This Pet Store Will Have Investors Wagging Their Tails (PETM)

Post on: 4 Август, 2015 No Comment

Watch stocks you care about

The single, easiest way to keep track of all the stocks that matter.

Your own personalized stock watchlist!

It’s a 100% FREE Motley Fool service.

Although shares of PetSmart ( NASDAQ: PETM ) plunged 5% last week after the pet shop operator’s reported earnings showed same-store sales dropping even as it met earnings estimates and raised full-year guidance. investors should look on the market’s gift of a lower entry point with a bit of puppy love, as trends show there’s no stopping the growth of this industry.

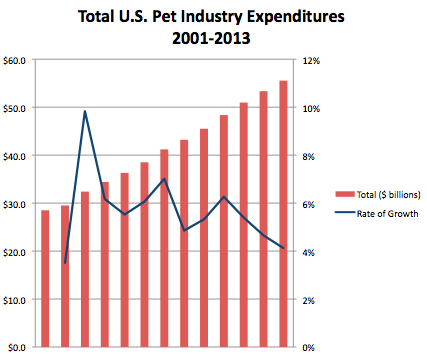

According to the American Pet Products Association, pet food sales will account for 38% of the $55.5 billion total spent on pet care in 2013, up 3% from the year before, as pet parents continue to humanize their four-legged household members. With almost 57 million households owning a dog and another 45 million owning a cat, according to a recent APPA pet owner’s survey, the need for food, medicine, veterinarian care, supplies, and grooming services will continue to grow.

Yet PetSmart is not alone in pulling on the leash from this news. The market researchers at Virgo Health & Nutrition report that this desire for treating Fluffy like one of the kids is opening up new opportunities for companies to expand their offerings for healthier fare while causing those outside the industry to look at a chance to capture some of the growth as well.

For example, chemicals giant DuPont ( NYSE: DD ). which has traditionally focused on the feed category for livestock, is looking to expand more into pet food through its Danish enzyme maker Danisco that it acquired two years ago. Virgo noted that the company plans to use its knowledge and experience in human and animal nutrition for the benefit of the pet food industry.

While I might disagree on the benefits associated with DuPont moving in, considering its work with genetically modifying the food humans consume. plenty of biosciences companies like Novus International and Kemin are also eyeing the pet food market’s growth potential.

Still, that bodes well for more traditional pet food makers like Colgate-Palmolive ‘s ( NYSE: CL ) Hill’s Pet Nutrition and animal health businesses like Zoetis ( NYSE: ZTS ). the animal nutrition specialist spun off from Pfizer. Hill’s sales rose 3.5% this past quarter on a 2.5% increase in volume, leading it to account for 13% of Colgate’s total revenues. And you thought toothpaste was big business. For Zoetis, where livestock health remains the largest component of its business, companion animal medicine and vaccines account for more than a third of its $4.3 billion in total annual revenues.

But because PetSmart is brand agnostic — it will sell anyone’s pet food along with its own private-label brand — it ought to best capitalize on the opportunity. Where the super-premium category seems to best reflect this trend and the importance it holds for the pet store operator, so far it’s mostly been in dog food, where pet parents have concentrated on buying better nutrition. PetSmart sees cat owners about three years behind their dog-owning counterparts, and that means that even if the dog food trend peters out, considering the number of cat owners out there, enough business will still flow from them to continue the sector’s growth trajectory.

So for those investors who cowered like a whipped cur at the decline in PetSmart’s comps, I’d say they were barking up the wrong tree.

Pet food sounds boring, but as PetSmart’s results attest, it has been a steady, tireless performer leading to an inexorable rise in its stock. If you’re tired of watching your stocks creep up year after year at a glacial pace, Motley Fool co-founder David Gardner, founder of the No. 1 growth stock newsletter in the world, has developed a unique strategy for uncovering truly wealth-changing stock picks. And he wants to share it, along with a few of his favorite growth stock superstars, WITH YOU! It’s a special 100% FREE report called 6 Picks for Ultimate Growth . So stop settling for index-hugging gains. and click HERE for instant access to a whole new game plan of stock picks to help power your portfolio.