Too Much Leverage Risk And Speculation! Dubai Market Now Down 25% On Margin Call We Setting

Post on: 14 Апрель, 2015 No Comment

Submitted by IWB, on June 24th, 2014

But Yellen does not see any leverage or margin issues on a global scale?

Dubai Stocks Crash On Levered Liquidations, Margin Calls Turmoil

Long before there was a Greece (and its existential threat to world order), there was Dubais sovereign crisis in 2009 with Nakheel; and Dubai World (the floating islands) faced withmassive debt loads and interconnectedness were bailed out. Since then its been nothing but ponies and unicorns until now. The debt is all still there (and the interconnectedness) and despite the mirage of wealth creation that equitys massive rally has created, the drop in Dubais stock market we noted yesterday turned into a rout overnight as it dropped a further 8% as one of the countries largest companies (Arabtec Dubais largest builder) plunged after high-level executive dismissals. “This is indiscriminate selling,” Ramez Merhi, director of asset management at Dubai-based Al Masah Capital, said by e-mail. “The markets took the stairway up, and an elevator down.”

Dubai stocks dropped the most in 10 months following top-level dismissals at Arabtec, the United Arab Emirates’ largest-listed builder.

Arabtec dropped 9.8 percent to the lowest since January after the company confirmed it cut staff. People familiar with the matter said yesterday the company’s chief operating officer, chief information officer and chief risk officer have been fired.

The builder’s shares plunged 53 percent so far this month as Abu Dhabi state-run Aabar Investments PJSC cut its stake, stoking speculation the builder was losing government backing.

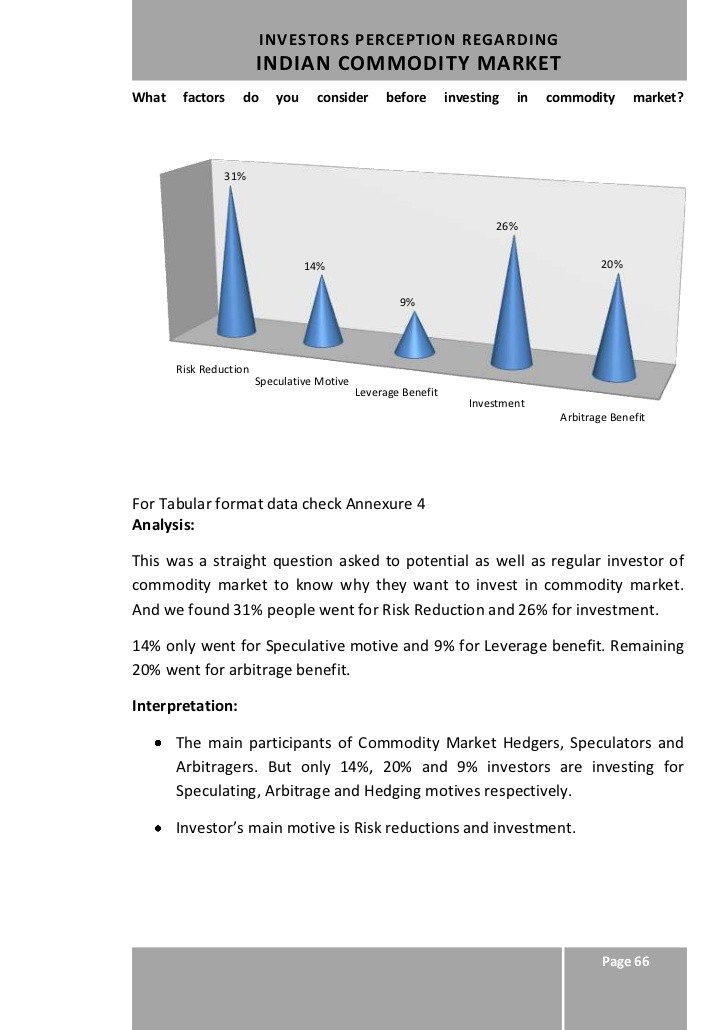

Dubai Market Now Down 25% On Margin Calls

Have You Seen What Real Estate Prices In Dubai Have Been Doing Lately?

20shot%202014-06-24%20at%209.27.14%20am.png /%

This morning, Dubais stock market crashed 8%.

The catalyst was trouble in the countrys real estate sector — the CEO of Arabtec, which built the Burj Khalifa, resigned yesterday amid hundreds of job cuts.

If youve been paying attention to Dubai real estate recently, this may not have come as a total surprise.

According to Global Property Guide, prices climbed 10% in Q1 against Q4, and 32% YOY — easily the largest jumps in the world. The IMF warned last month of “unsustainable price dynamics and an eventual correction,” and that megaprojects could create risks to Dubai’s government-sponsored entities, which are looking at debt levels of 141% percent of Dubai GDP.

June 24 (Bloomberg) Bloomberg’s Zainab Fattah reports on today’s steep drop in Dubai stocks, the largest since 2008, just one day after the market entered bear territory. She speaks on “The Pulse.”

It was all about leverage What is leverage?

Leverage is a way to control more of something when you can’t pay for it in full. We do it all the time; when we buy a car — except few of us actually buy the car, we finance it or lease it. We also do it when we buy a house — except almost no one pays cash for a house, we finance the purchase with a loan; it’s secured by a mortgage on the property.

Example of 5 times leverage:

When we buy a house and put 20% down, we buy a house worth 5 times as much as the down payment. If we put $100 thousand down we can buy a house worth $500 thousand. $500 thousand divided by the $100 thousand we put down equals 5 times leverage.

100 times leverage:

By the same calculation ZERO down mortgages were suffice it to say, 100 times leverage, it’s actually more but that’s a discussion for later. Repeat after me, no money down mortgages equal 100 times leverage.

***

Home-price growth posts sharp slowdown in April

Case-Shiller Index Has Slowest Annual Home Price Increase In A Year

There is a reason why Case-Shiller titled its summary presentation of the April housing market based on its 20-City Composite index Rate of Home Price Gains Drop Sharply. The reason is simple: in April the housing market, while still preserving some upward momentum, appears to stumbled severely in April, with the Y/Y increase in the 20-City composite rising only 10.8%, down from 12.37% the month before, and the lowest annual increase since April of 2013. And this time there is no snow to blame it on.

Dont Be Fooled By Reports Of Rising Home Prices

Here is a quote from the more complete article on marketwatch:

A separate measure on homes sold to or guaranteed by Fannie Mae and Freddie Mac saw no monthly appreciation in April. (Effectively, this is a “middle class” home-price index, since it excludes both FHA and jumbo loans.)

blogs.marketwatch.com/capitolreport/2014/06/24/a-city-by-city-look-at-home-prices-including-the-surge-in-boston/

So in reality the bottom 90 percent or so of all homes saw NO increase.

Middle class homes.

The corporate media is trying to persuade americans that housing

prices are going up, but they are not, not for the vast majority of

homes.

The housing price increases over the past two years or so

have been mainly confined to the upper 10 percent of homes. And

yet what is the headline here? That housing prices are climbing. But they are not!

The corporate media and the govt and the corporations are doing their best to reinflate the housing bubble and lure ordinary people into going into massive debt for overpriced houses.

20Fran%20housing%20market_0.jpg /%