Time to Move Out of TSP Stock Funds

Post on: 19 Апрель, 2015 No Comment

by TSPFundtracker. com

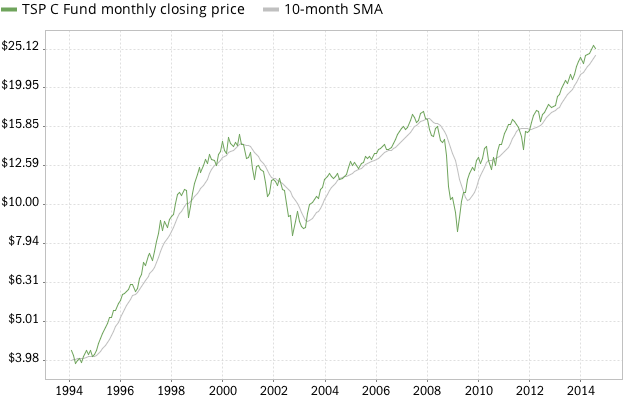

If your investment strategy includes timing the stock market, now is a good time to shift your holdings out of the TSP Funds that are composed of stocks, says one market watcher. Given the more than 7% run-up in the overall stock market that occurred between early June 2012 and September 1, 2012, now is a good time to take profits, says Tom Allen, editor of TSPFundTracker.com. For TSP Fund investors, we currently recommend shifting investments from the C, S, and I stock funds into the G bond fund, he says. More than 3 million federal employees invest in the TSP (Thrift Savings Plan) Funds.

Allen explains that the G Fund currently is preferred over the other TSP bond fund, the F Fund, as a place for temporarily parking money because interest rates are not expected to rise in the foreseeable future. The G Fund provides a higher interest yield rate than the F Fund, but the G Fund can lose significant value during a rise in interest rates. The F Fund does not lose significant value during an interest rate rise, but its interest yield rate currently is lower than G Fund.

The reasoning behind Allens current recommendation to shift out of the C, S, and I stock funds lies in his risk-to-reward evaluation. There is substantial historical evidence that a stock market rally in the last six months of a presidential election year often is followed by a large stock market downturn. Given the current weakness of the economy, we believe the risk of missing a large stock market rise in late 2012 is much less than the risk of getting caught in a large stock market downturn during that time or early in 2013. Our thinking is that a savvy investor could take their profits now and get an almost no-risk yield of about 3% in the G Fund for several months, and then shift back into the C, S, or I funds after a large stock market drop that begins in late 2012 or in 2013.

Whether or not to shift money between funds definitely is a big investment decision. Many investors probably are uncomfortable trying to time the stock market by switching all of their holdings out of the C, S, and I funds. An investor could take a less aggressive approach to market timing and hedge their bets by shifting only a portion of their holdings from those funds to the G fund, Allen says.

www.TSPFundTracker.com .

Sound Off. What do you think? Join the discussion.