Today s Market Japanese Economic Moves Earnings And Corporate News

Post on: 28 Март, 2015 No Comment

Summary

- Discuss Japan’s latest moves to boost the economy after weak economic numbers.

- Look at GPRO’s secondary and the announced deal between CSCO and Box to partner in the cloud.

- Highlight HD’s quarterly results and strong same-store sales growth.

Japan’s prime minister has called for a snap election, and delayed by 18 months what would have been the country’s second sales tax rate hike. We thought that Prime Minister Abe would move to reassure investors over the country’s economic plans to jump start growth, but the speed with which he has acted is quite surprising. With both Japan and China now having enacted new economic policies in the past couple of months, we do expect to see some improvement in both countries’ economic data.

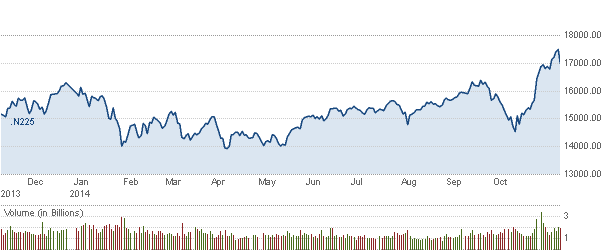

Chart of the Day:

The US 10-year has bounced back, but it will be interesting to see how the market reacts to the US Federal Reserve remaining on the sideline through the first half of 2015 as Europe and Japan continue their easy money policies. Capital seeks out the best return in relation to risk, and over the past few years, inflows from Japan and Europe have helped push rates here in the US lower.

Source: BigCharts

We have economic news today, and it is as follows:

- PPI (8:30 a.m. EST): Est. -0.2% Act: 0.2%

- Core PPI (8:30 a.m. EST): Est. 0.1% Act: 0.4%

- NAHB Housing Market Index (10:00 a.m. EST): Est. 55

- Net Long-Term TIC Flows (4:00 p.m. EST): Est. N/A

The Asian markets are higher today:

- All Ordinaries — down 0.24%

- Shanghai Composite — down 0.67%

- Nikkei 225 — up 2.18%

- NZSE 50 — up 0.27%

- Seoul Composite — up 1.20%

In Europe, the markets are higher this morning:

- CAC 40 — up 0.86%

- DAX — up 1.23%

- FTSE 100 — up 0.56%

- OSE — up 0.46%

Secondary Offering From Recent IPO

We are not surprised that GoPro (NASDAQ:GPRO ) announced that it would be increasing the size of its secondary, which will see insiders and the company’s CEO sell 9.1 million Class A shares on top of the 1.29 million that the company itself will be selling. While the CEO, Nicolas Woodman, will not be selling any of his Class B shares, he will be selling 4.1 million Class A shares in the offering. After the offering, Mr. Woodman will control 42.5% of the Class A shares.

The $930 million secondary offering is $130 million more than GoPro announced last week, when it announced the offering would total $800 million. Shares were trading lower in the after-hours session.

The bears have been looking for news to give them another excuse to try and take down GoPro shares, but it remains to be seen whether this share sale will provide them with the cover needed to force a pullback.

Source: BigCharts

Cisco Strikes Deal With Hot Start-up

In what could be a coup for both Cisco (NASDAQ:CSCO ) and Box, the two companies have agreed to work together on a project that should help both companies take on offerings from Microsoft (NASDAQ:MSFT ) and Amazon.com (NASDAQ:AMZN ). Cisco and Box announced Project Squared, which will enable cloud-based sharing and storage, while not compromising corporate networks. Cisco’s encryption on both sides will enable workers to use devices such as iPhones and iPads to monitor projects, without having to use hardware from work or download any software to gain access.

While Cisco should be able to increase sales dramatically for Box via the project, the real boost for Box should be the exposure its software tools gain through the collaboration and the revenue stream generated from the venture. With an IPO not too far off, this new revenue stream could turn out to be big for the start-up.

Home Depot Beats Again

Home improvement retailer Home Depot (NYSE:HD ) reported strong same-store sales numbers that came in a bit above the 5% that analysts were expecting. For the quarter, Home Depot saw revenues of $20.52 billion, which was above the $20.47 billion that analysts had expected. The company also beat on the bottom line, as it reported EPS of $1.15 versus the $1.13/share consensus estimate.

Regarding the data breach, Home Depot management said that they cannot provide an estimate to what the event will cost them, but thus far, they have net expenses of $34 million. This number could increase significantly if the company loses some of the civil cases which have already been filed.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.