TopDown Stock Selecting

Post on: 16 Март, 2015 No Comment

Posted on10.01.2011

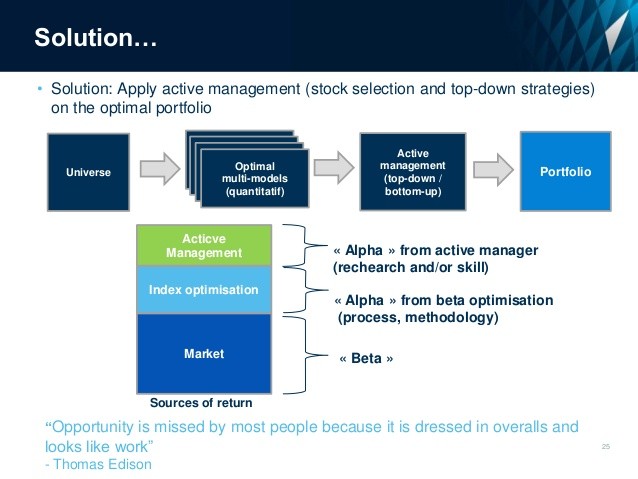

There are two methods of selecting stocks for trading:

- by examining individual stocks to find one that’s worthwhile, called the bottom-up approach, and

- by examining industry sectors to find one that’s moving and then to select an individual company from within that industry.

The latter technique, called the top-down approach, helps traders understand the current condition of the share market. Because most stocks will follow the market’s overall trend, this technique also helps traders position their portfolio most appropriately.

The top-down technique consists of three steps:

- Assess the overall market to determine if it’s overvalued, undervalued, or about right. An overvalued market may lead to more short-selling, an undervalued one invites a larger proportion of long entries, but if the market is fairly valued, it’s a judgment call and requires the trader’s best estimate on a sector-by-sector basis, considering the condition and trend growth of the underlying economy. The long-term P/E ratio, calculated on expected earnings in the next twelve months, which is available from Standard & Poor’s, is handy for this evaluation.

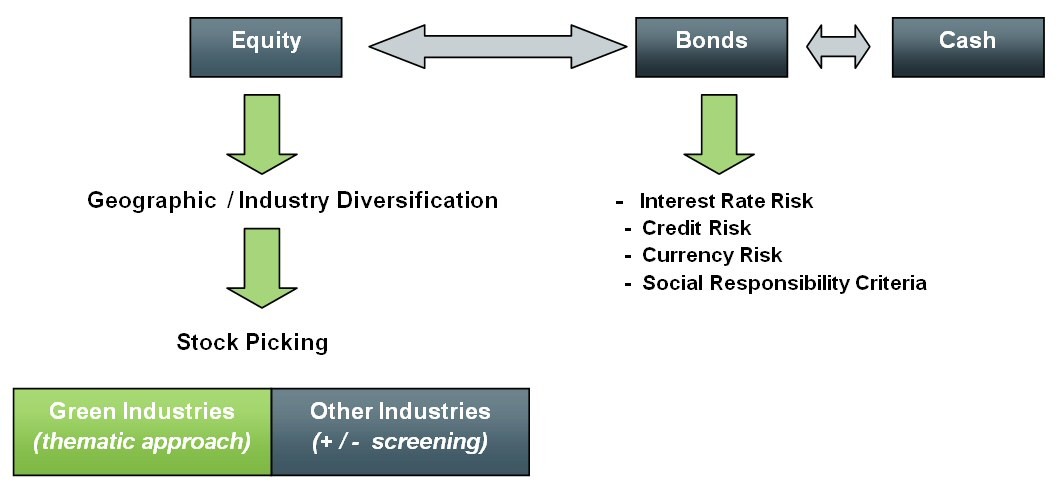

- Assess individual industry sectors, in the context of the economic cycle, to determine whether they’re likely to grow or contract within the trader’s preferred time frame. The portfolio and trading plan are arranged around this assessment, with greater weight given to sectors forecast to enjoy (or suffer) the largest moves.

- Assess individual stocks and select the ones most likely to perform as expected, filling the assigned slots within the trading portfolio.

Top-down stock selecting is usually shunned by technical traders who tend to see it as an investor’s tool. Top-down traders, after all, don’t care whether they’re holding Minara Resources (MRE) or Panoramic Resources (PAN), so long as they hold shares with a small-cap nickel miner (this is an example, not a suggested trading strategy). Selecting stocks to trade, using this technique, boils down to fundamental research rather than finding a just-starting trend.

However, when wielded properly the top-down approach can identify the industry sectors that are most likely to move within the coming year—e.g. it can point toward a trend before it actually begins. Once the top-down approach has been utilised and an industry sector is determined to be potentially hot, the trader can put the companies within that sector into a watchlist. From there, technical analysis takes over, signalling market entries and exits in the usual way.