Traders ask VWAP

Post on: 16 Март, 2015 No Comment

The average price for this period is 49.88, which would be the value we would get from a 5 period moving average. To calculate VWAP, each price is multiplied (read: weighted) by the volume done at that price, these products are added, and then divided by the sum of the volumes for the period under consideration. Pretty standard stuff as far as a weighted average goes, but just to check yourself, see if you get my answer of 49.62 for the example above. Take a minute also to make sure you understand why the VWAP is lower than the simple average in this case, more volume was done at the lower prices, pulling VWAP lower than the simple average.

VWAP can be calculated over any period, but the only one I pay any attention to is the standard whole day VWAP because this is the number so many equity execution traders are benchmarked to. (To be fair, a lot of executions are benchmarked to the VWAP corresponding to the period for the execution window of the trade, but since we have no way to know who is buying or selling at any time, this is just a curiosity.) Firms and traders are ranked by their performance relative to VWAP, so think for a minute what this tells you about the market. If Im one of these traders with a big order to fill, I will be penalized if I buy a lot above VWAP. If price is above VWAP, am I going to buy? (Umm hope we dont need to answer that one.) However, as price comes down closer to VWAP, I may start to buy a little if the stock really sells off under VWAP I might be willing to buy my whole order. This means that there is real and natural buying around VWAP, making this an important level to watch. (To be fair, I have simplified things a bit there are all kinds of games people play to beat VWAP, and there is a lot more going on that this simple example would lead you to believe. However, if you understand this, you have the essential information. and remember the same is true for sell orders as well.) One more teeny tiny nugget to keep in mind is that a lot of equity execution algos are also pegged to VWAP and to a band a certain percentage around VWAP. Something to keep in mind

I know a lot of people like to do things like consider VWAP over X day windows, with the idea that the relationship of price to VWAP shows you how far out of the money traders who executed at a certain point are. Honestly, this type of analysis has never really made sense to me because it assumes first of all that everyone is thinking about the market like short term traders. If a mutual fund is making an incremental adjustment to an exposure, do you think they care that they are now three points out of the money? Anyway isnt it also reasonable to assume that traders are in the money from the same point as well? I have just never really been able to extract useful information from that line of thinking.

From a practical standpoint, if you calculate VWAP, you want to do it on the shortest timeframe possible because otherwise you will lose some resolution. I have three versions of VWAP available during the day: 1) a number published by my data provider (I know from past experience that this matches the VWAP on the RediPlus platform exactly so Im inclined to consider this one the real VWAP.) 2) one I calculate on one minute bars and 3) one I calculate on five-minute bars because I monitor about 24 stocks on a big screen of five-minute charts. I see that the #1 and #2 are usually exactly the same, though they can differ in the morning. Number three may be significant different, so just beware of this if you choose to calculate the number yourself. I would tend to ignore VWAPs you calculate on 10 minute or higher bars.

Now how to use VWAP. First of all, I dont make any mechanical trades off of VWAP, but one I think you can make (havent really run the numbers to prove it) is to buy the first retracement to VWAP after a strongly trending stock makes a new high of the day. Reverse for shorts. (Every part of that sentence in bold is important. If you ignore any part of it (for instance, buying the second or later pullbacks) I think you could be in trouble.) You could also use this as a profit target if, for instance, you bought a stock on a fade at the lows and are wondering where to take most of your sells VWAP is likely to be a source of natural selling pressure so I would lighten up there.

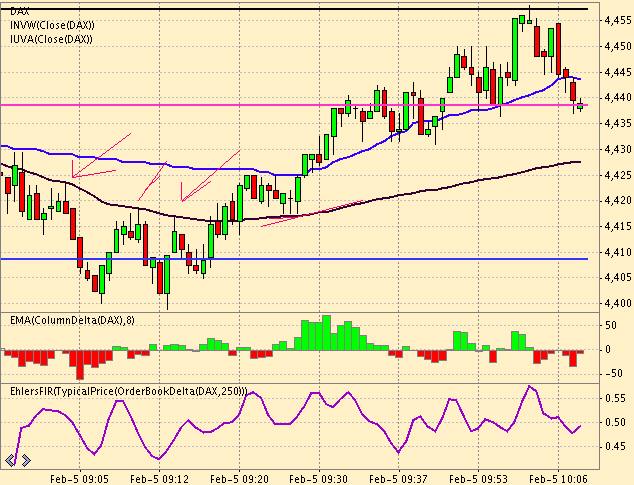

1 minute AMZN with VWAP

The chart above shows how I tend to use VWAP, which is more to give me insight into how a stock is trading. If a stock is chopping back and forth on both sides of VWAP, obviously VWAP is not really significant so I can safely ignore it. But look at the chart of AMZN above and note that there was selling at VWAP each time price touched and then finally those sellers lost the battle and the character of the stock was completely different. There are a lot of ways you could have used this information, but if you were short and pressing shorts, the momentum through VWAP should have warned you that you were fighting on the side of the losing army.

This was not intended to be an exhaustive article, but I hope it gives you some ideas and guidelines that you can incorporate in your own trading.