TICK Count Trend Indicator and Trading System

Post on: 25 Апрель, 2015 No Comment

$TICK Count Trend Video Update 02/07/2012

Below is a chart of the $TICK Count Trend Indicator on Friday 12/28/2011. The red line represents the increasing sum of bearish $TICKS, the blue line represents the increasing sum of bullish ticks, and the white line represents the increasing sum of neutral ticks. On 12/28/2011, the trend is down based on our indicator since the red line is leading the way higher.

The Bullish and Bearish threshold are inputs that can be adjusted. The indicator is reset to 0 for all values and the count starts over at the beginning of each trading day.

How does it work in a trading system?

The short signal above is taken when the Bearish Count is ahead of the Bullish Count by 30 and also ahead of the Neutral Count by 15. There are a few other conditions and an entry based on a slight retracement of the trend. Long signals use the same but opposite criteria (Bullish Count ahead of the Bearish Count by 30 and ahead of the Neutral Count by 15).

Trend Following Day Trade System

Using the Indicator on the E-mini S&P and SPY ETF

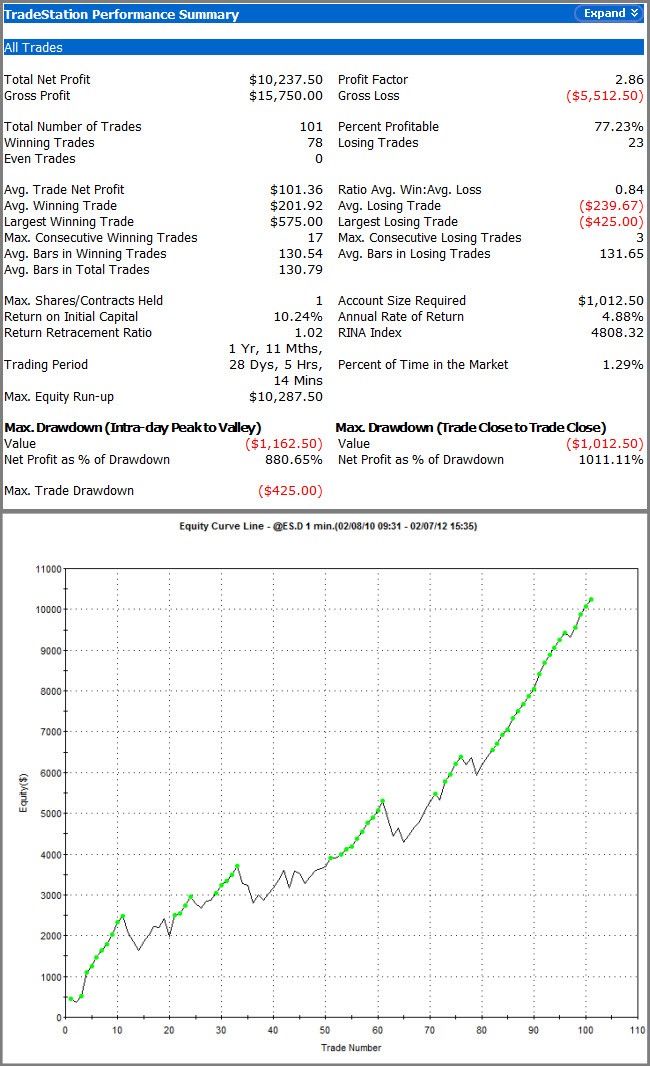

Below are the results of the Trend following version of the $TICK Count Trend Trading System over the last two years (2/7/2010-2/7/2012 on the E-mini S&P futures with no slippage and commission. This is a very basic strategy that could be modified and optimized. A further explanation of the $TICK symbol is below the video. We used the Bull Value as +200 and Bear Value as -200 for the system results below.

E-mini S&P Day Trade System (Trend Following)

SPY ETF Day Trade System (Trend Following)

Counter Trend Following Day Trade System

Using the Indicator on the E-mini S&P and SPY ETF

In February 2012, we have added a countertrend day trade system based on recent research that uses the $TICK Count Trend Indicator. This strategy works on the basic premise of a market becoming bullish based on the upticks in the $TICK symbol when the market is down on the day for long trades and for short trades, the market becoming bearish based on the downticks in the $TICK when the the market is up on the day. We enter on limit order’s and look for a short term high for shorts and short term low for long trades. The strategy is selective and does well on the E-mini S&P and SPY for the past two years.

The Bull Value and Bear Value inputs are +240 and -160 based on the 5 year close of the $TICK on 1 minute charts being around +40. We added 200 points to this for the Bull Value and subtracted 200 points for the Bear Value. Below is recent trade in the E-mini S&P and the TS Performance Summary for both the E-mini S&P and SPY.

Trade on January 9th below. The market is down but the blue line is above the red line and the $TICK’s are bullish based on the count.

Counter Trend Day Trade System

E-mini S&P

Using the $TICK Count Trend Indicator

Counter Trend Day Trade System

SPY ETF

Using the $TICK Count Trend Indicator

Below is a video of the $TICK Count Trend trading system on 5/20/2010

What is the $TICK symbol?

The $TICK symbol is listed on the New York Stock Exchange (NYSE) and keeps track of all the stocks on the NYSE on a tick by tick basis, tracking how many stocks are in an uptick, how many are in a down tick, and how many are in a side tick. The $TICK symbol is the difference in the number of stocks in an uptick and those in a downtick. There are approximately 3700 stocks on the NYSE. For example, if there are 2500 stocks in an uptick and 1200 in a downtick, then the $TICK symbol will be +1300. This number can be a + or — number. Another example, is if 2500 stocks are in a downtick and 1200 stocks are in an uptick, the $TICK symbol will be -1300.

The $TICK symbol usually has readings between +1200 and -1200. This symbol only represents the NYSE stocks and not the entire universe of all stocks but can be a good indicator of the short term direction of the stock market and can be useful when trading stock index futures.