Trading Technical Analysis Strategies Moving Average And Pullbacks

Post on: 18 Август, 2015 No Comment

If You Had One Indicator For Trading Technical Analysis What Would It Be?

I participated in a trading webinar this past weekend where I demonstrated a few strategies to about 1,000 traders. The question I got asked the most over and over by at least 20 participants was to provide my favorite indicator for trading technical analysis strategies. My explanation was rather simple; the best indicator is the one that fits the type of market environment that you are currently trading.

Although my answer was accurate and correct, I could tell that my answer was too vague and didnt satisfy the curiosity of most traders. After the seminar ended I was asked one last time a slightly different question. The question was if you had to choose only one technical analysis indicator, what would it be?

The Moving Average Indicator

My answer was quick and fast, it would be the 20 day exponential moving average. The exponential moving average is a variation of a simple moving average. Before computers were widely used for market analysis, traders relied on simple moving average indicators because they were easy and simple to calculate. To calculate a 10-day simple moving average, simply add the closing prices of the last 10 days and divide by 10. The 20-day moving average is calculated by adding the closing prices over a 20-day period and divide by 20, and so on.

As traders began using computers in the early seventies, they wanted to find ways to make improvement to the moving average, more specifically they wanted to find a way to create less lag between the market they were analyzing and the indicator. The simple moving average was just not fast enough to react to volatile market swings. Traders wanted an indicator that was similar to a simple moving average but would put more weight on recent price action and less on past price action.

You can see in this example how the simple moving average reacts much slower to price action than the exponential moving average. This is the primary reason why most short term traders and day traders use the exponential moving average instead of the simple one.

Notice How The Red Line Is More Dynamic Than The Green Line

Take a look at another example of how the exponential moving average is quicker to react when trading technical analysis trends. In this you can see how much faster the exponential moving average reacts to the stock turning back up. The simple moving average barely moves while the stock is gaining substantial momentum upwards.

The Green Line Barely Moves While Stock Gains Substantial Momentum Upwards

The Best Way To Utilize The Exponential Moving Average

During the next few days I will show you a complete trading method that I created several years ago that relies on the exponential moving average indicator. Since the exponential moving average is very dynamic and responds well to recent price changes, I tend to use it to trade pullback or retracement strategies.

The first thing you need to do is to adjust the exponential moving average to 20 days. The 20 day is a good starting point for most volatile stocks, futures and currency markets. If you are day trading, use 20 bars instead of 20 days.

After you adjust the settings you want to find a stock or other market thats trading substantially above the 20 day exponential moving average. The further the price is away from the average the better. You can see in this example how far the stock is trading above the moving average. This is a great filter for finding stocks or other markets that are trending strongly.

You Want To Find Stocks or Other Markets That Are Rising Sharply Away From The EMA

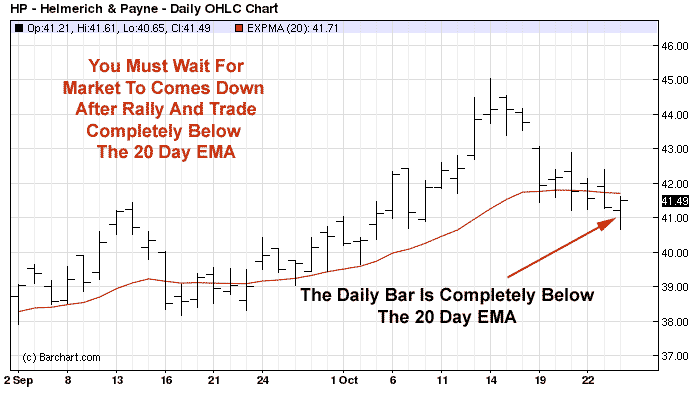

The next step is to monitor the stock or market you are trading and wait for the market to trade completely below the 20 day EMA. This example shows you exactly what I mean. You want to make sure that the high is not touching the EMA and is trading completely below it.

The Stock Rallied and Within A Few Days Drops Completely Below The EMA

The next step after the stock or other market you are trading drops completely below the 20 day EMA is to wait for the market to trade once again completely above the 20 Day EMA. You can see how the stock only dropped for a few days prior to resuming the strong trend, this is a good sign. If the stock was to stay below the average for more than one week I would probably be a bit concerned about continued momentum.

The Move Below The Moving Average Was Short Lived

Here is how the entire pattern looks like on one continues chart. You can get a good feel for how the 20 day EMA filters strong trending markets and more importantly, how it identifies pullbacks away from the main trend.

You Can See The Entire Process On This Chart