This LowVolatility ETF Deserves Your Attention

Post on: 27 Апрель, 2015 No Comment

When doubt and sensitivity enter a marketplace its healthy for investors to group to safety. In many cases, traders demeanour to blue chip stocks, fast currencies, changed metals, holds or even income marketplace investments as protected havens for their capital. Assuming reduction risk in relations terms compared to a extended U.S. marketplace is mostly a idea of investors and can engage investments, such as those listed above, or adjustments to item allocation and altogether risk tolerance. (For more, see: Volatilitys Impact on Returns .)

One common apparatus for many sell investors looking to revoke their portfolio risk is a iShares MSCI USA Minimum Volatility ETF (USMV ). For those unaware, this account attempts to lessen risk relations to a broader marketplace in hopes that it will assistance discharge waste during marketplace declines while still experiencing gains when a marketplace rises.

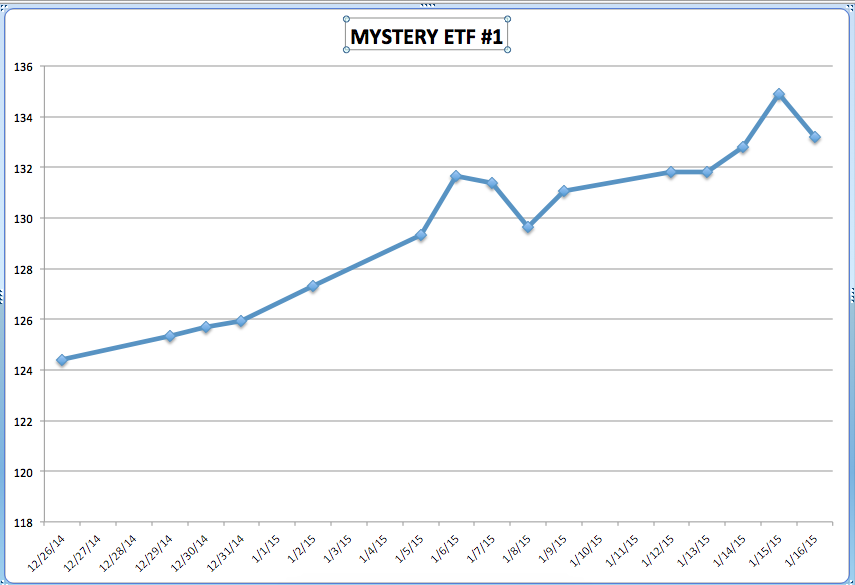

This product has been gaining traction for a past several months and has sum net resources of scarcely $4.5 billion. The supports components include of 156 land and it comes with a reasonable expense ratio of 0.15%. Taking a demeanour during a draft below, we can see that a fund’s plan has been profitable off for investors for a past 5 years and a clever uptrend suggests that a movement should continue.

Active traders will wish to note that a account has bounced off a support of a 200-day relocating normal (red line) on several occasions in a past. Most traders will wish to aim to enter a position as tighten to a trendline and moving average as possible, as it maximizes a intensity lapse relations to a risk. (For more, see: Is It Time for Low Volatility Funds? )

USMVs Top Holdings

Investors looking to emanate a portfolio with land that lessen sensitivity competence wish to examine a tip land of USMV. Closer hearing of a companies in a list next will exhibit that repeated income is a pivotal cause of their success. Each organisation has a clever patron bottom that will compensate for a company’s products regardless of a mercantile environment.

Walmart Breaks Higher

While investors try to figure out how to revoke their risk to descending commodity prices, Wal-Mart Stores has sensitively been on a move. Its not really common that intensely large-cap batch such as WMT breaks above a pivotal turn of long-term resistance. However, when these breakouts happen, it mostly rewards those that are profitable attention. (For associated reading, see: How Walmart Makes a Money .)

Based on a draft below, you’ll see that a turn noted by a plane trendline has acted as a clever turn of insurgency in a past. The pierce above in late 2014 was followed by a clever swell in movement and a bulk of a three-year lapse was done in usually a few brief weeks. The new retracement toward $85 has supposing an meddlesome short-term treading event given this turn has acted as support in a past. While a pierce competence be as clever as before, a ceiling movement is expected to continue and it could benefaction an event for those examination a charts. (For more, see: The Anatomy of Trading Breakouts )

The Bottom Line

When sensitivity starts to boost its usually healthy for investors to group to safety. One of a many renouned products accessible in a marketplace for this purpose is a iShares MSCI USA Minimum Volatility ETF. With clever fundamentals and a low responsibility ratio this product has been gaining courtesy for most of a past year. While extended ETFs like USMV competence not be for everyone, you’ll find that by examining a pivotal land of supports it is probable to find possibilities merit a mark in only about any portfolio. For associated reading, see: Consumer Staples Defend Against Volatility .)