Top Oil Stocks Buy Energy Stocks as Oil Futures Rise Focus List of Oil Stocks

Post on: 16 Март, 2015 No Comment

Investors View Magazine

by Mike Swanson

Billions and billions of dollars trade hands in stock market around the world. And the same applies with oil and energy stocks. The price of oil goes up and down on a regular basis and sometimes it is hard to tell if a certain time is opportune for buying and selling oil stocks. But wherever you go oil prices fluctuate in accordance to the political climate.

Politics might be considered boring but in actual fact it runs your life; what you eat; how you think and how much things cost is all dependent on politics. But the influence of politics on society is felt more on the oil price index. It is somehow a shame that the major oil producing nations are very much unstable politically. The Middle East OPEC countries are prone to political unrest and turmoil on a daily basis and with a situation like this the price of oil can rise or fall sharply.

And sometimes political leaders can control the price of oil strategically in response to how some countries are treating them and cause a move in the oil futures market. An oil producing country at loggerheads with a certain country can hike prices in order to punish them for blatantly aggressive foreign policy. So you must be well versed with the relations that your country has with other nations because this can be the difference between your success or failure.

Therefore you have to be in tune with political conditions in areas of the world that produce the world’s largest amounts of oil. Reading the newspaper or watching the news is important for a person trading in oil stocks. So with news filtering in you can decide on whether to sell your stocks or buy some more. Renewable energy is an industry just starting to grow in its infancy.

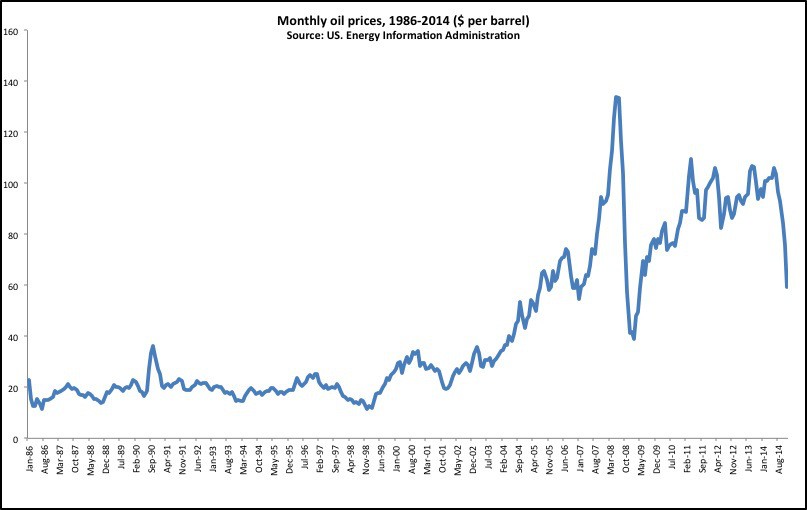

Judging from this you should be able to notice how the rules of supply and demand influence the prices of things. Pay attention to such factors and use them to dictate prices on a daily or weekly basis. A basic understanding of the definition of technical analysis helps if you are going to start investing in energy stocks .

You can use several oil etf’s to play the price of crude oil, but when it comes to investing in the stock market I have found oil and energy stocks to be among the best places to go, because so much money is made in the energy industry. That means that there are plenty of companies that generate good earnings and many that even pay dividends. You just need a good list of oil stocks to work off of .

However, you need to have to have a strategy whenever you make an investment and a real method for buying and selling stocks.

Through an exhaustive study of historical data I discovered the stock price chart patterns that occur most consistently and repeatedly before a huge move in a stock. I also examined fundamental valuation and earnings data and found that the stock picks with the lowest valuation and highest earnings growth potential tend to go up the most.

This makes logical sense, but most people only look at one of these things. They just pay any price for earnings growth or just look for cheap stocks.

I take this combination of technical analysis chart patterns and fundamental characteristics and call it The Two Fold Formula.

You can download this Formula in a PDF document for free. Just click here .

Oil stocks can give you huge potential gains and pay dividends at the same time. WallStreetWindow’s Free subscription service will give you access to our weekly oil stock picks and the doubling stocks Two Fold Formula. Click here to subscribe today