This is What a Biotech Selloff Looks Like Stocks to Watch

Post on: 16 Март, 2015 No Comment

By Ben Levisohn

If the biotech rally were the band Oasis, todays big drop would be like the release of Be Here Now. After selling millions of copies of Definitely Maybe. their debut, and (Whats the Story ) Morning Glory. the one with Wonderwall on it, the bands third album sold 350,000 copies on the day it was released and really marked the end of Oasis, even if the albums kept coming.

Like Be Here Now on its first day of release, biotech stocks moved massive volume in todays trading. MKM Partners Jonathan Krinsky explains:

With the [iShares Nasdaq Biotechnology ETF (IBB )] down

4.6% today, it would be the worst day since August 18, 2011 (-4.70%). With 30 minutes left in the session, volume is already over 4.5m shares, which is the highest volume in the ETF since March 2nd, 2009. At that time, however, the price was

$60 vs. $246 today. If we look at Value Traded (Price x Volume), it is already at 1.15bn, or the HIGHEST ON RECORD for this ETF (going back to 2001). The previous high was 1.005 bn on 3/7/14.

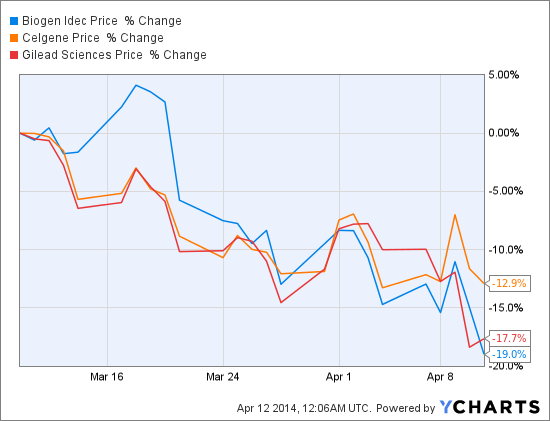

A picture is worth a thousand words (click for a larger image):

Todays selloff started when three Democratic Party congressmen challenged Gilead Sciences (GILD ) pricing of its hepatitis C-drug Sovaldi. The indiscriminate selling of biotech stocksBiogen Idec (BIIB ), Celgene (CELG ) and Regeneron (REGN ) all dropped at least 3.7%suggests that investors have itchy trigger fingers, says Bernsteins Geoffrey Porges and team:

Whether this public posturing damages investor confidence in the industry as a whole and its valuation remains to be seen, but we think such an effect is unlikely. On the other hand, the rapid sell off in the stocks today in response to an essentially toothless demand, does suggest some wavering of conviction on the part of major investors in the group. This could, over time, if not countered by positive newsflow, turn into a more significant correction.

The iShares Nasdaq Biotechnology ETF dropped 4.7% to $246.01 today, while Gilead dropped 4.6% to $72.07, Biogen Idec fell 8.2% to $318.53, Celgene declined 3.7% to $144.40 and Regeneron Pharmaceuticals finished down 5.5% at 310.79.

Tiffany: That Wasnt So Bad After All Next

The Markets Most Wanted: Dow Jones Industrials, S&P 500 Climb Most in Five Weeks