Top 5 Investment Strategies

Post on: 6 Июль, 2015 No Comment

It has been proven that under certain situations and in certain conditions, a return on investment (ROI) is likely to be made without much effort. If these situations and conditions are turned into a trading strategy and an investment strategy which is strictly followed, they can pretty much keep the wolves from the door and keep you making nice returns on your investments. The following investment strategies have been proven to make money but not without a thorough understanding of the market.

The trend is your friend: These age old words of wisdom are not folklore. Too many traders have learnt the hard way by going against the trend. Learn to follow the market trend, never go against it and in particular be ready to identify a breakout from a ranging market to form a new trend. Trends can go on for days, weeks, months and even longer before changing direction. Beware of false breakouts. This is where a thorough understanding of technical analysis is essential. Knowing when to close out a trend riding trade is important. Some traders only go for relatively safe profit levels and close the trades without thought on how long the trend will continue. This means a lot of profit is foregone, however, there is a risk philosophy that you cannot lose what you never had and by being risk averse, you will definitely stay in the game for much longer.

Follow the professionals: This is another tip that helps the inexperienced investor make some profits over a period of time. There is some danger here because professionals are only human; they can get overconfident in their abilities and make some risky decisions. If they go down, you go down with them! If your portfolio is relatively small, it may wipe you out. Choose a professional that is well respected in the market and who gives advice and share market tips that are based on solid foundations of fact.

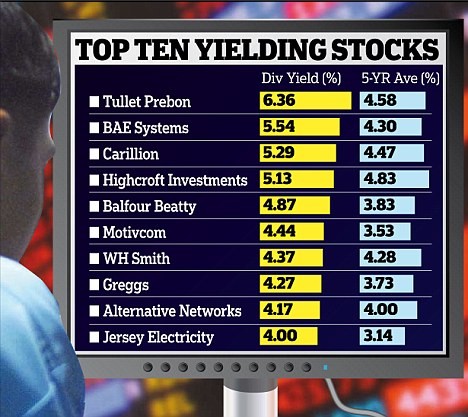

Invest in the long term: Pick the stocks that have the most potential in the long term. Invest only a small amount of money at a time and increase your investment capital as you get more experienced.

Let winning investments run and cut your losses on losing investments: Keep winning investments running so that you can capture the maximum profits possible from the big market moves. Cut losing trades short so that you only take small losses when something goes wrong (yes, even the best traders have losses); the crucial thing is to keep those losses small and move on to healthier trading opportunities.

Manage your risk and size positions to your strategy: Money management is a key concept to succeeding in investing in stocks and shares. This includes practicing a sound risk philosophy and sound money management rules, including position sizing based on your account size. It is essential for successful investing, that your rules on money management are written down and adhered to.