Trading Strategies 3 Biggest Forex Trades of George Soros

Post on: 8 Июнь, 2015 No Comment

Posted on May 16, 2013 by Fxi in Forex Strategies & Tips. Top stories with 3 Comments

Updated on May 05, 2014.

Uncover the trading strategies and analysis of the biggest and most notorious foreign exchange trades ever. Learn how George Soros shattered whole economic regions and made huge profits by betting on their weakness. Normally the big trades in forex stay unknown as the market is too big to spot individual traders. Also it is very unlikely that a single trader can influence the whole economies. But there are exceptions – and this exception is called George Soros.

G.Soros Strategy Revealed his TOP5 most profitable stocks of 2014

Nr.1. Soros Breaks the Bank of England and earns $1 Billion in a day

This is certainly the most notorious forex market event which took place on September 16, 1992 which is called “the Black Wednesday” and Soros got his nickname “the man who broke the bank of England” from transactions he performed together with other traders. They didnt break it directly, but they devaluated it so badly that Britain had to take it out from the European Exchange Rate Mechanism (ERM).

Fig.1. How Soros Broke the Bank of England in 1992.

Britain was in a recession from 1990 but despite this the pound (also known as Sterling) joined the ERM in 1990 thus fixing the pound’s rate to deutschmark in order to make the investments more predictable and stable among Britain and Europe. But as the political and financial situation in Germany changed during the unification of Germany many ERM currencies were under big pressure to keep their currencies within the agreed limits. Britain had the most problems its inflation rate was very high and the USD rate (many British exporters were being paid in USD) was also falling. So more and more speculators began circling and making plans on how to profit from this situation as it became clear that the pound was not able to artificially stand against the natural market forces. Speculators waited until the financial situation got as bad as it could naturally get and then created extra pressure on the pound by selling it in huge amounts. The most aggressive of them was G. Soros who performed this transaction every 5 minutes profiting each time as the GBP fell by minutes.

“The money that I made on this particular transaction would be estimated at about $1 Billion dollars. We very simply used the forward market – you borrow sterling and you sell the sterling that youve borrowed. And then you buy back the sterling when the loan expires.”

– G. Soros.

Watch the video on how United Kingdom was forced to leave the monetary union because of the Forex speculations performed by Soros and other traders:

Let’s look at a simplified example to understand the trading strategy of Soros :

Soros borrows 1 Million GBP, sells it at the current rate for 2 Million USD (GBP/USD = 2.00) and buys it back when the GBP/USD = 1.50 for 1.5 Million USD thus keeping the difference of 0.5 Million USD.

In order to sustain the fixed rate the Bank of England was buying 2 Billion GBP an hour which as an unprecedented amount. The policies of the ERM demanded that the countries with the strongest currencies have to sell their currencies and buy the weakest to help maintain the equilibrium – in this case the Bank of Germany had to sell deutschmarks and buy pounds but they didnt come to Britain’s rescue as apparently Germany had interest in seeing the GBP devaluated. All the Britain’s efforts of pumping in money and increasing the already high interest rates proved futile.

In the late afternoon of September 16 as the traders understood that the Bank of England has insufficient amounts of foreign currencies to buy in all the pounds that were sold, they pushed even more which resulted in a collapse and at 19:40 the British prime minister confirmed defeat and declared that Britain is leaving the ERM.

