Top Five Characteristics of a Great Mutual Fund

Post on: 16 Март, 2015 No Comment

Finding a good mutual fund can be a daunting task. After all, there are several thousand actively traded mutual funds to choose from and that does not even begin to include all of the index funds and exchange traded funds (ETFs) in which a person can invest. So where does an investor, especially a new one, begin his or her search for a good mutual fund? Below are five characteristics to consider when looking for a great mutual fund:

Mutual Fund Must-Have #1: Low Expenses

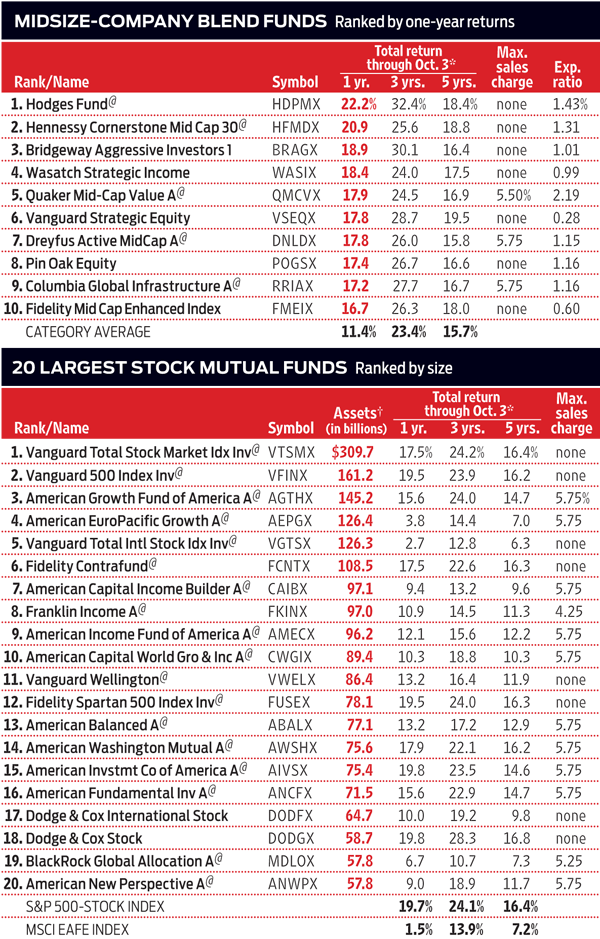

Index funds have shown that expenses matter considerably with respect to a mutual funds rate of return. The average actively traded mutual fund has an expense ratio of 1.5 percent.

Just like you and I, it costs a mutual fund company money to buy and sell a stock, but when you have millions under management those commissions can quickly add up and stocks are traded more frequently. Low expenses mean that you keep more of the funds profits in your own pocket. A higher expense ratio requires a mutual fund to work that much harder to earn the investors expected rate of return.

Mutual Fund Must-Have #2: No Loads

There are so many great no load mutual funds available to the average investor now. There is no reason to pay a load, which is just another name for a sales commission.

If you pay a load, either on the front end when you buy your shares or on the back end when you sell, that is just a higher rate of return that your mutual fund must attain in order to make a profit (just like the expense ratio). Because loads and fees are calculated based off of asset values under management and not profits, investors pay these fees and loads no matter how the mutual fund performs.

Mutual Fund Must-Have #3: Specific Investment Strategy

A style drift occurs when a mutual fund manager deviates, however slightly, away from his or her published investment strategy. This might not seem like a big deal to many investors, but style drift in a mutual fund can lead to bigger problems later down the road.

It can throw off an individual investors asset allocation mix, but more importantly, it is a broken covenant between the investor and the mutual fund manager. If the fund manager changes his investment style, what is to stop him or her from changing other aspects of the fund without the investors knowledge?

Investors should ensure their mutual funds are truly investing in the types of stocks and bonds theyre supposed to and follow the investing strategy they have laid out in the funds prospectus.

Mutual Fund Must-Have #4: High Ethical Standards

Ethical standards are more important now than ever in the financial services industry after the trying decade the markets have endured. From the Enron scandal to Bernie Madoff’s Ponzi Scheme, investors must be diligent in monitoring their mutual funds and other investments for improprieties. Further, investors should not hesitate to vote with their feet should a fund company behave inappropriately.

Mutual Fund Must-Have #5: Long-Term Records

While most mutual funds were devastated by the 2008 recession and their historical averages have been shell shocked, investors should still look at long-term records when searching for mutual funds to invest in.

Investors must now look back at returns and consistency over an even longer time horizon than previously needed. It may be necessary to look for mutual fund managers who have been at the same funds for ten years or more in order to get a more accurate historic feel for their potential performance. While a mutual funds past record is not a guarantee of future success, it is still a very good indication of its potential.

Finding a good mutual fund to invest in does not have to be difficult. With a little research and adherence to this list of characteristics, you should be able to find several great mutual funds that meet your criteria.