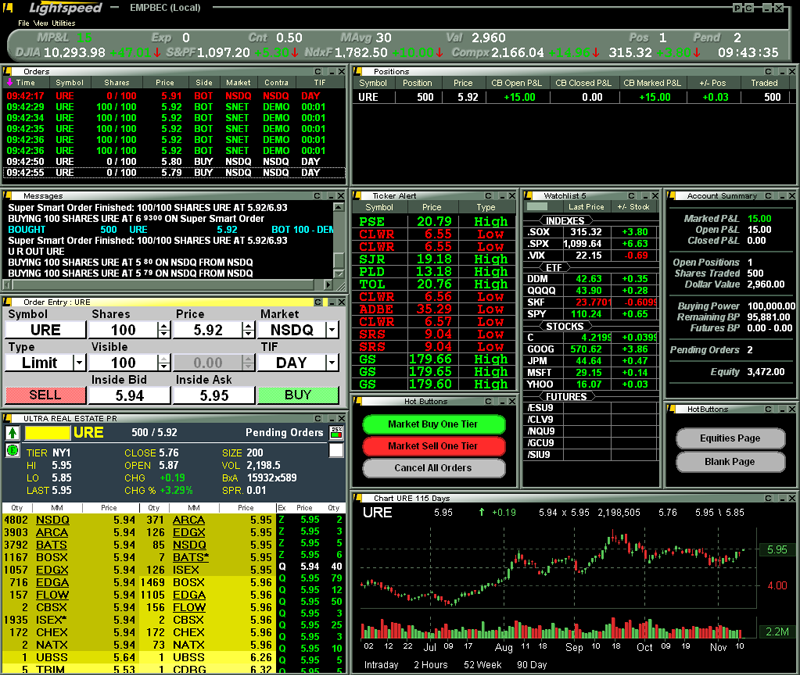

Trade Stocks With Lightspeed at 4 Trading Online Stock Options Futures Trading

Post on: 8 Апрель, 2015 No Comment

Trade Stocks With Lightspeed at 4 A.M.

March 27, 2013

In recent years, technology trends have led to widespread changes in financial markets. The vast amount of trading volume across assets now takes place on electronic trading platforms and the markets are increasingly accessible nearly around the clock.

Last month, Nasdaq OMX Group announced plans to open its pre-market trading session at 4 a.m. Previously, pre-market trading on Nasdaq began at 7 a.m. Eastern time. The new trading hours were implemented on Nasdaq in March.

The move comes as brokerages and exchanges are seeing an increase in client interest in pre-market trading. Competing electronic stock exchange Arca, which is owned by NYSE Euronext, has been processing trades starting at 4 a.m. since 2005.

“This move by Nasdaq is the next step in guiding our equity market toward being 24/7,” Stephen Ehrlich, chief executive of Lightspeed Financial told the Wall Street Journal. “I really think that, at some point, we will see the ability to trade all instruments almost all the time.”

Although pre-market trading volume is relatively thin compared to regular trading hours, the move by Nasdaq will offer investors more flexibility to react to overnight news. The longer hours will also make trading U.S. markets from Europe more convenient.

Lightspeed is known for being at the technological cutting edge of the trading industry and the firm is one of few retail brokers that allows clients to begin pre-market trading at 4 a.m. The brokerage announced last month that it would be moving the start of its pre-market trading from 7 a.m. to 4 a.m effective immediately. The new time will allow clients to place orders 5.5 hours ahead of the regular open.

Lightspeed also offers after-hours trading until 8 p.m. four hours after the closing bell. In total, this gives traders access to equity markets 16 hours per day.

“We are seeing an upward trend in client trading activity during the early pre-market hours,” said Lightspeed’s chief technology officer Scott Ignall. “We believe this stems from our sophisticated client base seeking a competitive edge by modifying their trading strategies based on news and market activity in Europe and Asia.”

In pre-market trading, only limit orders (bids and offers) are accepted and there must be a match for a transaction to take place. Due to significantly lower volume and fewer participants, there is more opportunity and risk in pre-market and after-hours trading.

It is frequently possible to execute trades at advantageous prices based on breaking news and corporate developments in either the pre-market or late trading session, but because of decreased liquidity there are additional risks as well and prices can be quite volatile.

The advantage of pre-market trading is that it allows for early rising market players to be among the first traders to react to breaking news developments. Lower volume and much thinner markets, however, means that prices can move sharply in a short amount of time. These dynamics make trading in the pre-market and after-hours sessions riskier, but also potentially more lucrative, due to higher levels of volatility.