Trading Stocks Education How to Trade Gaps

Post on: 12 Июль, 2015 No Comment

Trading Gaps — Part 1

GAPS are a category all unto themselves. Lets discuss gaps in two parts. First we will look at what they are, why they happen and what the concepts are. Next we will look at some chart examples.

A gap is a term used to describe the circumstance of when a stock opens at a higher price than it closed the prior day. The word gap refers to the gap that is left in the daily chart; the empty space from yesterday’s close to today’s open. Gaps can be either up or down. They can happen to all stocks, listed or Nasdaq.

The gap is measured from the prior day’s 4 p.m. closing price to the current day’s 9:30 a.m. opening price, all in Eastern Standard Time. The post market activity and pre market activity do not affect the gap for our purposes. Stocks can trade after market hours through ECNs (Electronic Communication Networks), until 8 p.m. and pre market starting at 8 a.m. but this is currently not considered to be normal market hours.

For example, stock XYZ closes at 4 p.m. EDT at 37. It trades in after market hours up to 38. The next day at 8 a.m. EDT it starts trading at 38.5 and trades up to 39.5. By 9:30 the stock is all the way back down to 37.10. The gap as we measure it is only 10 cents. All those post and pre market trades do not matter. The stock traded, and people made and lost money, but the gap is not affected.

With VisualTrader . you will know when the market is turning, which industry groups are leading the stampede, and which charts have the best setups.

OmniTrader gives you the power to make decisions fast! It gives you real trading signals with all of the supporting information automatically displayed for you.

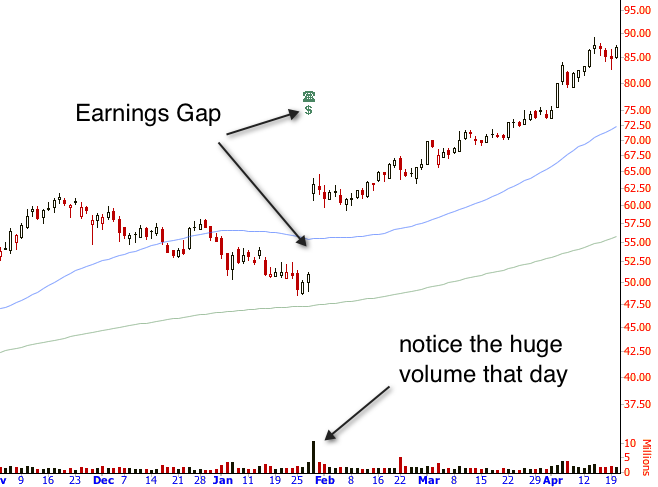

What causes gaps? Usually it is news driven. Individual stocks can gap up or down due to news such as earnings reports, earnings pre-announcements, analysts’ upgrades and downgrades, rumors, message board posts, CNBC, or key people in the company commenting or buying/selling the company stock.

Groups of stocks or the whole market may gap up or down due to various economic reports, news on the economy, political news, or major world events (most recently is the large gap down from the Sept. 11 incident). This news can cause many individual issues to gap with the market. Many big name stocks move very closely with the market. Some may be in the sectors that are most affected by the news.

Whatever the exact reason, gaps are the result of some kind of event happening while the market is closed. The result is the buying or selling pressure at the open of the next day, which will make the stock open at a different price than where it closed. Why are they important? This sudden move by a stock, the sudden change in demand, is often the beginning of a major move. They are swing trading strategies that capitalize on entering after a gap, and guerrilla tactics that capitalize on one or two day moves after a gap.

Here are some concepts and general rules about gaps. First, we generally never buy a large gap up at the open or sell short a large gap down at the open. When market makers have the chance, they will often exaggerate the gap. Also, large gaps are already extended, making the play risky. We tend to fade the gap initially, if played at all. Fading means to play the stock to come back in to where it was. Fading a large gap up would be to go short the stock as it trades down after a large gap up.

After the initial move, the charts must be looked at along with the amount of the gap, and the share price of the stock. Small gap up that gaps over resistance can be watched for long entries. Large gap up that gaps into resistance can be watched for short entries. What is large or small and what is resistance is all a matter of chart reading and interpretation, but there are some rules we will be looking at.

Small gap down that gaps under support can be watched for short entries. Large gap down that gaps above support can be watched for long entries. What is large or small and what is resistance is all a matter of chart reading and interpretation, and again, there are some rules we will be looking at.

The concept of gaps is a very difficult one for most traders, even those with considerable experience. They are a strategy all by themselves, and are part of many other strategies. We will next look at a few examples. While this cannot serve to fully educate you on the topic, it can get you started thinking correctly about a big part of the trading day: the opening.

Types and Characteristics of Gaps

Importance of Volume Trading gaps Part 2