Three Risky ETFs Protect Yourself Now

Post on: 10 Май, 2015 No Comment

A lot of ink has been spilled over the past few weeks about risky ETFs. Its turning into a branding problem, since most people associate exchange-traded funds with lower, not higher, risk.

ETFs are designed to capture the return of an entire index, say, the S&P 500, minus a small fee. Buying an index offers diversification. Owning many stocks, your risk of loss from one or two is diminished.

Wall Street being Wall Street, they took the idea of tracking an index and expanded it to all kinds of assets. Thats where the risk turns more serious. Heres a breakdown of three risky ETFs you probably should not buy or, at least, should buy with your eyes wide open:

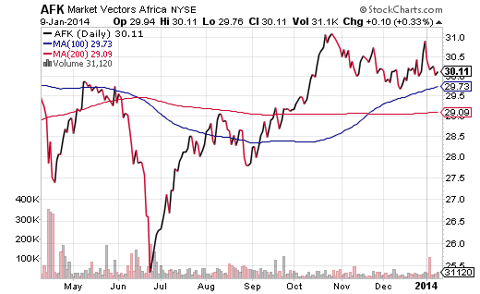

1. An ETF with significant tracking error

If you hope to replicate the S&P 500, its not that hard. Several simple ETFs own the 500 stocks and thats that. But an ETF that attempts to track a market 15 time zones away, trades in a foreign currency or is illiquid by design can be harder to pull off. Morgan Stanley, in a study, found the average tracking error to be 59 basis points, more than half a percent. It could go either way, however, missing positively or negatively by 5% or more.

2. An ETF for inverse trading

Did you really mean to short the entire market? Some ETFs have safe-sounding names that include all the typical buzzwords, such as index and market return and then throw in inverse or double inverse at the end. If you buy that fund, beware. Youve actually bought an instrument designed to earn the opposite of the index or a double (even triple) opposite return. If the index goes up, you go down.

The fix: Make sure to buy unleveraged, long-only indexes, not short variations. It should be clear from the name and, failing that, the prospectus.

3. An ETF with unusually high fees

The whole point of ETFs is the low fees, right? Not for some investors. If you really want exposure to sugar cane, theres an ETF that will bring that to you — and charge you 2.32% for the ride. Comparatively, the broadest stock market index ETFs charge as low as 0.04%.

The fix: Just because a fund says S&P in the name, that doesnt mean its the best deal for you. Research the underlying fees and make sure you get what you pay for. If its active management you want, fine. But dont pay active management fees for a simple index tracker .