Trading the Trend

Post on: 16 Май, 2015 No Comment

The market is all about ebbs and flows. Based on recent trading, stocks appear to have regained some momentum. The DOW closed above 10,500 resistance on Monday for the first time since April 12, 2005, and it may be set to challenge key resistance at 10,600 in the coming days.

Similarly, the tech-laden NASDAQ has ticked higher on the last seven consecutive days and may be set to take a serious run at key resistance at 2,100, last broken on March 7, 2005.

Now, you may be seeing some decent trading gains over the past few weeks, and youre likely wondering if you should continue to add to your position and play the current momentum in the market.

If you read my column last week on momentum and lackluster trading volume, you should remember that prudence is necessary in an upward trending market void of volume. As I said, successful trading generally requires you to follow the herd in whatever direction, but, of course, there are exceptions to this rule. Following where the money flows is critical in trading. You want the market to be committed to a specific stock before you start trading your hard-earned money.

Say you have recorded some major gains in this recent rally. Do you take profits, or do you ride the crest of the market higher and take your chances?

First of all, let me make it clear that I do not like the concept of taking chances. Minimizing trading risk should always be a key tenet of your investment and trading strategy.

Special: An Important Message from Michael Lombardi:

I’ve identified six time-proven indicators that now all point to a stock market crash in 2015. You can see my latest video, Six Time-Proven Indicators Now All Pointing to a 2015 Stock Market Crash, which spells out why we’re headed for a crash and what you can do to protect yourself and even profit from it, when you click here now.

Here is what you may want to consider, given the current market situation. If you want to play the momentum game, then make sure you place trailing stop-loss orders at pre-determined levels. This may be 10% or 20%, depending on your risk aversion. If you find it difficult to stomach volatility, you may want to take some profits off the table now and set a close stop-loss. But be aware that, in wide swinging markets, setting a tight stop-loss could take you out of the game prematurely.

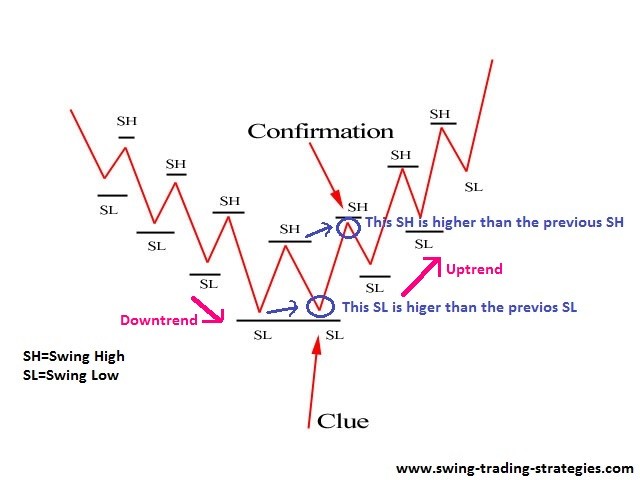

Another strategy you may want to consider is called, trading the trend. Lets say you like a stock that is rising. You can start off with an initial small position and then accumulate additional shares on pullbacks. But, for this to work, you have to make sure the trend is rising and the pullbacks do not break below the previous lows, otherwise you could be witnessing a reversal.

If the stock you are accumulating breaks below the previous low, you should monitor the trading action and make sure it is not a trend reversal. If the money flow is increasing on the pullbacks, you definitely want to review your situation and make appropriate decisions.

In any situation, the key is to maintain appropriate stop-loss limits on longs and stop-buys on shorts. Do this and you will save a lot of grief and avoid the risk of seeing significant losses to your capital base.

For those of you that dont currently follow this simple strategy, know that it would have protected you during the devastating market meltdown five years ago. Learn from the past, and trade for the future!