Threefund portfolio

Post on: 23 Июнь, 2015 No Comment

A three-fund portfolio is a portfolio which does not slice and dice. but uses only basic asset classes usually a domestic stock total market index fund. an international stock total market index fund and a bond total market index fund. It is often recommended for and by Bogleheads attracted by the majesty of simplicity (Bogle’s phrase), and for those who want finer control and better tax-efficiency than they would get in an all-in-one fund like a target retirement fund.

There is no magic in the number three; the phrase is shorthand for a style of portfolio construction that emphasizes simplicity, and is related to lazy portfolios.

Choosing your asset allocation

You must decide for yourself what percentage of stocks to hold. based in part on your personal risk tolerance. There are no shortcuts and and it needs to be done no matter what investment approach you are using.

Even if you are going to use a single Target Retirement fund, you should not take the shortcut implied by the use of a retirement year in the name; you need to decide for yourself what percentage of your portfolio you want to invest in stocks, and choose the fund that matches it. Even if you are going to use a single LifeStrategy fund. you need to decide which of them to use, based on the percentage of stocks each one holds.

One traditional rough rule-of-thumb is age in bonds, or percentage of stocks = 100 — age. This is a conservative rule, and leads to smaller percentages of stocks than Vanguard chooses for its Target Retirement series.

The second decision is what percentage of your stock allocation should be U.S. (domestic) and what should be international. This is a much less critical decision because U.S. and international stocks have similar risk profiles and have similar long-term returns. In 2010, Vanguard increased the international allocation of its Target Retirement and LifeStrategy funds from 20% of the stock allocation to 30%, and increased it again to 40% in 2015.

Vanguard’s tool

As of 2012, Vanguard provides a tool that recommends a balanced portfolio similar to the kind discussed here (Vanguard recommends a four fund portfolio ), with percentages based on your responses to a short online questionnaire. The tool is entitled Get a recommendation to fit your goals ; you can navigate to it by way of Vanguard.com, Go to personal investors’ site, What we offer: Mutual Funds, Get a Recommendation.

Choosing your asset location

Since your portfolio may be split between multiple locations (one or more tax-advantaged retirement accounts, and one or more taxable accounts) you should look at Principles of tax-efficient fund placement to determine which funds belong in each account. In general, the international fund should go into a taxable account, the bond fund should go into a tax-advantaged account, and the domestic equity fund should fill in the remaining space.

You may need to hold the same (or equivalent) funds in multiple accounts to have ideal asset allocation and asset location.

Choosing three funds

For Bogleheads. the answer for what mutual funds to use in a three-fund portfolio is low-cost funds that represent entire markets.

If you ask different people to choose funds for a three-fund portfolio, you will get different fund choices. The differences are usually of no fundamental importance, and are usually the result of a) making choices between nearly identical, almost interchangeable funds, and b) simplifying further by using combination package funds. Watch out for high expense ratios, particularly in the bond funds.

Vanguard funds

From Vanguard’s list of core funds, the funds that are best for a three-fund portfolio are:

- Vanguard Total Stock Market Index Fund (VTSMX)

- Vanguard Total International Stock Index Fund (VGTSX)

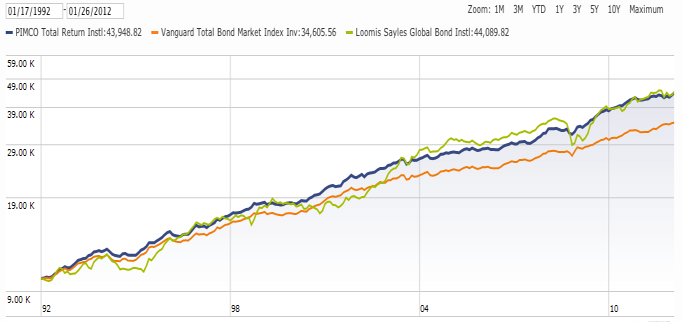

- Vanguard Total Bond Market Fund (VBMFX)

So, a three-fund portfolio might consist of 42% Total Stock Market Index, 18% Total International Stock Index, and 40% Total Bond Market fund.

Bill Schultheis’ Lazy Portfolio in fact, consists of these three funds in equal proportions.

One could, of course, use ETFs rather than mutual funds. For example, one could use Total Stock Market ETF (VTI) [1]. Vanguard Total International Stock Index Fund (VXUS) [2] for international, and Vanguard Total Bond Market ETF (BND).

- Sample three-fund portfolios