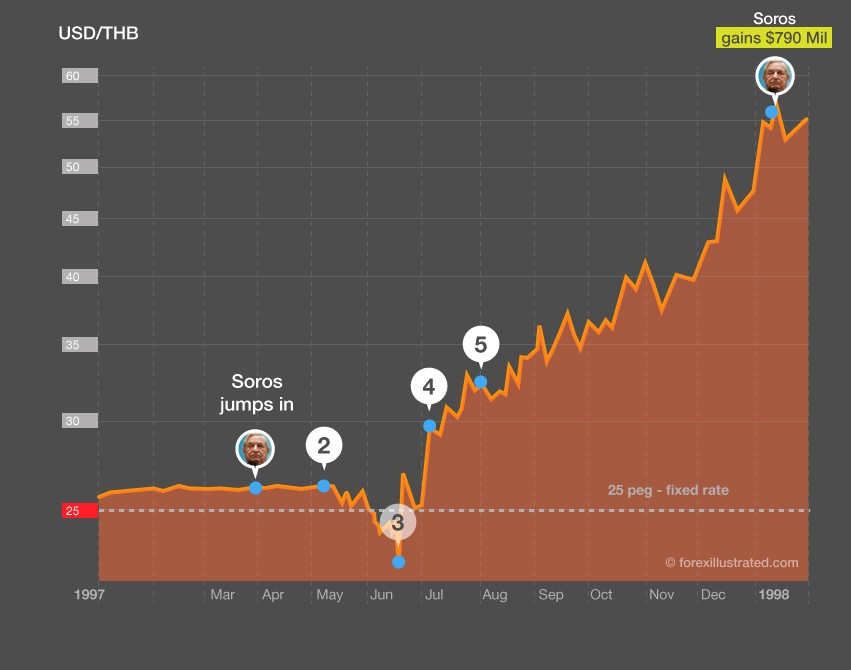

Nr.2. How Soros earns $790 Million, crashes the Thai Baht and triggers the Asian crisis.

The second most notorious trade of Soros came in 1997 as he saw a possibility that the Thai Baht could go down so he went short on the baht (by going long on USD/THB) using forward contracts. His actions are often considered to be a triggering factor which formed the big Asian financial crisis affecting not only Thailand but also South Korea, Indonesia, Malaysia, Philippines, Honk Kong and others.

Fig.2. How Soros gained $790 Million and destabilized Thailand’s and Asian economies in 1997 – 1998.

- Soros goes short on the baht.

- Thailand spends almost $7 Billion to protect the Baht against speculations.

- Soros sells all his baht resources and keeps telling everyone to do the same by publicly scaring people with the fall of the baht and crisis. It works.

- On July 2, Thailand is forced to give up the fixed rate of the Baht and it starts to float freely. Thailand asks for help from the International Monetary fund (IMF).

- Thailand takes on hard austerity measures to secure the loan from the IMF.

- Baht has fallen from 1$ for 25 baht to 56 baht thus Soros had gained more than 790 million USD.

Nr.3. Soros gains $1.4 Billion from the falling Yen

Japan’s economy was seriously damaged after the devastating tsunami in 2011 and the economic recovery didnt happen so fast. Since then traders have been awaiting the weakening of the yen which started to form in the end of 2012 as Shinzo Abe (candidate for the post of Prime Minister of Japan) publicly spoke about his plans to weaken the Yen in order to boost the economic situation of Japan. Taking into consideration his high ratings this was a good signal for the investors to open big USD/JPY positions betting that the value of dollar would rise against the yen.

Fig.3. How Soros used the the economic situation in Japan to earn $1.4 Billion in 2013

The first one to jump in was George Soros who is legendary for his skills of shorting different currencies with high leverages and worldwide consequences. He forecasted the upcoming trend and Soros Fund Management allocated 10% of its $24 Billion to USD/JPY in mid-November 2012. Since then they have gained $1.2 $1.4 Billion (according to sources close to the Fund) in this deal and the Yen still keeps going down. Other big players who opened similar positions include Daniel Loeb, David Einhorn, Caxton Associates, Tudor Investments and Moore Capital – and these huge bets helped the momentum of Yen’s slide to increase even more. This was not only beneficial for the traders who went short on the yen, but also for Shinzo Abe who knew that a weaker yen could attract more foreign investments and also make Japans export more competitive. This in turn was heavily criticized from the biggest EU countries who understood that such interventions would in turn lower their export potential as Japanese production would cost less and less.

Banks and hedge funds soon started telling their clients to bet go on this bet as well. The growth of dollar increased even more when Shinzo Abe was elected as the Prime minister on December 26, 2012. After this Even the Bank of America jumped in to make profits from this trend.

Luckily for Japan these moves of Soros and other traders didn’t threaten its currency as it did when Soros went short on GPB in 1992 and on Thai baht on 1997 thus damaging these currencies and creating financial collapses in both countries. The reason for this is that the biggest part of Japans resources and debts are owned by locals.

What can we learn from these super deals?

The main trading strategy of Soros and other traders is to spot upcoming economical vulnerability of a country and then go short on its currency right before the fall happens. The highest potential of currency fluctuations and thus also gains is when a currency has a fixed rate to other currency – as in the case of pound and Thai Baht. In these cases the weak countries are very vulnerable to speculations as they try to artificially sustain the fixed rate by buying in its currency that is being sold as people sell it. This artificial currency balance is prone to collapse very dramatically when it can’t fight the natural market forces anymore – and this is exactly what happened here. In the case of Japanese Yen the signal to go short on it was when Japanese government said it would depreciate the currency in order to boost its economy and attract investors.

So as you can see from these examples once again – economic crises often offer the best opportunities for currency traders. Of course it all looks much easier when observed in retrospective, but still these are patterns which can be used by everyday traders as well.