Top International Equity ETFs for your portfolio

Post on: 29 Март, 2015 No Comment

Posted by Mark on July 28, 2013

Let every man divide his money into three parts, and invest a third in land, a third in business, and a third let him keep in reserve.” – Talmud, circa 1200 B.C.-500 A.D.

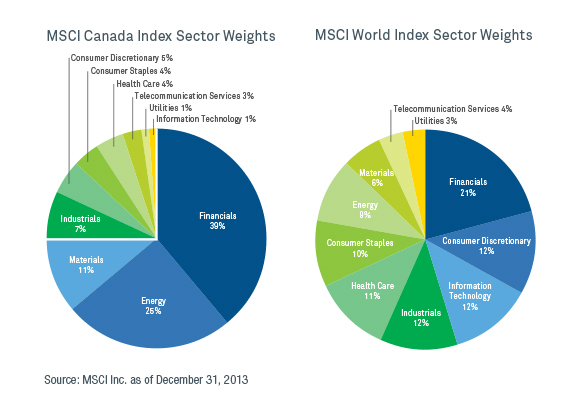

Last month, I provided you some of my favourite Canadian equity and bond ETFs to consider for your portfolio . While Canadian holdings in your portfolio are important if you’re a Canadian and you plan on retiring in Canada; using Canadian money for retirement income, they aren’t the only investments you should own. This is because global equity investments can balance out your portfolio and potentially deliver some healthy returns for you.

While expert opinions vary, how much foreign content you should own in your portfolio, financial pros usually agree on this: diversification is essential to manage risk. Diversifying across asset classes and within an asset class reduces risk to a particular company, sector, or market segment. While diversification cannot prevent an investment loss, it can definitely help mitigate a catastrophic one.

To help with diversification in your portfolio consider some of the following top international equity Exchange Traded Funds (ETFs) below.

The Vanguard Dividend Appreciation ETF seeks to track an index that measures companies with a record of growing their dividends year after year.

- MER = 0.10% (since my last post, was 0.18%).

- Top-3 holdings: PepsiCo, Procter & Gamble, Coca-Cola.

- Number of stocks = 146.

The Vanguard FTSE Emerging Markets ETF seeks to invest in stocks of companies located in emerging markets around the world, such as China, Brazil, and South Africa.

- MER = 0.18% (since my last post, was 0.22%).

- Top-3 holdings: Taiwan Semiconductor, Petroleo Brasilerio, China Mobile.

The Vanguard Total Stock Market ETF is an awesome product to own to capture the U.S. stock market. Yes, Im biased with this one.

- Holds over 3,500 companies.

- Extremely low MER = 0.05%

- Top-3 holdings: Exxon Mobile Corp. Apple Inc. Microsoft.

The Vanguard FTSE Developed Markets ETF seeks to track the investment performance of the FSTE Develop Market index, ex-North America.

- MER = 0.10%.

- Top-3 holdings: Nestle SA, Royal Dutch Shell PLC, HSBC Holdings PLC.

The Vanguard Total International Stock ETF gives investors broad exposure to major stock markets around the world, ex-United States.

- MER = 0.16%.

- Very diversified; holds over 5,700 companies.

- Top-3 holdings: Nestle SA, Royal Dutch Shell PLC, HSBC Holdings PLC.

The iShares MSCI EAFE Index Fund ETF (hedged in Canadian dollars) provides investors with broad exposure to countries in Europe, Australasia and the Far East.

- MER = 0.50%.

- Over 900 holdings.

- Top countries: Japan, UK, Switzerland, France, Germany.

- Top-3 holdings: Nestle SA, HSBC Holdings PLC, Roche Holding AG.

The iShares MSCI World Index Fund ETF provides investors to broad exposure to the equity market performance of developed markets.

- MER = 0.47%.

- Over 1,500 holdings.

- Top countries: US (>50%), Japan, UK, Canada, Switzerland.

Vanguard Canadas FTSE Developed ex-North America Index ETF (CAD-hedged) will track the broad global equity index.

- MER = 0.28%.

- Over 1,200 holdings.

- Top countries: Japan, UK, Switzerland, France, Germany.

Vanguard Canadas U.S. Total Market Index ETF (CAD-hedged) seeks to track, to the extent reasonably possible, the performance of securities included in the CRSP US Total Market Index (CAD-hedged) back to the Canadian dollar.

- MER = 0.17%.

- Over 3,500 holdings.

How many of these ETFs do you need in your RRSP? Well, in my opinion definitely not all of them. Thanks to a reader question, in a future blogpost later this summer.

If you want to invest in other ETFs or youre already invested in some ETFs and surprised that some of your products didnt make my list above, don’t worry too much. These were my favourites and most of these are tailored to your RRSP account. I wrote most, not all, since not all ETFs are created equal. If you want to hold international investments in your portfolio, be cautious where you own them since they can cause some issues from a tax perspective. There is much more to that story so I encourage you to read this page on my site to learn more about withholding taxes in particular. You might be paying withholding taxes right now, and not realize it. Personally, I figure I pay enough taxes and because Im assuming you feel the same, I encourage you to check that page out.

In closing, while investing in Canada and with Canadian ETFs makes sense for many of us, consider spreading your investment wings and see the rest of the world, ensuring you put the right products in the right accounts. Your investment portfolio will be much healthier overall for it.