Trading Options Trading ETFs Part 1

Post on: 30 Март, 2015 No Comment

For many traders, the only thing more exciting than the prospect of exchange-traded fund (ETF) trading is the idea of trading options on ETFs.

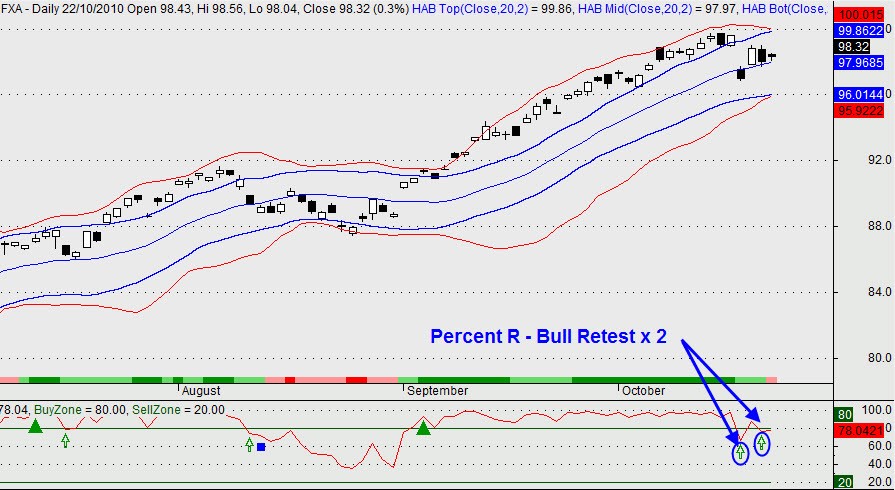

Buying and selling short ETFs based on short term overbought and oversold conditions is an excellent strategy, and one that we have used to produce 15 out of 17 winning trades in Larry Connors Daily Battle Plan trading service this year.

But for some traders who want to leverage both the power of our high probability ETF trading strategies, and the power of derivatives, the idea of buying and selling calls and puts on ETFs is irresistible. In this article, Ill show you a basic options trading strategy for ETFs, with a more complex, advanced options trading strategy for ETFs reserved for a follow-up article next week.

Click here to learn how to utilize Bollinger Bands with a quantified, structured approach to increase your trading edges and secure greater gains with Trading with Bollinger Bands® A Quantified Guide.

Trading options on ETFs allows traders to use the leverage of the derivatives market to potentially increase gains from high probability ETF trades. But not all ETFs have liquid options for traders to use. Traders looking to make options trading a part of their ETF trading strategies should make sure that the options that would be used are liquid, with relatively tight spreads. For many ETF traders, this often means sticking to the more widely-traded index ETFs such as the ^DIA^, the ^SPY^ and the ^QQQQ^), as well as the more liquid country ETFs from iShares and others.

Options Chain for the S&P 500 SPDRS: An example of very liquid options are those for the S&P 500 SPDRS, which has a healthy open interest and trading volumes for most near-the-money strike prices .

Options Table Courtesy of OptionsXpress .

Todays basic options strategy for ETF traders is a simple but effective one: buying deep in the money calls with long signals in ETFs or buying deep in the money puts to fulfill short ETF signals.

Calls, of course, are options that traders buy when they think that prices are headed higher. A call gives the owner the right, but not the obligation, to buy stock at a pre-set price. Buying a call is a leveraged way of reserving todays prices for an item that you think will be higher priced in the future.

By deep in the money, I mean a call that has a strike price that is two or three strikes below the ETFs current price. For example, if an ETF were priced at $44 and we received a long signal on the close, a deep in the money call would be a call with a strike price of 40 or even 35. (By contrast, a deep out of the money call would have a strike of 50, 55 or higher).

The same strategy works for traders who receive short ETF signals and want to express that market opinion using puts. Puts are used by traders who believe that prices are likely to head lower in the near term and increase in value as their underlying market retreats. And as with calls, buying puts that are deep in the money is the preferred way for traders to use puts on overbought ETFs (if the ETF is trading at 38, a deep in the money put would have a strike price of 45 or 50).

Why a deep in the money option as a choice for ETF traders using options?

When trading options as, essentially, ETF substitutes, traders should use deep in the money options because those options are most likely to closely track their underlying asset (an ETF in this case). While out of the money options often provide greater leverage and are an attractive alternative to many, there are a few dangers with trading out of the money (OTM) options that ETF traders should keep in mind.

Foremost, because the options are out of the money, they have no intrinsic value. Practically speaking this means that, among other things, adverse price movements in the underlying could have a major impact on the price of an OTM option. As such, even when the underlying rebounds and perhaps closes profitably as a straight ETF trade, an options trader who used deep out of the money options may not see his or her OTM options recover significantly before it is time to exit. This can be all the more true as options expiration day approaches.

Trading options options on stocks or options on ETFs can be complicated for some. But a basic understanding of what options are, and the difference between trading in the money and out the money calls and puts, is something that most traders can grasp especially after a little reading and a little practice. Try, for example, paper trading ETFs using different types of options out the money, in the money and see how the results and risks for yourself.

Click here to continue to Part 2 of Trading Options, Trading ETFs. In part 2, well look at some examples of ETF trading with in the money options based on recent overbought and oversold ETF signals.

David Penn is Editor in Chief at TradingMarkets.com.