This Year Make a Goal to Contribute More to Your 401(k) Money And Finance

Post on: 10 Июль, 2015 No Comment

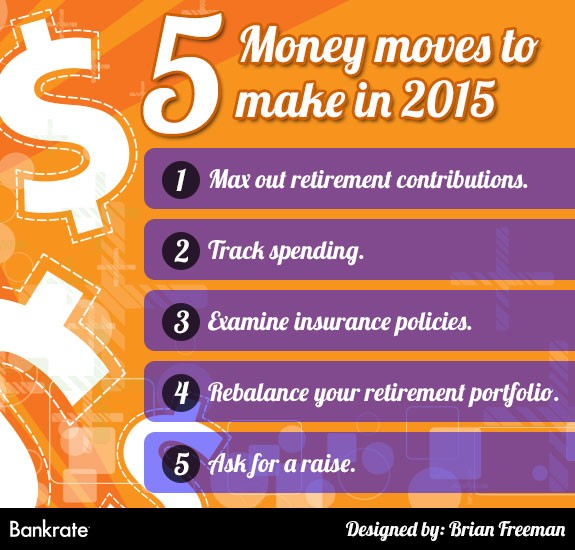

This Year, Make a Goal to Contribute More to Your 401(k)

Posted: Monday, March 2, 2015 2:42 pm | Updated: 4:39 am, Tue Mar 3, 2015.

(NewsUSA ) — Are you participating in an employer-sponsored retirement plan? If your company has one, consider yourself fortunate. But if you’ve been ignoring whatever your company is offering, it’s time to get the facts.

A good retirement plan will allow you to defer taxes on whatever you contribute to your 401(k) account until you begin to withdraw money, presumably in your retirement. The amount of money you contribute is deducted from your salary when Uncle Sam is tallying up your taxable income for the year. Granted, you won’t see the money you contribute until you retire, but committing to a plan like this is one way of both saving on taxes and forcing yourself to save for the future.

If your company offers any kind of a match, meaning it will throw in some money to match your contribution at a certain proportion, you are definitely leaving money on the table by not participating. For example, a company may match 50 cents on one dollar up to 4 percent of pay — yours could be better or worse.

One primary reason a retirement account is such a good idea is compounding interest. Add earned interest to the money you are contributing, plus an employer match, deduct the amount contributed from your taxable income, and you’re well ahead of the game.

Most 401(k) plans allow you to choose how to invest your money. The plan administrator provides a choice of investments, which may include cash equivalents, bonds, stocks or a mix. When choosing your investments, you can decide exactly how aggressive or conservative you wish to be.

IRS increased the contribution limit for employees who participate in 401(k) plans from $17,500 in 2014 to $18,000 for tax year 2015. The catch-up contribution limit for employees aged 50 and over who participate in 401(k) plans increased from $5,500 to $6,000, which is motivating to many baby boomers who are behind in saving for retirement.

Sitting down with a tax professional to determine what you can do to minimize your tax burden this year and take advantage of every tax deduction and credit available to you just makes good sense. A licensed tax professional can help. Enrolled agents (EAs) are licensed by the U.S. Department of Treasury after passing a stringent three-part exam on taxation. They must complete IRS-approved continuing education to keep the license. You can locate an EA in your area using the Find an EA directory at www.naea.org .