This Is How You Should Invest Your Next $10K In Dividend Stocks

Post on: 25 Июль, 2015 No Comment

Investing has become an extreme sport of late. If you are looking for growth, youll have to ride the stock market rollercoaster. While you will eventually end up with more money in your pocket, you will have to endure several end of the word news headlines and bad quarter results in the meantime. On the other hand, if you are looking for secure investments, you will run into a different brick wall with interest rates around 2% for a five year term deposit. That doesnt even match inflation and youll eventually start considering Kraft Dinner for supper three times a week if you plan on living off your investments at retirement.

Tell me, what are you going to do with your next $10,000?

Ive personally decided to put my confidence in dividend stocks, nothing else, I go all in for Dividend Investing . Why? Simply because dividend stocks suffer less in a bearish stock market while earning a lot more than bonds and CDs.

Dividend Investing is Perfect to Make Money & Beat Inflation

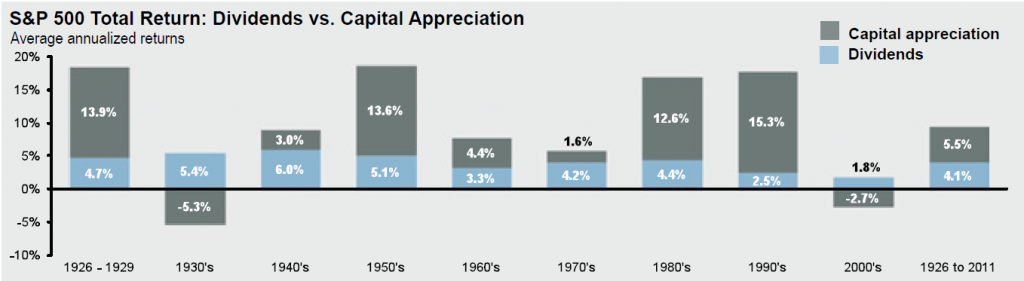

For the past 85 years, dividend stocks have contributed 43% of the total S&P500 annualized returns.

(Click to enlarge)

Therefore, this investing strategy doesnt only generate a constant income stream but it also performs well over time. By building a 3%+ dividend yield portfolio with an overall dividend increase of 2-3% minimum, you are also assured to beat inflation over the long haul. In other words, your portfolio doesnt only generate a 3% dividend yield today but your payout will grow faster than the rate of inflation. If you plan on living off of your dividend income, this source of income had better be indexed better than a pension plan! Doesnt this sound like a good retirement investment for you? No more mandatory Kraft Dinner meals!

Dividend Investing is Not Complicated

The first reason why I decided to go with dividend stocks is that it makes my investment process a lot smoother. When you select dividend paying stocks for the long term (and I prefer stocks increasing their dividend each year), you know you are picking a healthy company for the most part. Since they are ready to distribute a part of their profits, it must be because they feel confident in their future. But the dividend yield is not enough to pick the hen who lays golden eggs. My dividend stocks must comply with the following criteria:

- Dividend Yield >3% (Im going after yield after all)

- 5 Year Dividend Growth >1% (I want this yield to grow over time)

- Dividend Payout Ratio < 75% (I want sustainable dividend growth)

- 5 Year Annual Income Growth >1% (I want potential for more dividend growth)

- ROE > 10% (I want companies making great investment returns)

- P/E Ratio <20 (I dont want to pay too much for the stock)

I use those metrics because they are simple and easy to use with free stock screeners such as the TMX .

How Can You Buy U.S. Stocks in a Canadian Account Without Paying Taxes?

Lets face it; the Canadian stock market is too small to build a sustainable, diversified dividend growth portfolio. Once you have picked a few banks, telecoms and REITs, you will have a hard time finding additional diversification. This is why your portfolio should contain in good part several U.S. dividend stocks. There are plenty of world-class companies paying healthy dividends south of the border.

The problem is that there is a whole tax issue around U.S. dividend stocks. How can you buy them without having withholding taxes? You can avoid taxes by adding your U.S. stocks to your RRSPs and keeping your Canadian stocks in your TFSA for example. I suggest that you manage your portfolio as a whole (non-registered + RRSP + TFSA asset mix all together) but use a different asset mixes by account when considering tax rules. Keep in mind that if you invest in U.S. stocks in your TFSA, a 15% withholding tax will apply which you cant get back. There are also brokerage firms offering USD accounts so you dont lose money on currency exchange rates when dividends are paid. Heres a list of brokers and if they offer US$ RRSP account: