Trade Leveraged and Inverse ETFs

Post on: 21 Апрель, 2015 No Comment

What are Exchange Traded Funds?Exchange Trade Funds (ETFs) are cousins of mutual funds. They correspond to baskets of stock that are bought and sold like stocks. Generally, there is a one day delay af.

What are Exchange Traded Funds?

Exchange Trade Funds (ETFs) are cousins of mutual funds. They correspond to baskets of stock that are bought and sold like stocks. Generally, there is a one day delay after a sell order is placed on a mutual fund; ETF sell orders are executed immediately during hours. During a market crash this difference could be significant. There are other advantages. Except for brokerage fees for trading ETFs, there are none of the maintenance fees associated with mutual funds. Also, there are no loads [penalties] associated with opening a mutual fund account.

What is a Leveraged ETF?

Over the past few years, a new class of ETFs has emerged — leveraged ETFs. To help you to understand leverage, let’s use an example: Let’s say we have two equities, ABC and XYZ. For every change in the price of ABC, the price of XYZ changes double the percent move in the price of ABC. If ABC were to change 5% then XYZ would change 10%. Notice this does not imply if ABC were to change by one dollar that XYZ would change by two dollars. It’s the percent change that matters, not the dollar amount.

In the past, it was common for investors to employ margin in their NON IRA accounts. You are not permitted to use margin in an IRA account. Margin let’s you borrow money from your broker at a percentage rate. Once the margin account is opened and operational, you can borrow up to 50% of the purchase price of a stock.

Here’s an example. Let’s say you want to buy $20,000 worth of Company A stock, 50% of it on margin. That means you need to have at least $10,000 cash in your account, allowing you to borrow the other $10,000. Just like a bank, your broker will charge you interest on the loan. Rates vary between firms and can depend on the balance in your account as well as the current interest-rate environment.

In the past you had to use margin in order to obtain leverage in your NON IRA account. Leveraged ETFs are structured so that no fee is involved. Generally, when you find a leveraged ETF its underlying ETF is a broad-based index.

For example, SPX is an ETF that represents the S&P 500. SSO also represents the S&P 500. However, it is leveraged 2:1 compared to SPX. That means that if SPX goes up 2%, then SSO goes up 4%. You get the leverage you are after without borrowing from your broker. Additional fees are not incurred. Furthermore, buying these leveraged ETFs is allowed in an IRA account.

This chart compares the year-to-date performance of SPX versus SSO. SPX has a gain of 3.77% while SSO has gained 8.13%.

Another example of a leveraged ETF is UWM. UWM moves twice the percentage move of IWM. By the way, IWM is the Russell 2000. The Russell 2000 is made up of two-thousand stocks and represents a broad portion of the stock market.

Want more leverage on IWM? Buy TNA and get three times the move of IWM.

What is an Inverse ETF?

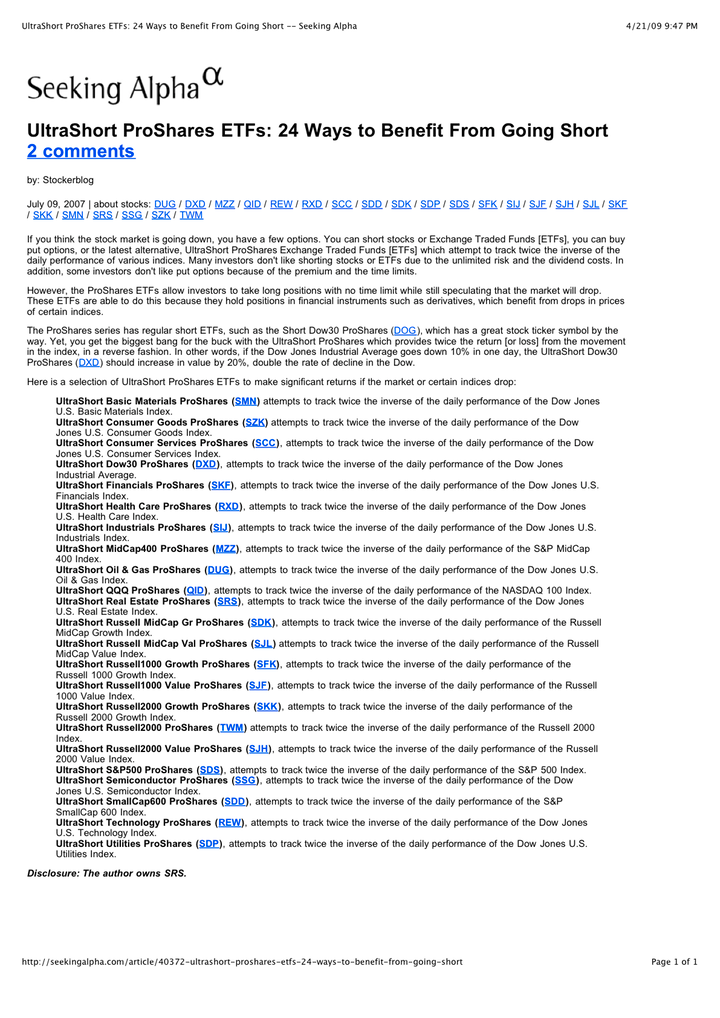

Another new class of ETFs has emerged, called inverse ETFs. An example of an inverse ETF is TWM. TWM represents the Russell 2000 but it moves inverse to IWM. For example, if IWM goes DOWN 2%, then TWM goes UP 4%. Now you can play a down market even in your IRA

This 3 year chart displays the leveraged UWM with its inverse TWM. When one goes up the other goes down.

Want more inverse leverage? Use TZA. TZA is an inverse ETF that represents IWM, (Russell 2000). If IWM goes down 3%, TZA goes UP 9%. During the market collapse in 2008, those who held TZA made a fortune.

Why Use Leveraged and Inverse ETFs?

You might think trading leveraged ETFs is dangerous. However, as I mentioned above, they correspond to broad-based indexes. In comparison to trading stocks, these are much better behaved. Even stalwart stocks like GE have lost fortunes for their investors over the past few years. There are dozens of stocks that we all know which behaved similarly. Buying stocks means that you have to be a good stock picker.

How many of us are good stock picker’s? I know I’m not. Usually investors pick stocks because of company news. Unfortunately, by the time you learn the news, half the world already knows about it. Of course, you can make a good profit by choosing a winner. Instead, many prefer leveraged ETFs, both for their safety and profit potential.

The government discourages investors from shorting the market. In a down market, those with retirement accounts had only two choices: either staying cash and be protected or hold your investment and watch its value diminish.

Inverse ETFs solve this problem. In a falling market you can close your long positions and buy inverse ETFs like UWM.

Compounding Returns

The most important reason for trading in bear markets has to do with compounding. To keep things simple, let’s assume the market is bullish half the time and bearish half the time. In addition, assume we gain 5% in consecutive periods. The net profit if you had only traded in the bull market would be 5%. However, if you had traded in both periods your net profit would not be 10%. It would be 10.25% because of compounding. Over time, the small difference would become significant.

How to Trade Leveraged and Inverse ETFs

I use three guide posts to trade these ETFs: a good market timer, an entry condition to ensure the ETF is moving in the same direction as the market and sound money management. Collectively, these three principals have eliminated draw-downs associated with leveraged ETFs. As a result, I’ve been able to sleep well at night while generating good profits during the day.

You can tell by these charts that leveraged ETFs are significantly more volatile than their underlying broad-based indexes. You will not succeed if you try to apply your trading strategy to them. Instead. keep applying it to the index. Simply trade the leveraged instead of the index.

Source: Free Articles from ArticlesFactory.com