Top 5 Fastest Growth Stocks Making My List Checking It Once

Post on: 22 Июль, 2015 No Comment

Since this is the time a year for making our Christmas lists for filling our stockings with gifts, we thought it would be appropriate to offer our growth stock shopping list. However, the central idea behind this stock shopping list is to identify our top five fastest-growing companies that hold the potential to keep on giving year after year. In order to accomplish this, not only did our stock selections have to be capable of generating significantly above-average growth, but they also had to be reasonably priced. This is important, because, unfortunately, the very best and fastest growing businesses are often significantly overvalued.

Consequently, it can be a real gift to be able to find really fast growing companies that can be purchased at a reasonable price, as long-term return potential can be extraordinary. However, one caveat is in order— even when fast-growing companies are at reasonable prices, this could also mean that they are selling at above-average (higher than average) price earnings ratios. But, even though really fast growth logically comes at a higher price, it should still be a price that represents sound and prudent value.

Sticking with our shopping theme, when shopping for common stocks with a potential to generate very high returns, its important to recognize that what we are really buying are earnings. Therefore, the only logical reason to pay a high price for current earnings is because you believe that you are buying future earnings on the cheap. Logically, this can only be true if the company is growing earnings at a very fast or high rate of growth. If your company is growing earnings very fast, you will have a much larger pile of future earnings for the market to capitalize than you originally purchased.

The moral of the story is— true investors are really buying future earnings. And, like any shopper, the smart stock shopper always wants to buy the highest quality merchandise they can at the most reasonable price possible. When this is understood, there is an additional caveat that applies to seeking very fast growth stocks to invest in. The prudent investor understands that achieving very high rates of growth is very difficult, and therefore, when looking at companies where your expectations for growth are very high, you are also simultaneously assuming more risk.

Our Top Five Fast Growers as a Group

The following portfolio review summarizes our suggested list of the five fastest growing companies that can be bought at reasonable valuations. This list is presented in order of the highest five-year estimated annual total return to the lowest. Interestingly, the order of this list also corresponds with the highest estimated EPS growth to the lowest. Although we have created this list based on a compilation of essential fundamentals at a glance, the list has only been checked once. Like any good Christmas list, it needs to be checked at least twice. In other words, we offer this group of companies as a prescreened list of extraordinary growth stocks that we believe are currently reasonably valued, and therefore, worthy of a more comprehensive research effort.

Click to enlarge

Our Top Five Fast Growers A Closer Look

Since space and time does not permit, we will not provide a comprehensive analysis of each selection. Instead, we will provide a brief description of each company taken directly from their respective websites. Since a picture is worth a thousand words, we will provide earnings and price correlated historical F.A.S.T. Graphs on each selection that will give the reader a comprehensive look at each companys historical operating results (earnings growth). Additionally, each historical graph will provide perspectives on how the market has traditionally priced or valued each of the companys shares.

Although we can learn a great deal from the past, we must remember that we can only invest in the future. Therefore, we will also provide an earnings and price correlated calculator based on the consensus five-year earnings forecasts of the leading analysts reviewing each company and reporting their results to Capital IQ. However, since each of these growth stocks are expected to grow future earnings at very high rates, we are only calculating growth over the next three years. We believe this is prudent given the risk of achieving such high rates of future earnings growth.

We will let the historical graphs speak for themselves; however, we will provide brief commentary on each companys forecast graph (earnings and price calculator) for clarity. Its important that the reader recognize that although the historical achievements are accurate, they cannot be relied upon when looking to the future. Therefore, it should be noted that the forecast graphs are based on different, and typically lower, expectations for future growth than what has been achieved in the past.

There are a few final comments that are appropriate to offer on the forecast graphs. Note that we are only running these forecast graphs three years forward. Therefore, these are different calculations than what were shown on the original portfolio review, which included the calculation for the complete five-year earnings estimates forecast. We would also like to focus the readers attention on the earnings calculations at the bottom of each graph. We have applied orange circles to current earnings and expected future earnings in order to focus the readers attention on the magnitude of what compounding earnings at high rates of growth can achieve. Remember, we believe that the prudent investor is buying future earnings as cheaply as possible.

