Tips for Using LEAPS with Collars

Post on: 16 Март, 2015 No Comment

Tips for Using LEAPS with Collars 5.00 / 5 (100.00%) 1 vote

Using leaps with collars is a great way to limit risk while locking into profits. It is far more cost-effective than using put options alone and it is very effective for hedging against drastic and sudden downturns. If you have found a solid stock and are eager to stay making money with it but want to protect yourself against major loss, this strategy is well worth using.

The Basics Of Using Collars

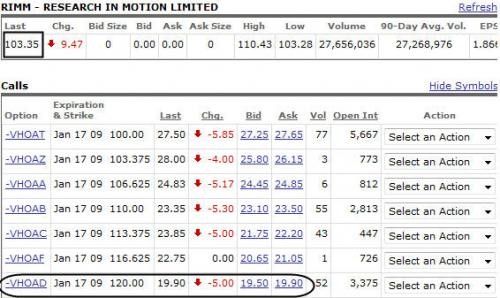

When investors buy puts and then place calls against their stock positions, this strategy is referred to as using a collar. People commonly buy a single put and a single call per every 100 shares of the related stocks that they have. This gives them the opportunity to finance their purchases with the call orders while getting an adequate amount of protection on the downside from their put orders. It enables investors to lock into profits with a limited upside, which is a bit of a drawback. Nonetheless, the process of locking into profits is essentially free and downside risks have been effectively mitigated.

Due to their call orders, investors will have to sell their positions with the underlying stocks if the prices of these go over a set amount before they expire.

When To Use Collars

Collars are an excellent investment strategy to use when attempting to mitigate risk that is specific to a company. When investors are attempting to hedge against dramatic downturns in the economy, however, there is the option of buying collars for all portfolio stock. This, however, is rarely a feasible plan and it can also be quite costly. There is the alternative solution of buying index puts on LEAPS or long term equity anticipation securities.

The major drawback of this strategy, however, is the fact that it can only be used in very specific instances. These must be used on a portfolio that currently mimics an index. It is rarely possible to use this in a portfolio that has a number of micro cap companies that are relatively unknown. These movements of these companies are simply too difficult to anticipate collectively as they will be too diverse. Moreover, the results of doing so could be catastrophic if there is no correlation between the two and uncovered losses are experienced on all sides of the trade.

Establishing A Maximum Loss

Using LEAP with collars is all about establishing a maximum loss. This is how collars help to diminish risk without causing the investor to miss out on the profits that a solid stock is already producing. If a stock dramatically increases in profitability, however, investors may be dissatisfied with the limited upside that using LEAPS with collars produces. Due to this fact, it is important to note that this is further evidence that risk cannot be minimized without also diminishing the overall profit potential of an investment. Thus, this strategy will require an assessment of personal risk tolerance and a careful look at individual investment goals.