email:

Alternatives to VIX

As mentioned earlier, the VIX is not an inverse index to the S&Ps index, but is just a measure of the volatility of S&P options and, by extension, VIX options. If you want to protect your portfolio in the event of a stock market correction, true inverse ETFs would track the markets changes much more faithfully.

There are numerous lists of inverse ETFs on the web, including the Short Dow30 (NYSE: DOG), Short S&P500 (NYSE: SPXU), and Short QQQ (NYSE: PSQ), which inversely tracks the NASDAQ.

However, we now need to realize that holding a large number of inverse ETF shares will drag behind a rising market like an anchor tied to the rear bumper of your car. If not used strategically, inverse ETFs can reduce your upside if the market keeps rising, which is a flaw of the VIX as well (in most cases).

If one does use inverse ETFs. he should change their portion of the portfolio as the market moves, increasing protection near a top and decreasing it near a bottom in preparation for the next leg up.

Or one can simply avoid such protective stocks or options altogether and just use cash as the corresponding trade. Selling some shares after the market has risen would shift funds from stocks to cash for protection, and then buying shares after a pull-back would shift funds from cash back to stocks, improving the dollar-cost-average in the process. In this case, cash becomes your protector against a falling market.

The VIX is just one of many protective tools available. While institutional investors have large enough accounts to make a successful go of it, smaller retail investors should familiarize themselves with it thoroughly before jumping into the volatility index. For as we have seen, it does not always behave as you might expect.

Joseph Cafariello

If you liked this article, you may also enjoy: