Trading ClosedEnd Funds The Basics

Post on: 10 Апрель, 2015 No Comment

Introduction

The primary objective in trading closed-end funds (CEFs) is to make a profit of 25-40% in a period of a few weeks or so. This may seem difficult. Finding stocks that move 25-40% in a few weeks is not easy, finding diversified mutual funds that make such moves is extremely difficult. But the special characteristics of closed-end funds make such trading profits quite common. The idea here is that the market or sector in which the closed-end fund invests in need not itself move up by 25-40%; in fact, very few markets will do so. Only a 15% move in the market should suffice, and these are not uncommon as reflexive bounces after sharp selloffs.

Here’s how the math works:

Suppose you select a CEF (lets give it an NAV of $10 for simplicity) which usually trades at a 10% discount (that is, its 15-week moving average of the discount is 10%). Suppose sharp declines or bad news forces investors to bail out of the fund pushing it to a much wider discount than normal, say to a 20% discount (or a 10% relative discount ). This is your entry point (in this case $8, 20% discount on the $10 NAV). The events occur, the markets heave a sigh of relief and a reflex bounce of 15% occurs pushing the NAV (assuming it keeps up with the market) to $11.5 in the next few weeks. Investors, now secure that the bad news is history, rush in on the bounce of 15% pushing the discount, in their enthusiasm, to a modest 5% over the normal discount. This is your exit point (in this case, $10.9 = $11.5 * .95).

The market and NAV moved up by 15%, but how did the trader fare? He/she made 36.3% (10.9 / 8). There were three factors contributing to the 36.3% gain: the 15% market move up, the 15% shift in discount due to investor sentiment change, and the 6.3% gain due to the leverage of the discount ($8 controlled $10 worth of securities). In fact the special characteristics of closed-end funds contributed more to the gain than the actual market move!

Two important corollaries: The worse the news, the larger the relative discount, and the better the buying opportunity. The sharper the bounce, the greater the shift in investor sentiment, the larger the foray over the normal discount, and the better the selling opportunity.

Now we know that it can be done. Our objective here is to identify guidelines for trading successfully. Here we will focus on a conservative trader, more aggressive traders may shift thresholds or trade on margin more liberally.

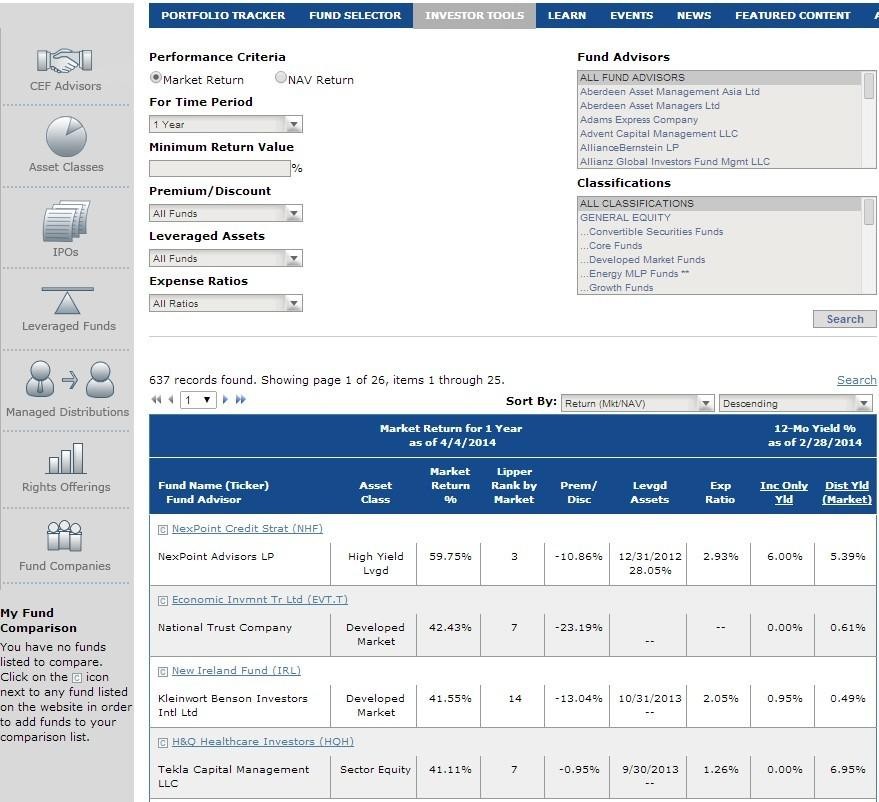

The mechanics of trading involves three steps: a) selecting candidate CEFs, b) buying CEFs, and c) selling CEFs. We will examine each of these in detail.