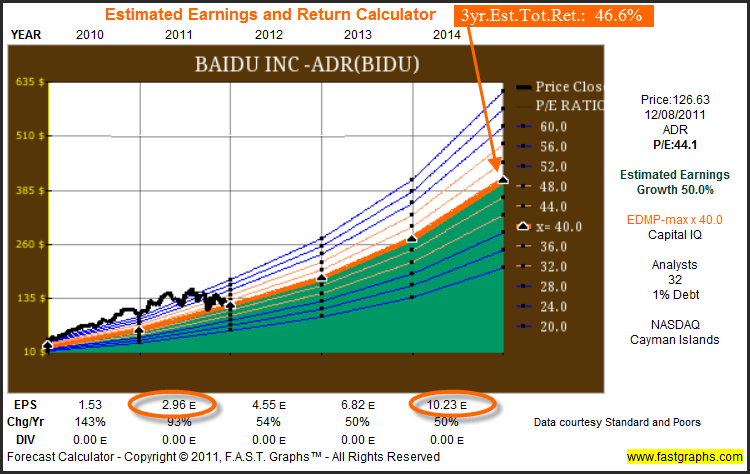

Baidu Inc-ADR (NASDAQ:BIDU )

Baidu, Inc. is the leading Chinese language Internet search provider. As a technology-based media company, Baidu aims to provide the best way for people to find information. In addition to serving individual Internet search users, Baidu provides an effective platform for businesses to reach potential customers. Baidu’s ADSs trade on the NASDAQ Global Select Market under the symbol BIDU. Each of Baidu’s Class A ordinary shares is represented by 10 ADSs.

Click to enlarge

Baidu is expected to continue growing earnings at over 50% per annum over the next five years. As previously stated, we are only running our calculations out for three years. Furthermore, the three-year estimated total return calculation assumes that Baidus earnings are capitalized at a maximum PE ratio of 40. To be prudent, we maximize our PE ratio expectations at 40. An actual PEG ratio calculation for Baidu would imply a PE ratio of 50, which would approximate the price indicated by the first blue line above the orange earnings justified valuation line.

Its also important to note that the stock market has historically applied a much higher normal PE ratio of 75.8 based on a much higher level of historical earnings growth than is currently being forecast. We believe this is a rational valuation adjustment that the market is making. Although, a strong argument could be made that the historical PE ratio of 75 was valid, and an equally strong argument implies that a future valuation based on more reasonable expectations of growth is also valid. In other words, we believe that Baidu appears reasonably valued and only modestly overvalued at its current PE ratio of 44.1.

Click to enlarge

Cummins Inc. a global power leader, is a corporation of complementary business units that design, manufacture, distribute and service engines and related technologies, including fuel systems, controls, air handling, filtration, emission solutions and electrical power generation systems. Headquartered in Columbus, Indiana, (NYSE:USA ) Cummins employs approximately 40,000 people worldwide and serves customers in approximately 190 countries and territories through a network of more than 600 company-owned and independent distributor locations and approximately 6,000 dealer locations. Cummins earned $1.0 billion on sales of $13.2 billion in 2010.

Click to enlarge

Cummings Inc. represents an atypical inclusion onto this list, but it has been included for two reasons. First of all, it has experienced a strong surge of growth coming out of the great recession of 2008. Second, it is expected to continue to grow very quickly over the next 3 to 5 years. Therefore, it offers a compelling total return expectation that is further enhanced with a decent dividend yield and a record of raising dividends when earnings growth is strong.

However, the market has traditionally only applied a PE ratio of approximately 15, which is more consistent with a quasi-cyclical industrial. Therefore, we believe that the three-year estimated total return based on a PEG ratio valuation is overstated in this example. A more appropriate valuation would be for Cummings Inc.s stock price to be valued at 15 times the $15.18 expectation for 2014 earnings, or $227.70. This would imply a valuation that is approximately half of what the chart indicates.

