Top Ten Traits of Successful Investors

Post on: 28 Март, 2015 No Comment

Everyone knows that to succeed as an investor or trader you must buy low and sell high. As

simple as this concept is, the actual act of doing so is almost impossible. That

is unless you are prepared (i.e. pre-programmed) to buy at low prices, or to

sell at irrationally high prices. Behaviorists suggest that we are pre-wired to

avoid pain and to pursue pleasure. Unfortunately, these instincts can work

against you in the financial markets. Its painful and unpleasant when prices

are low and declining even further. Its euphoric when markets are climbing

beyond rational levels of value. The following 10 traits of successful investors

Trait #1. The ability to buy stocks when everyone else is panicking, and sell

stocks while others are overly optimistic. This has been a hallmark of the

worlds greatest investors since the days of Homer. J. Paul Getty remarked that

he got rich by buying when everyone else was complaining, and he sold when they

were celebrating. Mark Sellers told a graduating class of Harvard MBAs that the

Trait # 2. Having a methodology. Great investors have a system for weighing the

Trait # 5. Being properly diversified, not overly diversified. Mathematically,

it can be shown that having too many stocks can actually increase your odds for

poor performance. Google the Kelly Formula, and youll find that owning only a

small 2% position in a stock is the equivalent of providing yourself a 51%

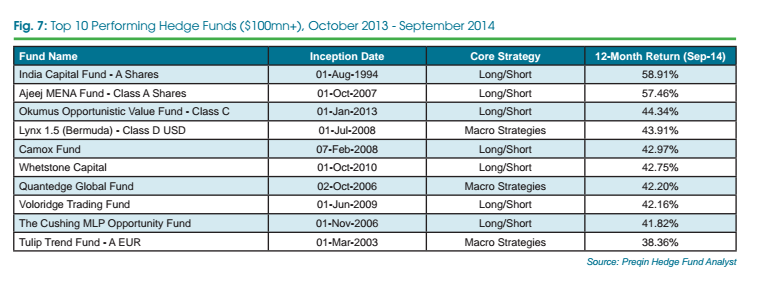

Trait # 6. Living with volatility without changing your investment strategy.

Very few people can handle the volatility required to achieve great performance,

so they over diversify hoping to reduce their risks. Because volatility is

inherent in all markets, successful investors use these periods of volatility to

take advantage of price discrepancies. As can be seen by the accompanying chart,

the S&P 500 declined ahead of the collapse of Long Term Capital Management in

Trait # 7. Recognizing that volatility is not the same as risk. Sharp swings up

or down are not the same as a permanent loss of your capital, unless you panic.

Trait # 9. Understanding risk. In the words of Voltaire, common sense isnt so

common. In every market cycle, we see evidence of this thru historys frequent

booms and economic busts. Whether its sub-prime mortgages, real-estate, or