Trading High Volatility Stocks

Post on: 3 Июнь, 2015 No Comment

Trading High Volatility Stocks Requires Action

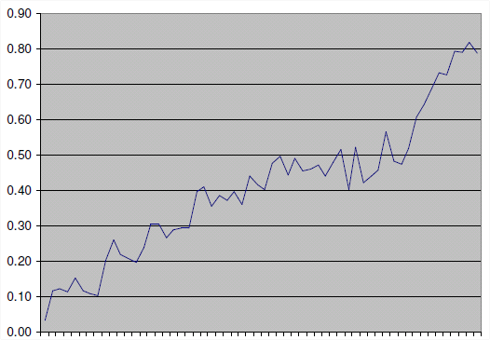

Trading high volatility stocks can be very profitable for traders that understand how to trade highly volatile stocks. However, trading high volatility stocks requires that traders pay constant attention to the price movement of such stocks, and is not suitable for causal stock traders or investors.

Stocks that consistently make large price movements up and down are highly volatile stocks. In Wall Street lingo, these stocks are known as high beta stocks. Highly volatile stocks are often accompanied by considerable volume and market interest, which makes them suitable for short term trading, including swing trading and day trading .

When trading high volatility stocks, it is very important to identify and act upon signs of momentum reversal in the stocks to initiate or close positions. Subscribing to stock analytical and charting services, such as Nifty Live Charts. is well worth the cost to provide an edge to stock traders trading high volatility stocks . Stock analytical and charting services provide real time information that alert stock traders about technical indications and chart formations that are likely momentum reversal points which indicate when highly volatile stocks should be brought or sold. A trader of highly volatile stocks may act upon such buy and sell signals many times within a day or over a period of days. The technical indicators and chart formations will provide clues regarding when to act. They key is to follow through and act, because high volatility stocks may not provide a second opportunity to initiate or close a trade at a suitable price, which could mean the difference between a profit and a loss.

Since money can be made or lost trading high volatility stocks very quickly . it is a good idea for inexperienced traders to start out trading high volatility stocks by paper trading. That means following the technical indicators and chart formations for highly volatile stocks and making note of signs of momentum reversal and buy and sell signals, then writing on a piece of paper how much stock one would buy or sell at that moment, then seeing how the trade works out on paper. Once a novice trader has gained enough confidence to start trading high volatility stocks with real money . it is a good idea to start out with small amounts of money, and then to increase the amount of money committed to such trades as mastery of the skills associated with trading high volatility stocks is achieved. Taking a course in trading high volatility stocks may also be worthwhile, since the trading principles learned in such a course should help with making smart trading decisions while trading high volatility stocks and ultimately profits.

The Principles of Trading High Volatility Stocks Can Be Applied Broadly

The exciting thing about trading high volatility stocks . besides the huge profit potential, is the fact that the analytical and charting principles used to trade highly volatile stocks can be utilized for just about any stock with sufficient volatility. The only requirement for trading high volatility stocks is that a stock is volatile enough and has enough volume and market interest to provide the liquidity necessary to buy and sell the stock easily.