Click to enlarge

Echo Global Logistics Inc. (NASDAQ:ECHO )

Chicago-based Echo Global Logistics is a leading provider of technology-enabled transportation and supply chain management services, delivered on a proprietary technology platform, serving the transportation and logistics needs of its clients. Echo’s web-based technology platform compiles and analyzes data from its network of over 24,000 transportation providers to serve its clients’ shipping and freight management needs. This year, Echo has procured transportation and provided logistics services for more than 24,900 clients across a wide range of industries, such as manufacturing, construction, consumer products and retail.

Click to enlarge

Echo Global Logistics Inc. is expected to grow earnings at over 30% per annum over the next 3 to 5 years. Therefore, the current PE ratio of 31.7 appears very reasonable for such high future growth. To put this into context, we are only paying a PE ratio of approximately 13 times our expected $1.26 worth of earnings by year-end 2014.

Click to enlarge

OpenTable is a leading provider of free, real-time online restaurant reservations for diners and reservation and guest management solutions for restaurants. The OpenTable network delivers the convenience of online restaurant reservations to diners and the operational benefits of a computerized reservation book to restaurants. OpenTable has more than 20,000 restaurant customers, and, since its inception in 1998, has seated more than 250 million diners around the world. The company is headquartered in San Francisco, California, and the OpenTable service is available throughout the United States, as well as in Canada, Germany, Japan, Mexico, and the United Kingdom. OpenTable also owns and operates toptable.com, a leading restaurant reservation site in the United Kingdom.

Click to enlarge

We believe the most valuable insight that the Opentable, Inc. graphs illustrate is how the market has adjusted its valuation based on a more realistic expectation of future growth. Although historical growth that averaged over 128% per annum was extraordinary, it only spans two short years. Therefore, even though the expectations for future growth are still very high at over 30% per annum, they clearly do not justify PE ratios north of 100 times earnings.

This is a lesson that investors dabbling in growth stocks would be wise to heed and remember. It is easy to get caught up in all the hype and hysteria for young companies that are growing very quickly. However, it is also very prudent to understand that such extraordinary rates of growth are simply not sustainable.

But most importantly, its important to know that the market also understands this, and will inevitably apply appropriate valuations. Therefore, when examining growth stocks — Caveat Emptor (let the buyer beware). The price action on the estimated earnings return calculator on Opentable, Inc. makes this point vividly clear.

Click to enlarge

Discovery Communication Inc. (NASDAQ:DISCA )

Discovery Communications (NASDAQ: DISCA, DISCB, DISCK) revolutionized television with Discovery Channel and is now transforming classrooms through Discovery Education. Powered by the number one nonfiction media company in the world, Discovery Education combines scientifically proven, standards-based digital media and a dynamic user community in order to empower teachers to improve student achievement. Already, more than half of all U.S. schools access Discovery Education digital services.

Click to enlarge

We believe that the estimated earnings and return calculator on Discovery Communications, Inc. (DISCA ) offers another example of how the market eventually gets it right when evaluating businesses, even businesses with strong rates of earnings growth. Assuming that Discovery Communications, Inc. achieves the estimated earnings growth rate of 21.3%, it now appears to be very reasonably priced.

Click to enlarge

Conclusions

Companies that have the ability to compound earnings growth at very high rates can be extremely rewarding long-term investments. However, its important that investors run the numbers and therefore have reasonable expectations of what each company is capable of achieving, and more importantly, a reasonable expectation of how the markets would treat those growth rates.

Each company on this list has achieved remarkable historical earnings growth rates. However, only Cummings, Inc. and Baidu, Inc. have been around for five years or more. Nevertheless, all five of these companies appear to have excellent prospects for achieving significantly above-average growth over the next 3 to 5 years. Most importantly, the market appears to be currently pricing each of these companies at reasonable valuations consistent with these growth expectations.

However, with the exception of Cummings, Inc. each of these selections are only appropriate for investors willing to take on some risk, and who are looking for significantly above-average long-term returns. Keep in mind this list has only been checked once, and as we all know— any good Christmas list must be checked twice. In other words, additional due diligence is implied.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.